💼 Portfolio Update: Main Trading Account | August 2025

It’s been six months since my last update on the Main Trading Account, and it’s finally time for another portfolio review. With summer now behind us and five months left in 2025, I’m more excited than ever about the progress of my trading journey. While I continue to share a lot of content around my 25 Year Trading Experiment, the Main Trading Account remains my primary focus when it comes to building long-term net worth.

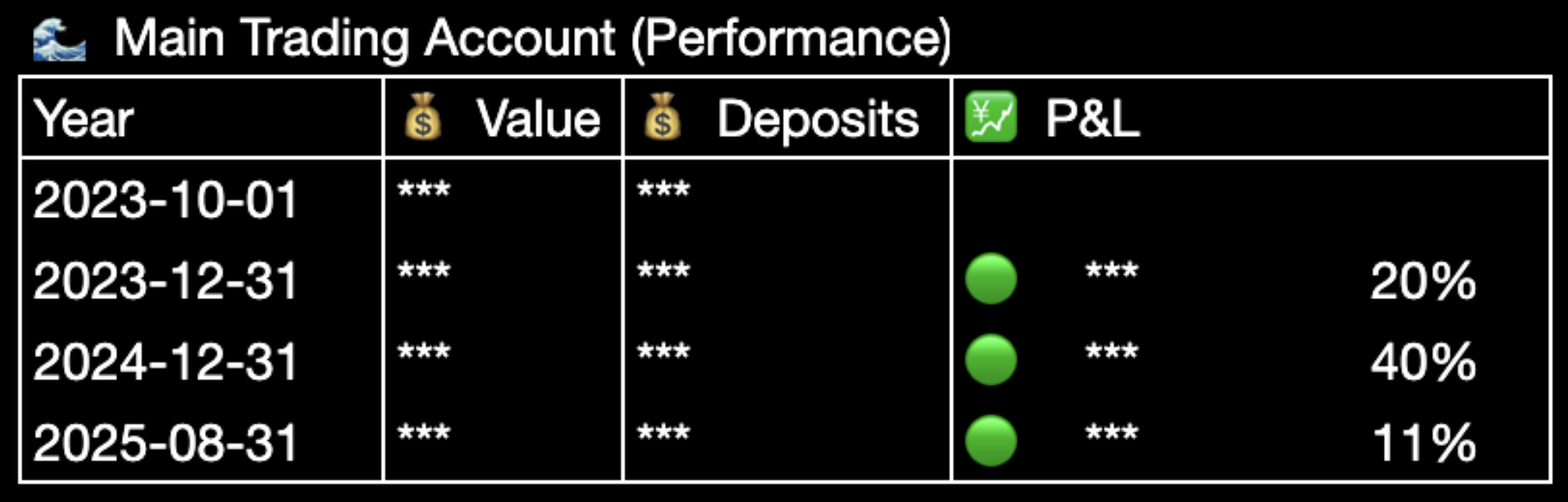

Performance: Year to Date

Although I’ve added significant deposits to my Main Trading Account during 2025, the portfolio is still up 🟢 +11% on a P&L basis (as of August 31, 2025).

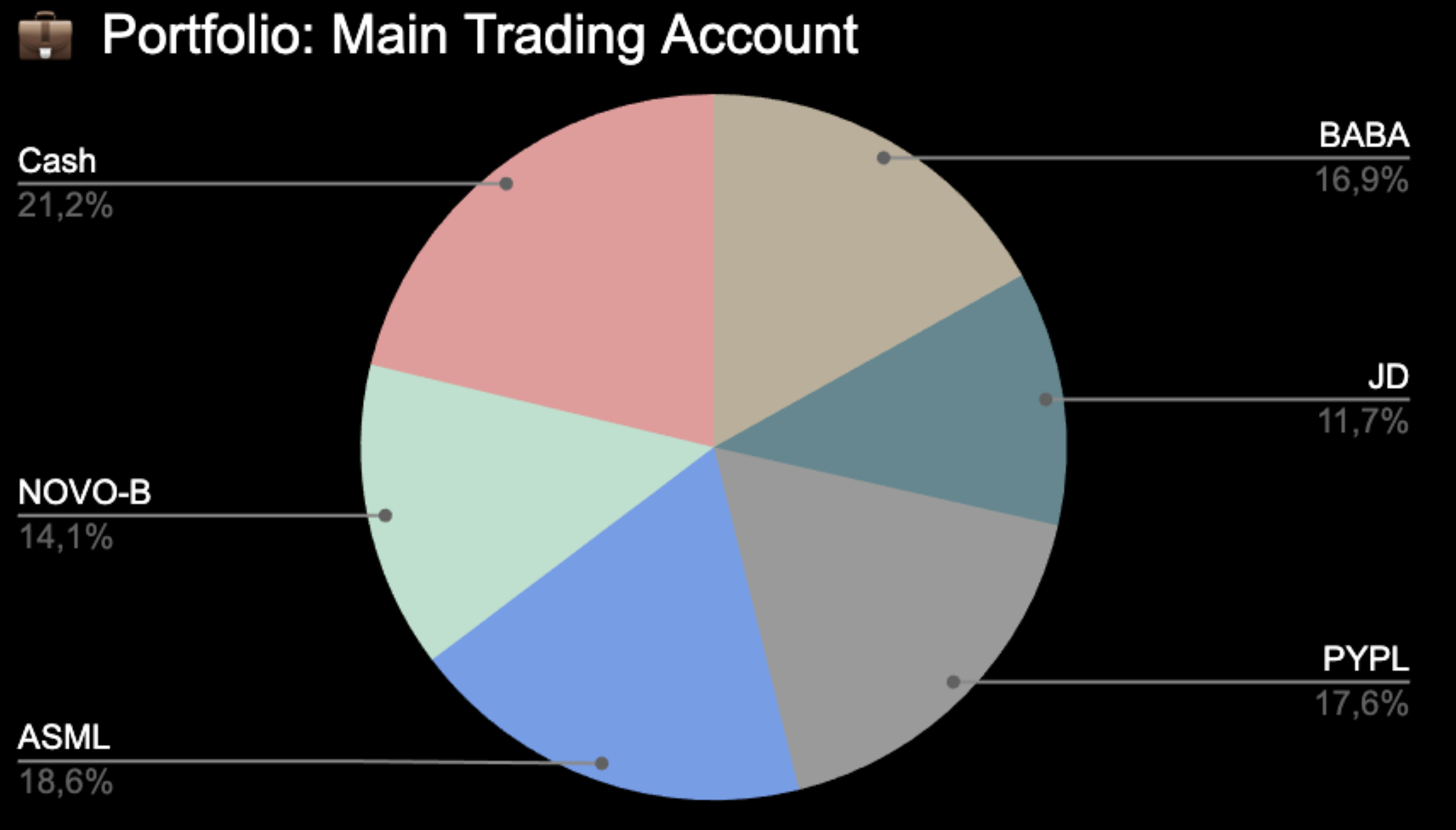

Open Positions

The portfolio currently consists of 5 open positions, with the largest position being $ASML and the highest-risk position being $JD.

| 📌 Ticker | 💼 Portfolio Allocation | ⚠️ Risk per Trade |

| $BABA | 16.7% | 3% |

| $JD | 11.7% | 5% |

| $PYPL | 17.6% | 3% |

| $ASML | 18.6% | 4% |

| $NOVO | 14.1% | 4% |

| 💰 Cash | 21.2% |

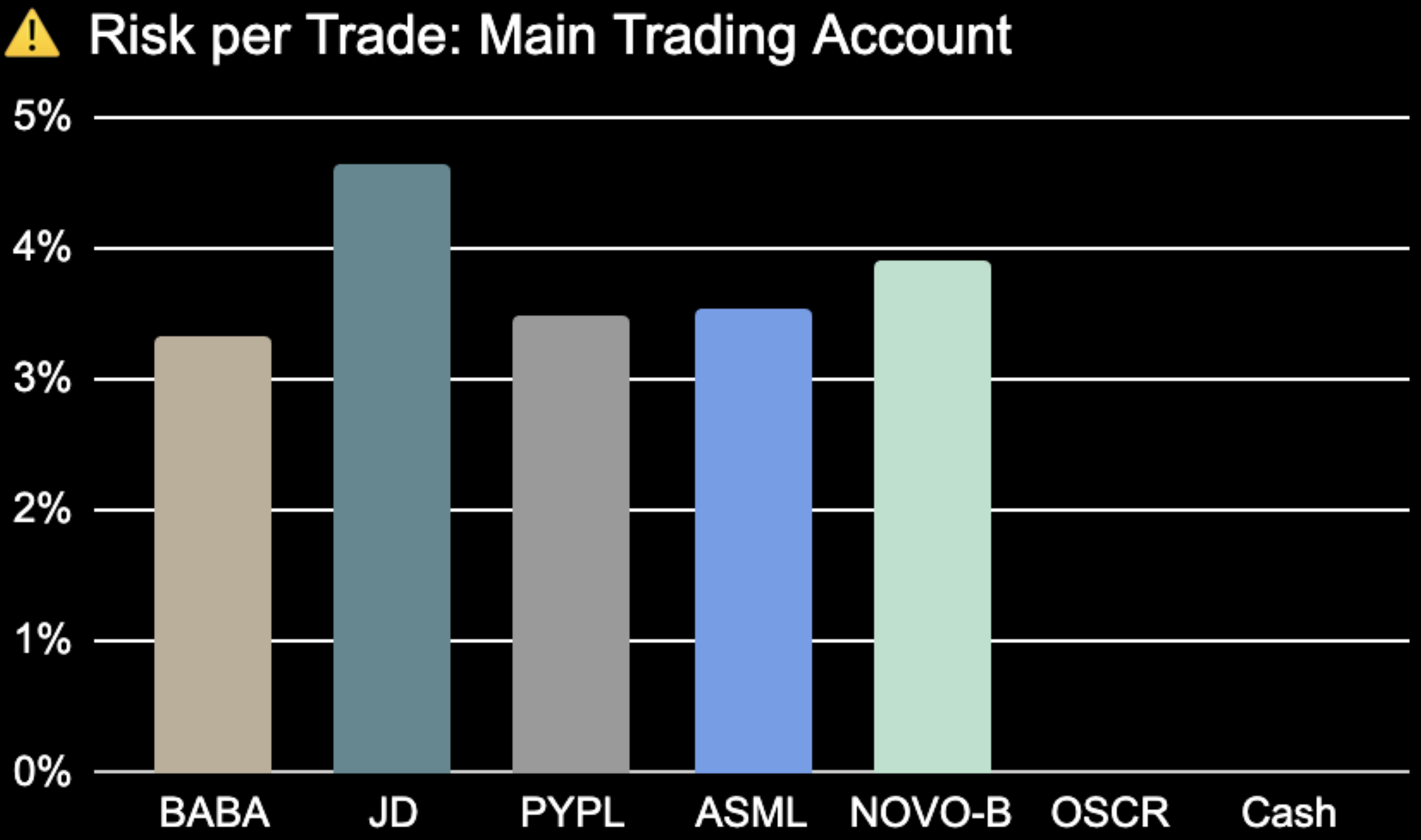

Risk per Trade

The total risk of invested capital is currently ⚠️ 19% whereas the total risk on portfolio drawdown is ⚠️ 22%. The risk per trade on positions range from 3% to 5%.

⚠️ The total portfolio drawdown represents the maximum loss if all trades are invalidated and exited at their defined stop-loss levels.

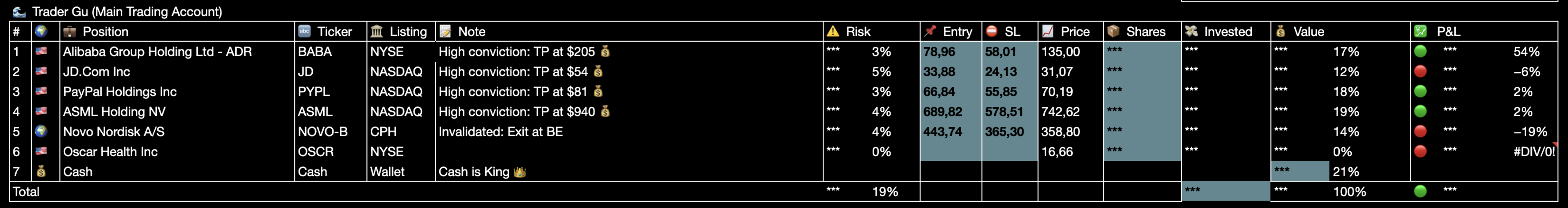

Open Positions: Detailed Overview

The following table contains the entry, stop loss, position size, and current market prices.

All trades and portfolio management is shared live on my X, @trader_gu

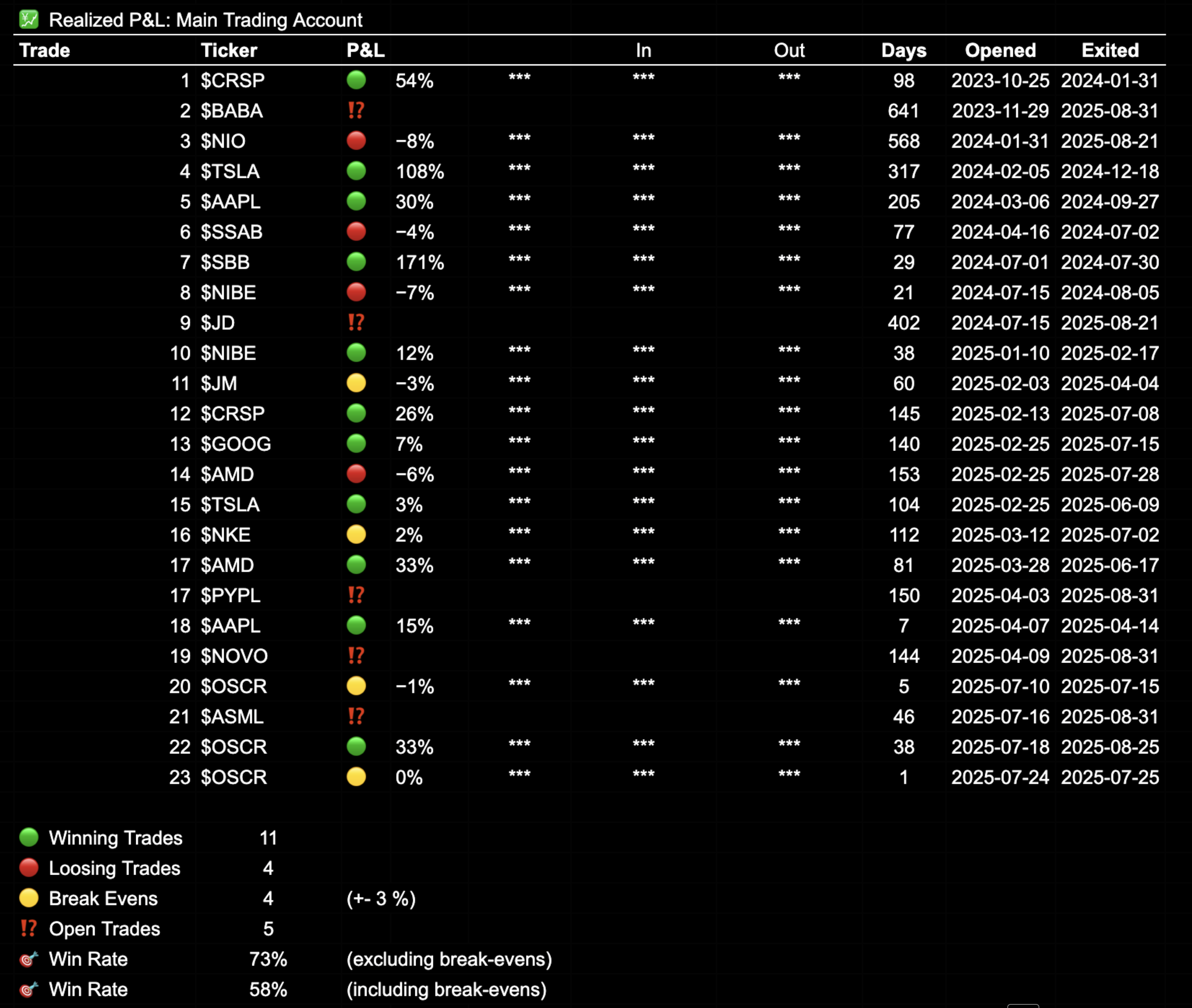

Realized P&L

Since inception in October 2023, I’ve taken 24 trades, realizing P&L on 19 of them:

- 🟢 11 Winners

- 🔴 4 Losses

- 🟡 4 Break-even (±3%)

This equates to a 73% win rate when excluding break-even trades, or 58% including them. I currently have 5 open trades, with the longest running since the end of 2023 for a total of 641 days. My top 5 trades have delivered returns ranging from 33% to 171%.

Performance to Date

The performance year-on-year of my Main Trading Account has ranged from 11% to 40%. So far, I’ve not had a negative year.

- 2023: 🟢 +20%

- 2024: 🟢 +40%

- 2025: 🟢 +11%

Worth mentioning is also that this year’s P&L result is also heavily affected by the volatile $USDSEK development which has had a 🔴 16% move to the downside since beginning of 2025.

Summary

The main trading account is in solid profits. While the additional deposits this year have lowered the year-to-date percentage gains, I remain confident in both the performance and the scale of this account going forward. Looking back since inception, it’s striking to see that I’ve taken only 24 trades over nearly three years - a reminder that strong results can be achieved by being selective with where you put your capital to work. That said, I do recognize that I’ve been over-trading in 2025. My focus now is on reducing the number of trades, only taking the highest-conviction setups, and staying disciplined with both my trading strategy and my overall goals for the remainder of the year.

In addition, I’ve been considering switching my account base currency from SEK to USD to avoid currency exchange fluctuations impacting my P&L. If I decide to make the change, it will be implemented at the start of a new year.

How has your trading performance been so far for 2025, and are you tracking in USD or possibly a local currency?

💬 Drop a comment below, share your thoughts on my YouTube channel or connect with me on X - I’m always interested to connect with like-minded people.