📊 Trade Review: $ASML - My Biggest Trade of 2025

The semiconductor industry has been on a tear in 2025. After previously posting a trade review on $AMD resulting in my biggest trade in terms of percentage gain on position, I’ve now closed my biggest trade in terms of absolute P&L. Here’s my breakdown of what went well, what could be improved, and the key takeaways for the future.

Let’s dive into the charts.

All trades shared LIVE on my X - Not Financial Advice

Long-Term Watchlist

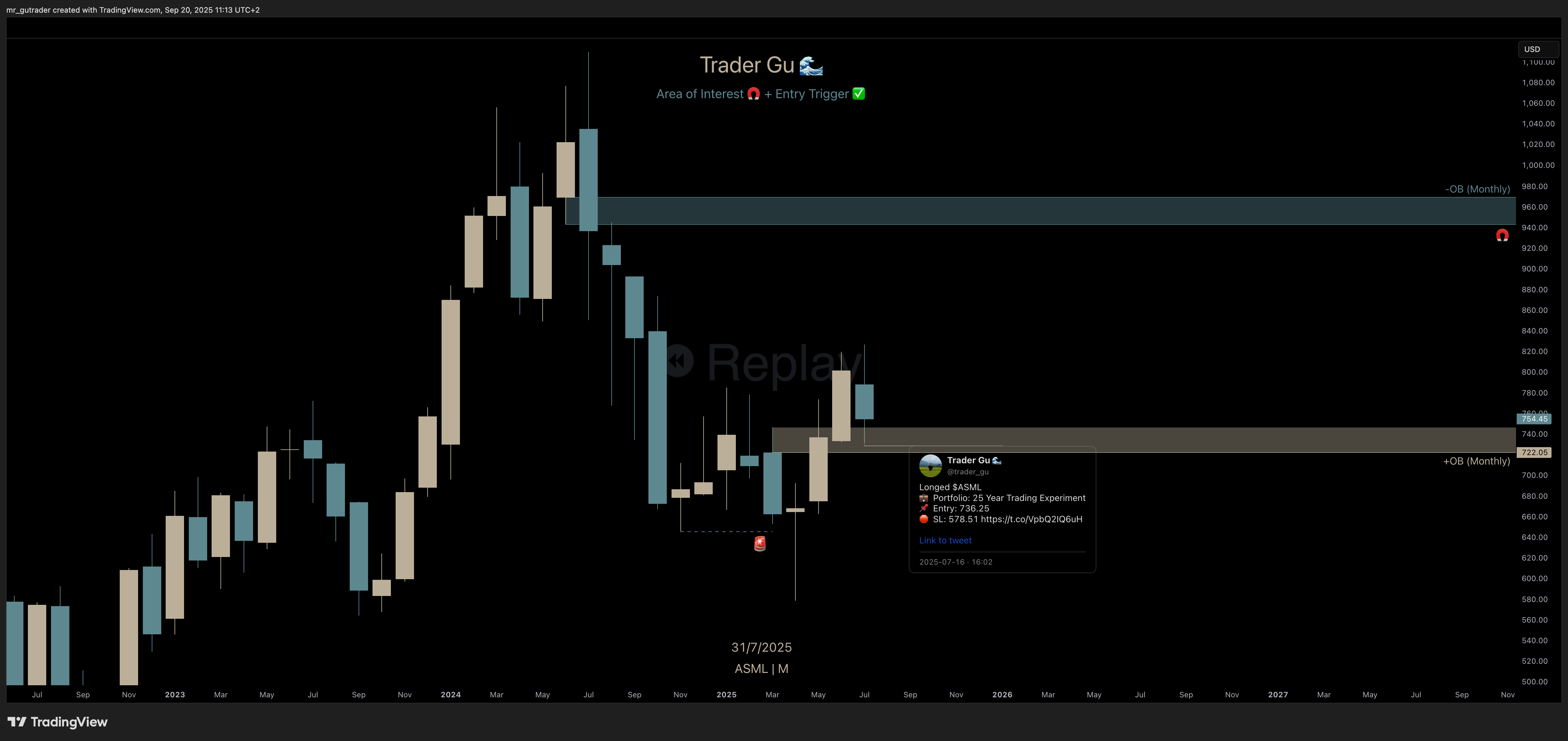

I had been tracking ASML and added it to my high-timeframe watchlist after price took out a significant monthly liquidity level. From there, I was watching for two possible scenarios to unfold:

- A liquidity sweep followed by a move higher, confirming a bullish reversal pattern on the monthly timeframe.

- A deeper breakdown, with price seeking liquidity at the 2023 low. I prepared for both outcomes.

$ASML - Long-Term Watchlist monthly chart

$ASML - Long-Term Watchlist monthly chart

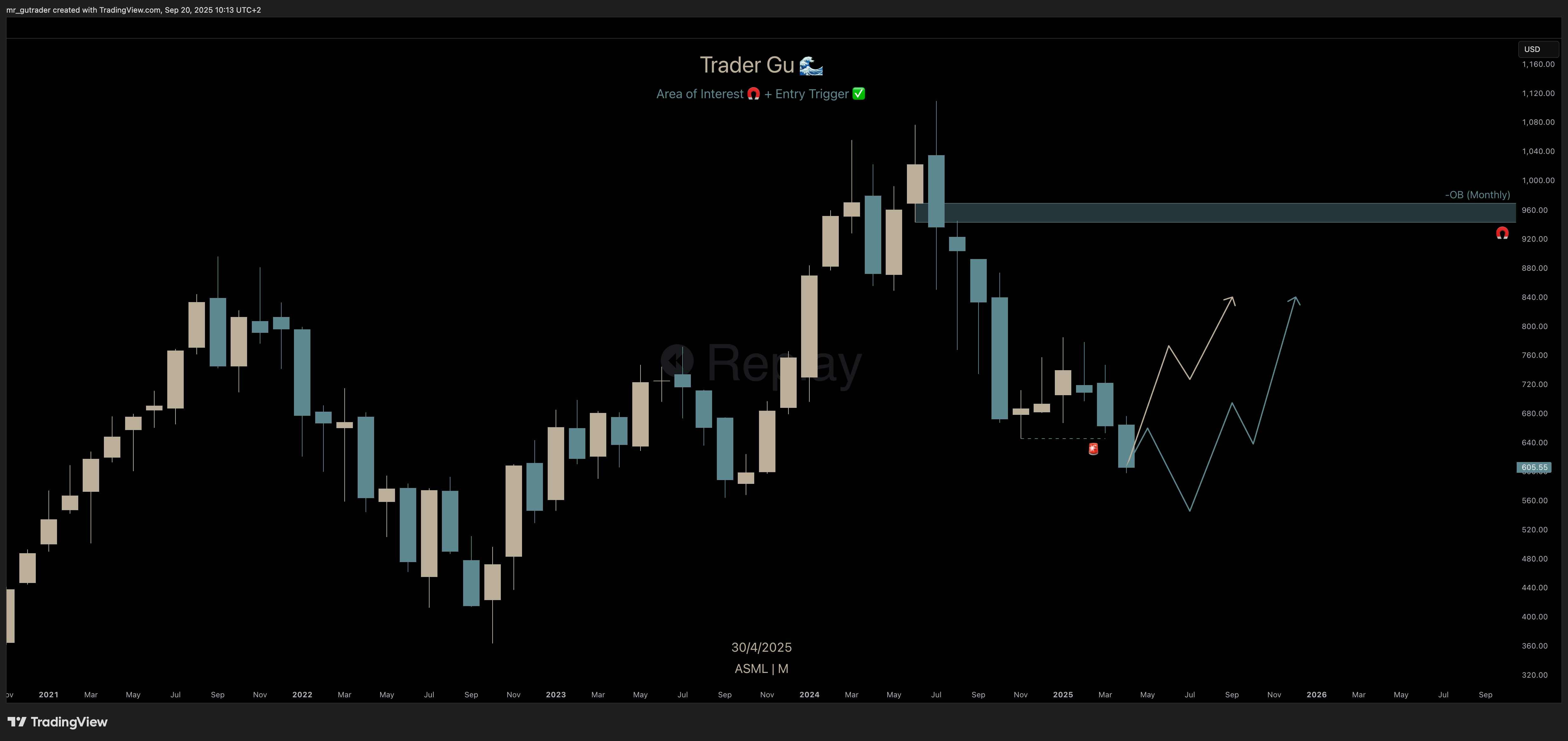

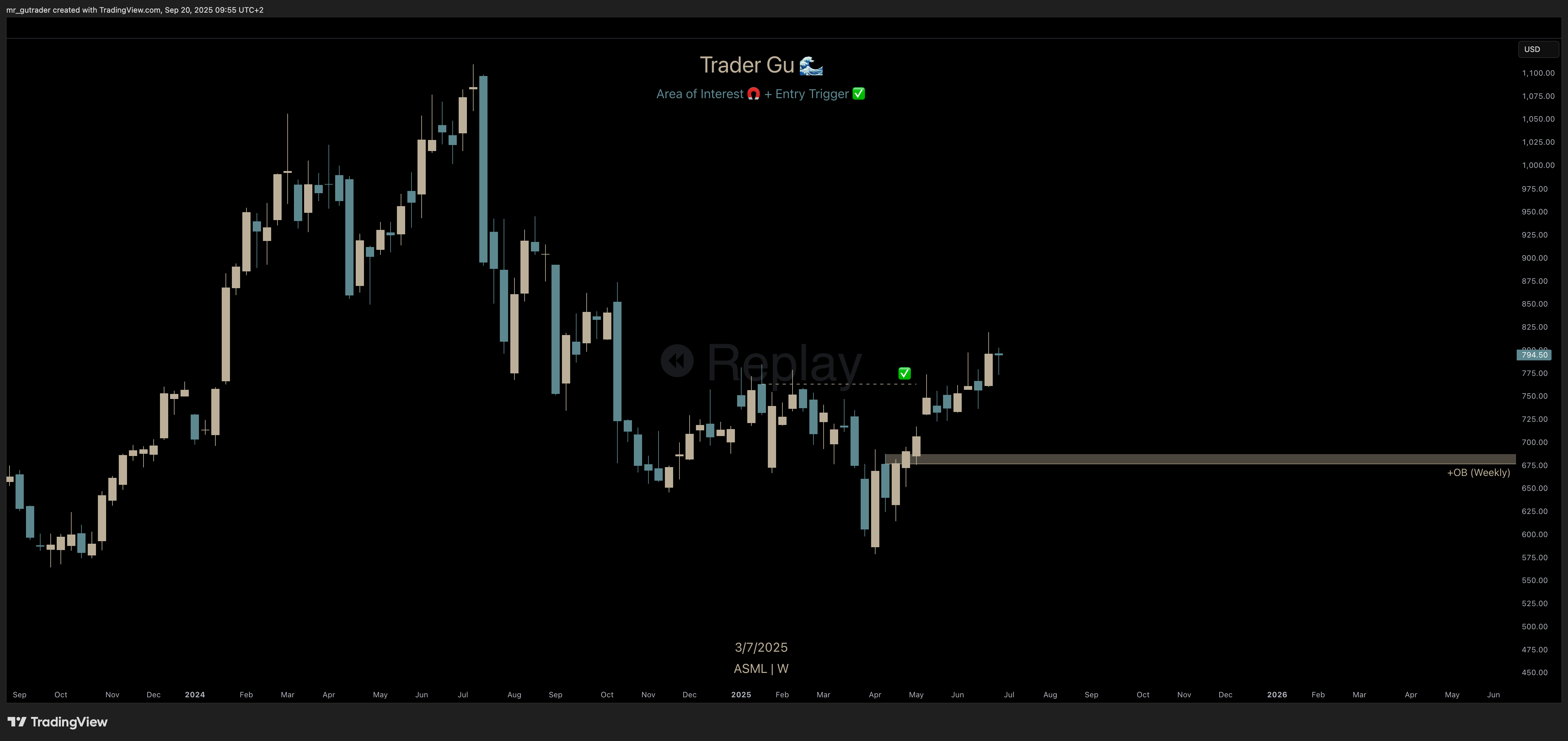

🧲 Area of Interest

Price chose the first alternative, and we got a clean liquidity sweep followed by a confirmed bullish reversal pattern. The monthly candle closed above $740, leaving behind a bullish monthly order block at $746-$722 acting as a strong support and liquidity level for a high conviction move to the upside.

The target for this move was to re-test the bearish monthly order block and resistance level at $943-$970.

$ASML - Area of Interest, monthly chart

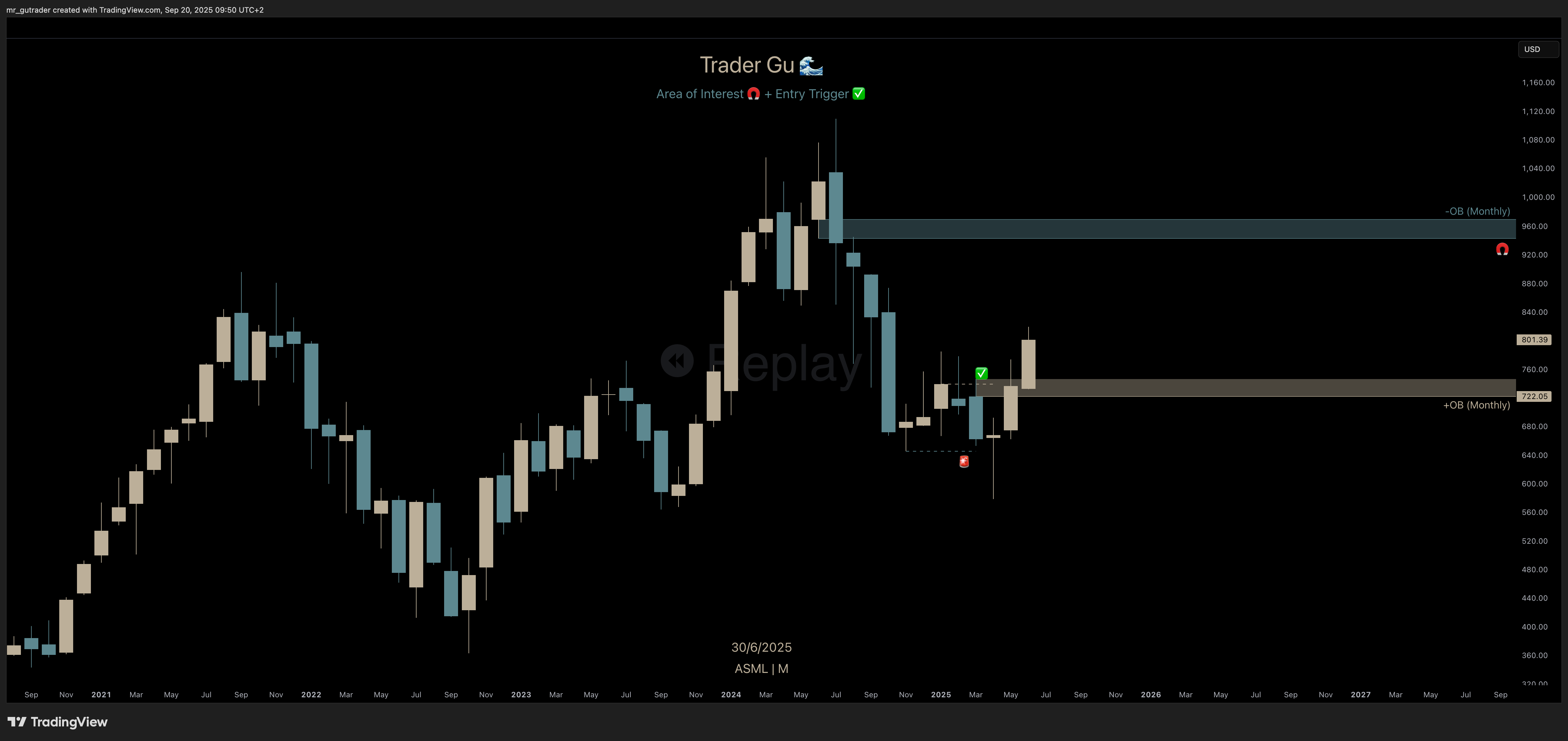

On the lower timeframes, we also had a clear bullish reversal. On the weekly chart, once we closed a candle above $763 and left behind a bullish weekly order block around $680–$678, that zone became the key area I was watching for an entry. For me, it offered a really attractive entry level with strong risk-reward, especially with my target up at $940.

$ASML - Area of Interest, weekly chart

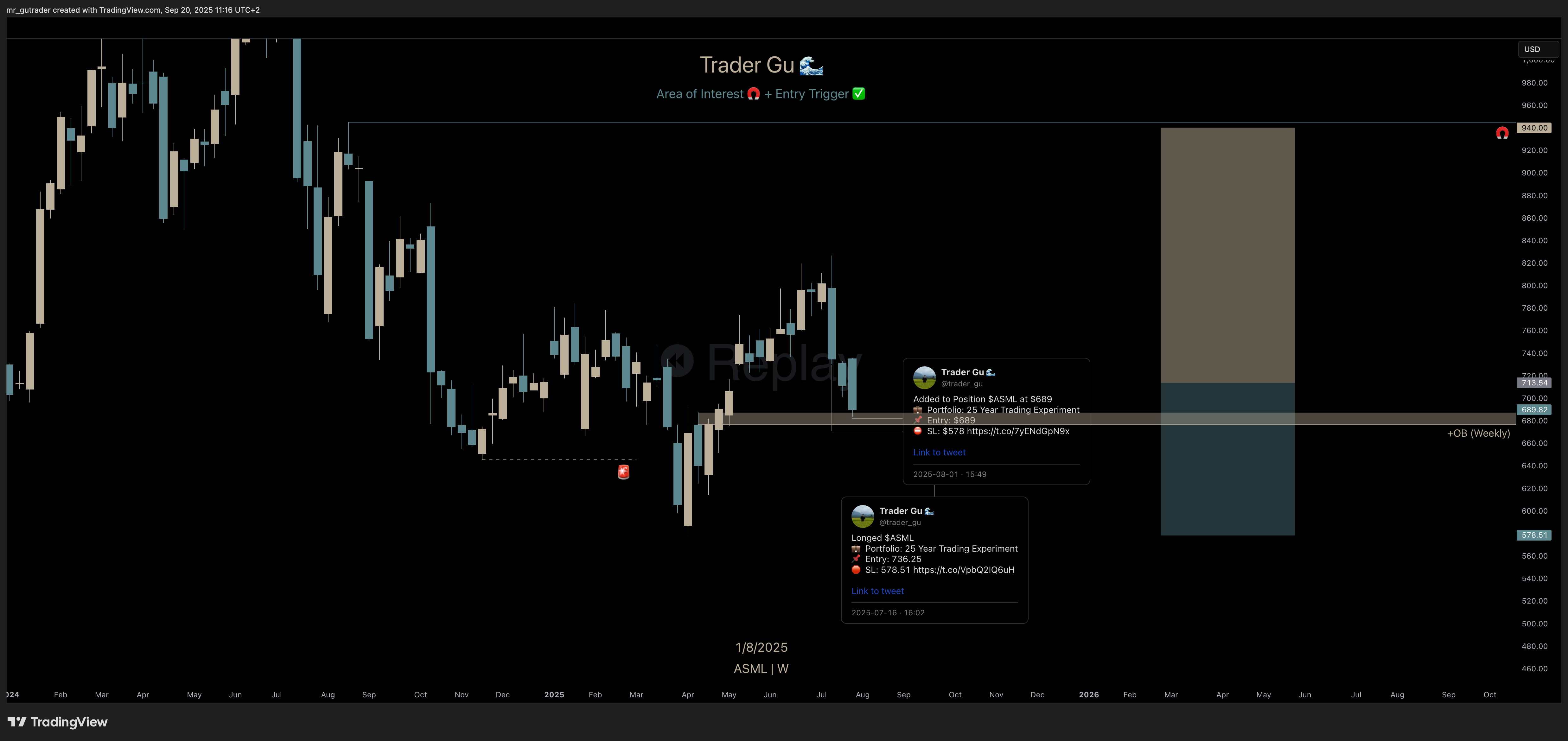

✅ Trade Entry

I opened a position on a retracement to the monthly order block with an entry at $740, keeping a stop loss under the newly formed low at $620. I entered with half risk, anticipating we would have a further move to the downside - retesting of the weekly order block.

Trade Entry

📌 Entry: $736,25

⛔️ SL: $578.51

💰 Target: $940

✅ Added to Position

Two weeks after my first entry, price finally tapped into the support zone I’d been waiting for. I added at $689, which brought my overall average entry up to $713.54.

Added to Position

📌 Entry: $689.00

⛔️ SL: $578.51

💰 Target: $940

Averaged Position

📌 Entry: $713.54

⛔️ SL: $578.51

💰 Target: $940

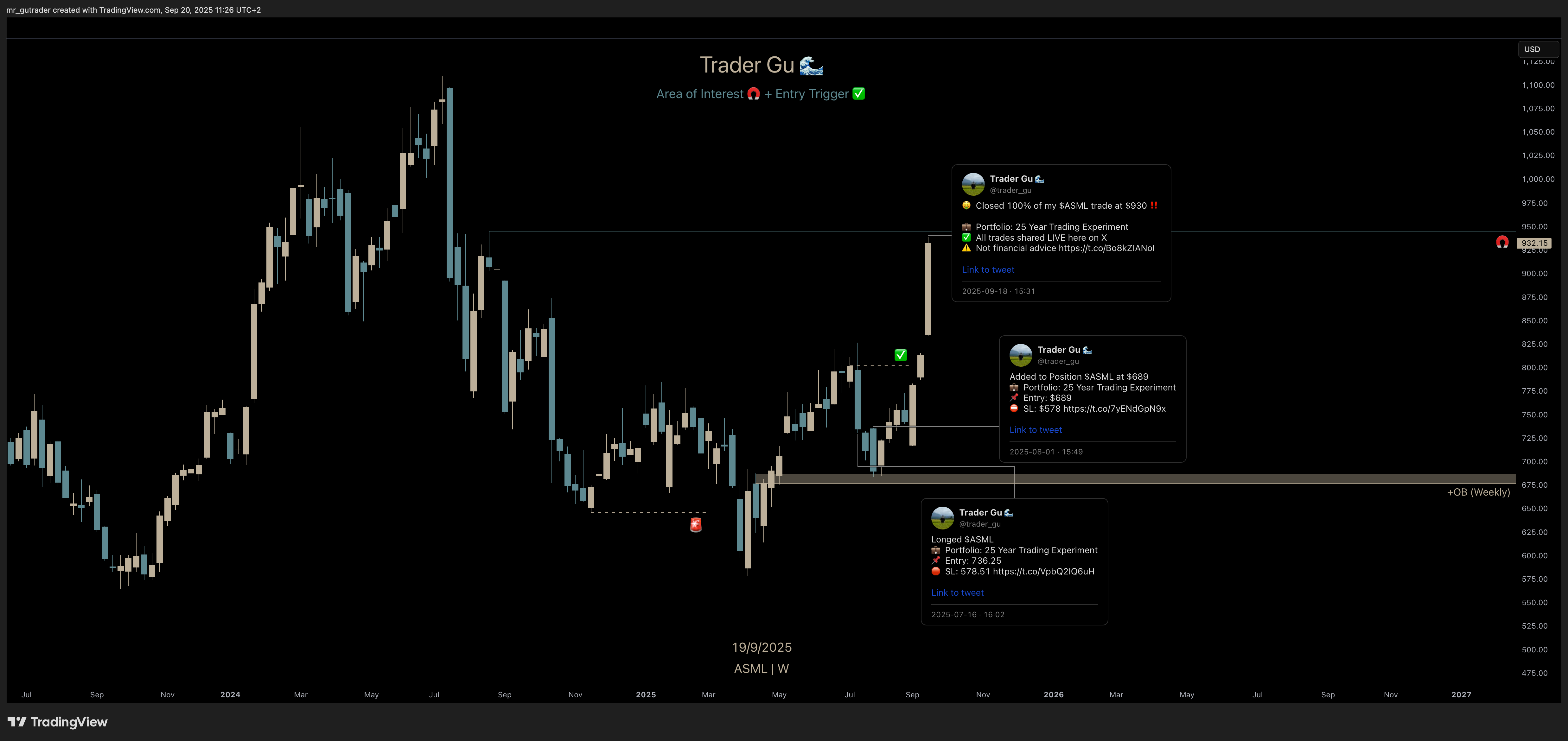

$ASML - Added to Position, weekly

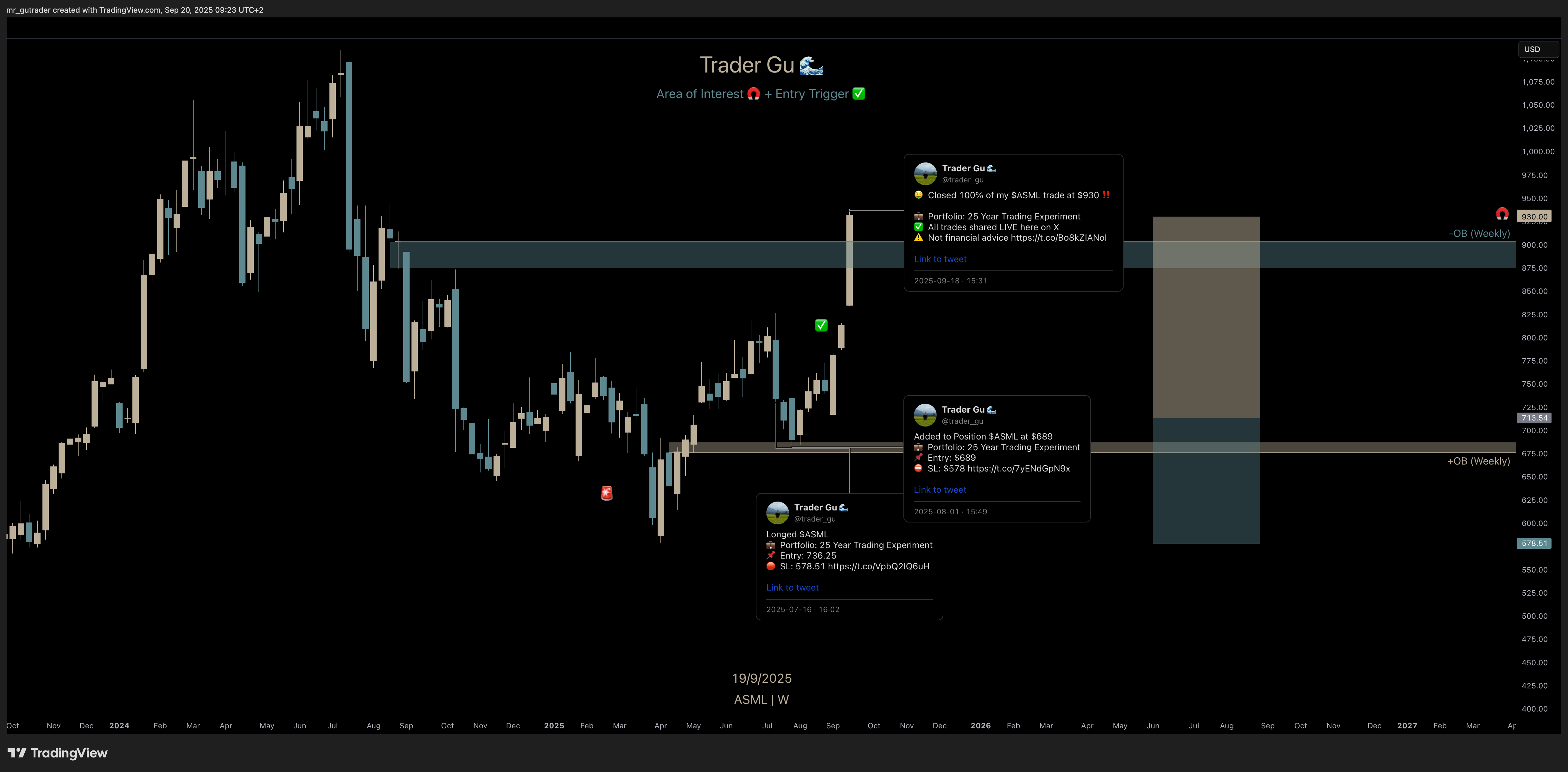

💰 First Target

After price reached my second entry zone and the bullish order block, it left behind a new resistance level - a weekly bearish order block at $780. That was my first target, where I considered taking some profit and maybe re-entering on a pullback. But the percentage move was too small to justify the risk-reward, so I held on.

The following week, price smashed through that level, completely invalidating the weekly order block and closing above $801. That confirmed a bullish reversal on the weekly timeframe - and at that point, I had full confidence we were on our way to my $940 target.

💰 Exit Position

My main exit target was $940, based on the monthly order block, with a weekly liquidity level lining up right at the same spot. That made it an even higher-conviction level for me. I ended up taking profit just below, at $930, locking in a 30% 🟢 gain on position.

$ASML - Exit position, monthly

🪞 Reflection

This was a trade I had been waiting on for months, tracking price action daily across all timeframes. Overall, I feel very confident and satisfied with how it played out. I followed my strategy, added to the position, and held all the way through to my target. I managed to take this trade in both my Main Trading Account and the 25 Year Trading Experiment, making it by far my biggest realized P&L of 2025.

My first entry was a bit rushed - I could have waited for a lower entry around $680 or gone in bigger. But I’m glad I didn’t get greedy. If I had waited and price never pulled back, I would have missed out on a significant gains. So in the end, I’m happy with how I managed it. If there’s one thing I might have done differently, it would be to size up the risk even more, since this was one of my highest-conviction trades of the year.

✅ Followed my strategy

✅ Added to position

✅ Took full profit at target

If you want to learn how I build conviction for trades like this, check out:

More learnings can be made from my previous trade reviews as well as following my journey on X for live updates.