📊 Trade Review: $BRKR - Strong Profits, Early Exit?

Bruker Corp. $BRKR was unknown to me until I first saw it in my X-feed two months ago. It caught my attention after noticing we had a Covid low-liquidity sweep followed by the build-up of a high-conviction trigger. I decided to enter a large position, and in this post I am walking through my thought process of a trade that realized a 22% gain on position for my 25 Year Trading Experiment portfolio.

As $BRKR caught my attention, I also published a Video Chart Analysis on my YouTube page.

All trades shared LIVE on my X - Not Financial Advice

Long-Term Watchlist

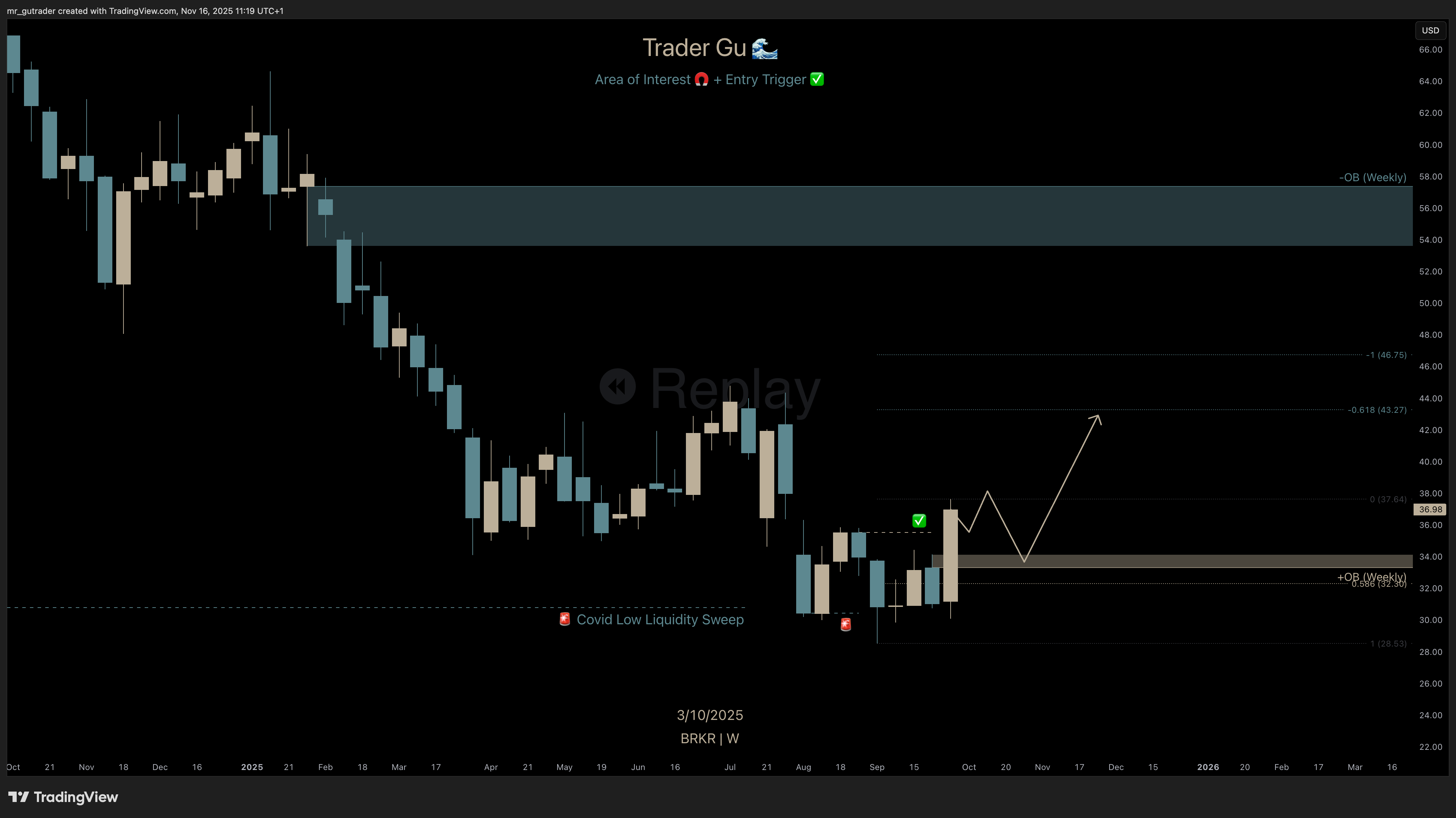

After years of having a bullish market structure and reaching an all-time high at 94.86 dollars, price action reversed into a bearish structure confirmed with the monthly close in March 2024.

The downward pressure resulted in a 69 percent move to the downside, sweeping the low of the Covid low-liquidity. Price showed a strong reaction and is building for a higher time frame bullish reversal, which would be confirmed by a candle open or close above 41.20 dollars. Such a move could potentially reach 54 dollars, although at that time this was still only anticipation and not yet confirmed by market structure.

$ASML - Long-Term Watchlist monthly chart

$ASML - Long-Term Watchlist monthly chart

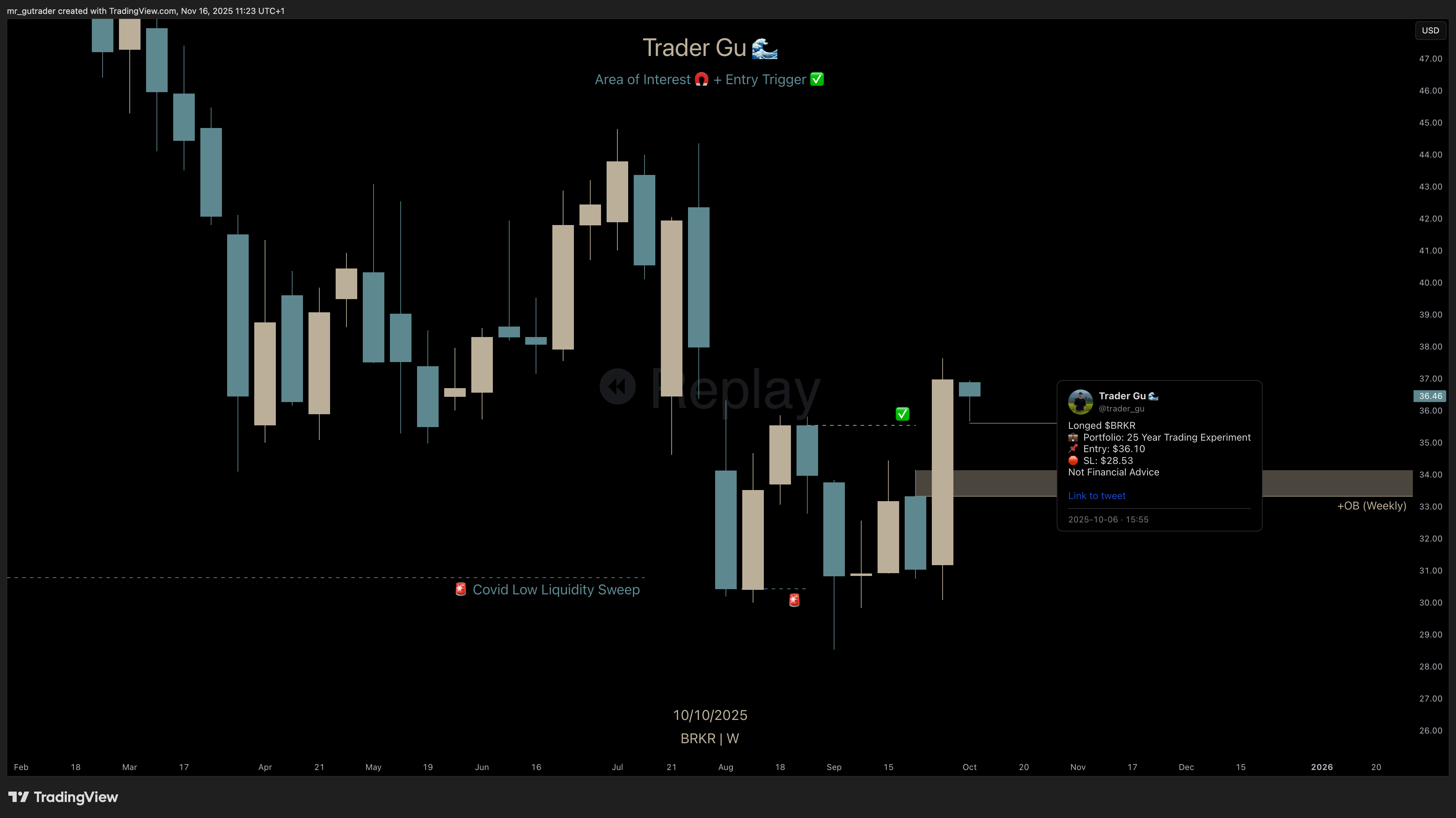

🧲 Area of Interest

The weekly chart appeared even more promising. There was a proper liquidity sweep of the previous week’s low followed by a confirmed weekly bullish reversal pattern that left behind a newly formed bullish order block at 34 dollars. This was my area of interest to enter a position, with a clear structure and invalidation level at 28.53 dollars.

$BRKR - Area of Interest, weekly chart

✅ Trade Entry

Without waiting for my planned entry at the 34 dollar support zone, I opened a position with two thirds of my risk allocation on a small retracement to 36.10 dollars. Although I anticipated a deeper retracement, the higher time frame alignment made me not want to risk missing the position entirely.

Trade Entry

📌 Entry: $36.10

⛔️ SL: $28.53

💰 Target: $43.27

✅ Added to Position

Already two days after my first entry, we had reached my target zone, and I added to position at $34.15, ending up an average $35.44 position. The trade took over a whopping 24% of my portfolio with a 6% risk on invested capital - high-conviction to say the least.

Added to Position

📌 Entry: $34.15

⛔️ SL: $28.53

Averaged Position

📌 Entry: $35.44

⛔️ SL: $28.53

$BRKR - Added to Position, daily

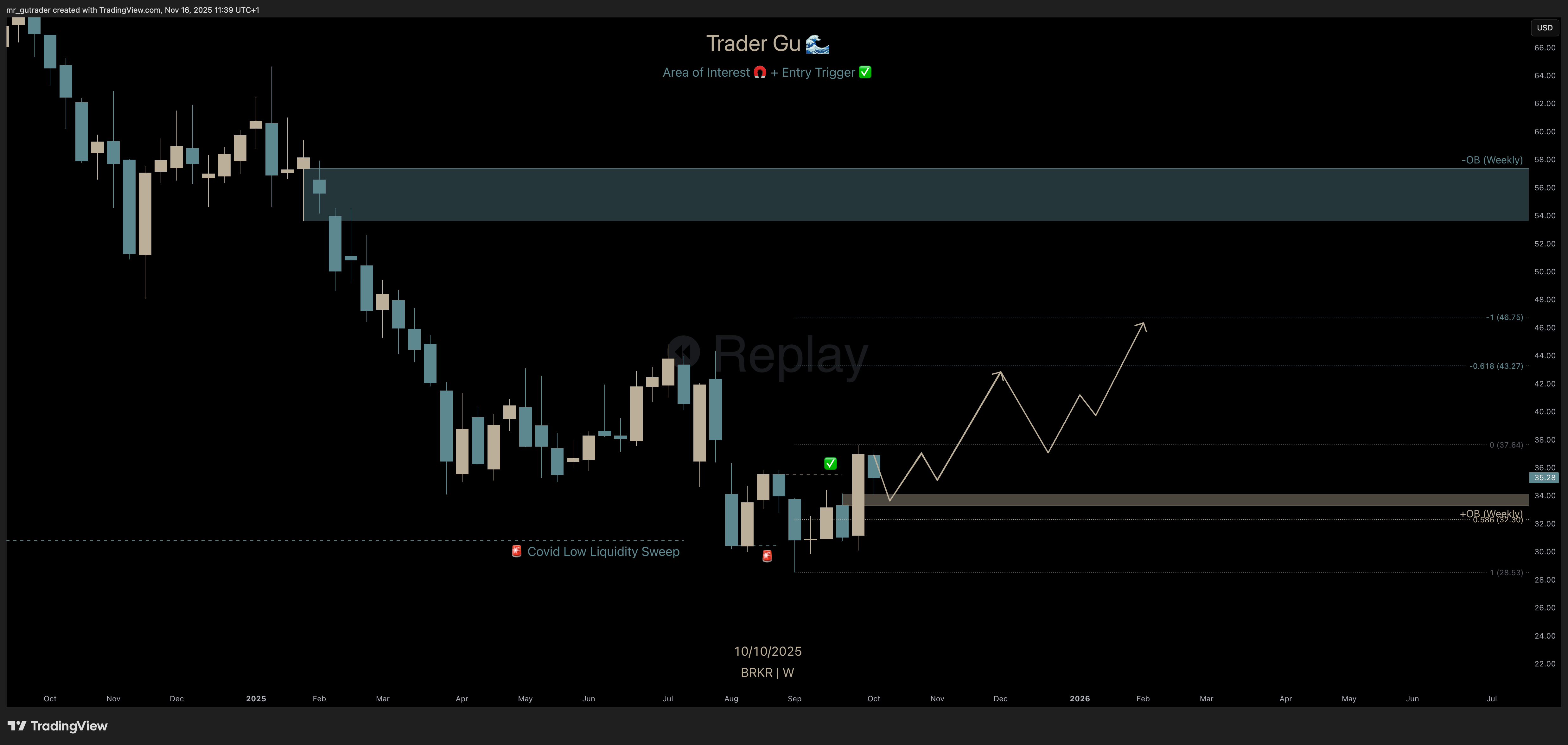

💰 Trade Targets

Although I have had a higher time frame target of $54 based on the monthly time frame, we still had a couple of weeks to confirm a monthly bullish reversal trigger. I had my eyes on the weekly expansion and Fibonacci levels 0.618 and 1, targeting $43.18 and $46.75.

Also considering staying in this position until possibly seeing $54, but as we are currently in an extremely overvalued market in general, I decided to follow my wife’s reminder not to be greedy planning an exit at $43.18.

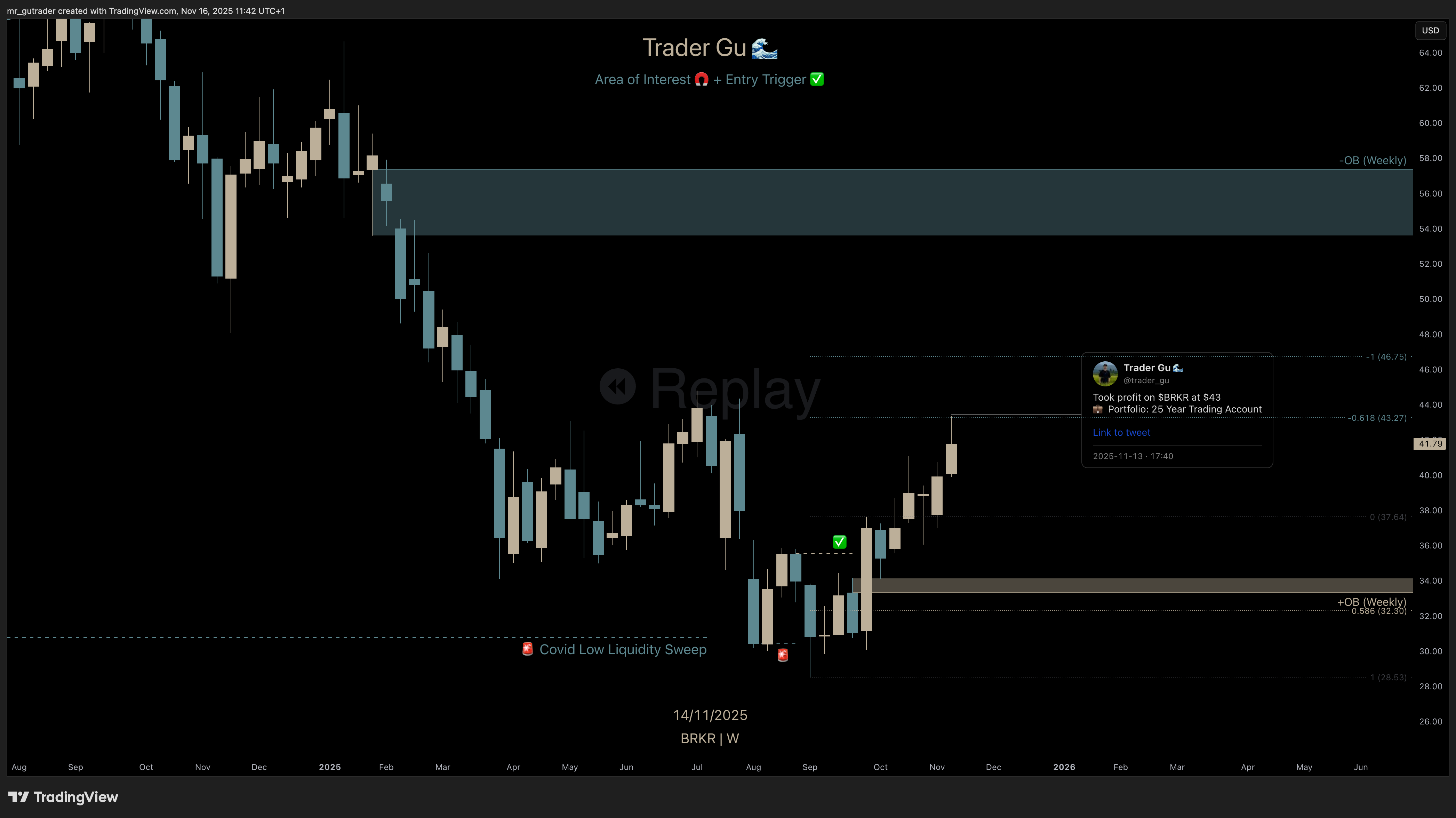

💰 Exit Position

I exited 100% of my position at $43, realizing a 22% gain on position.

🪞 Reflection

The technical chart for $BRKR was one of the most interesting I saw all year. Although I am satisfied and believe I executed the trade well, capturing significant profits, I am slightly concerned that I exited too early instead of holding toward my higher time frame target at 54 dollars. Time will tell whether it was the right decision.

Looking back, although I had a significant risk of 8 percent of invested capital, the strong technical fundamentals suggest I should have increased my risk from 8 percent to 10 percent or possibly even 15 percent. I believe I sized too small for a setup with such high conviction.

✅ Followed my entry trigger

✅ Added to position

✅ Took full profit at target

😵 Possibly took profit too early

If you want to learn how I build conviction for trades like this, check out:

More learnings can be made from my previous trade reviews as well as following my journey on X for live updates.