🎯 $NIO: Bullish Reversal or Bull Trap?

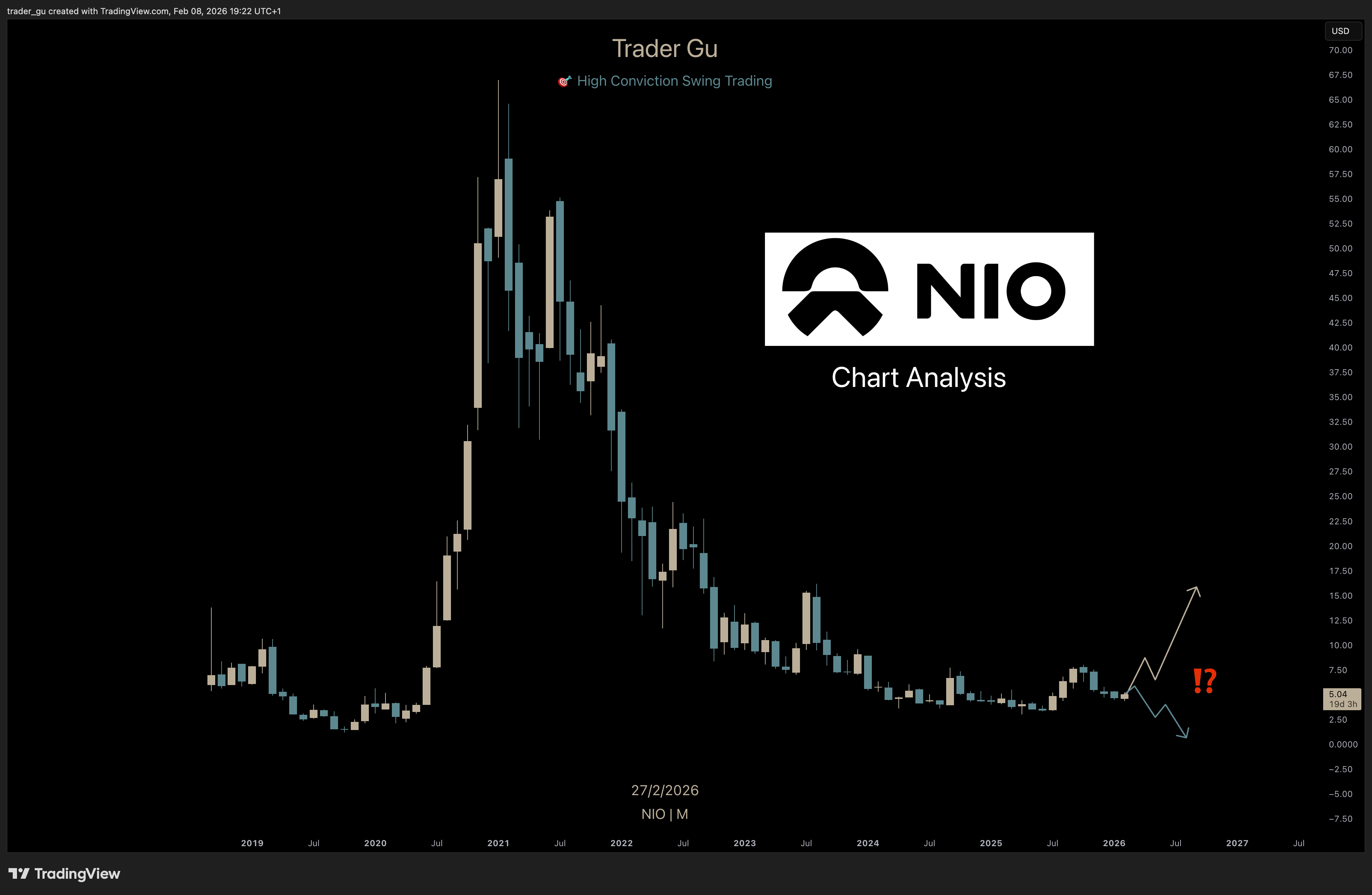

$NIO has been sitting on my developing-to-trade watchlist for a few weeks now. From being a COVID-era lovechild that took the stock from $2 to an all-time high at $68, followed by the 2021 bear market round-tripping investor profits all the way back to the IPO price. NIO has been the retail investor’s nightmare while short sellers profited for years.

Until the past few months.

$NIO is making headlines, not only finally reaching profitability but also having confirmed a bullish market structure reversal on the higher timeframe. Are we looking at a high-conviction bullish reversal, or is this heading for new lows? Let’s break down the price action across timeframes and find out where the probabilities are higher for the next move.

In this post, you’ll get:

- Monthly and weekly timeframe analysis with market structure context

- Key levels for entry, invalidation, and targets

- My conviction verdict on $NIO right now

Monthly Timeframe

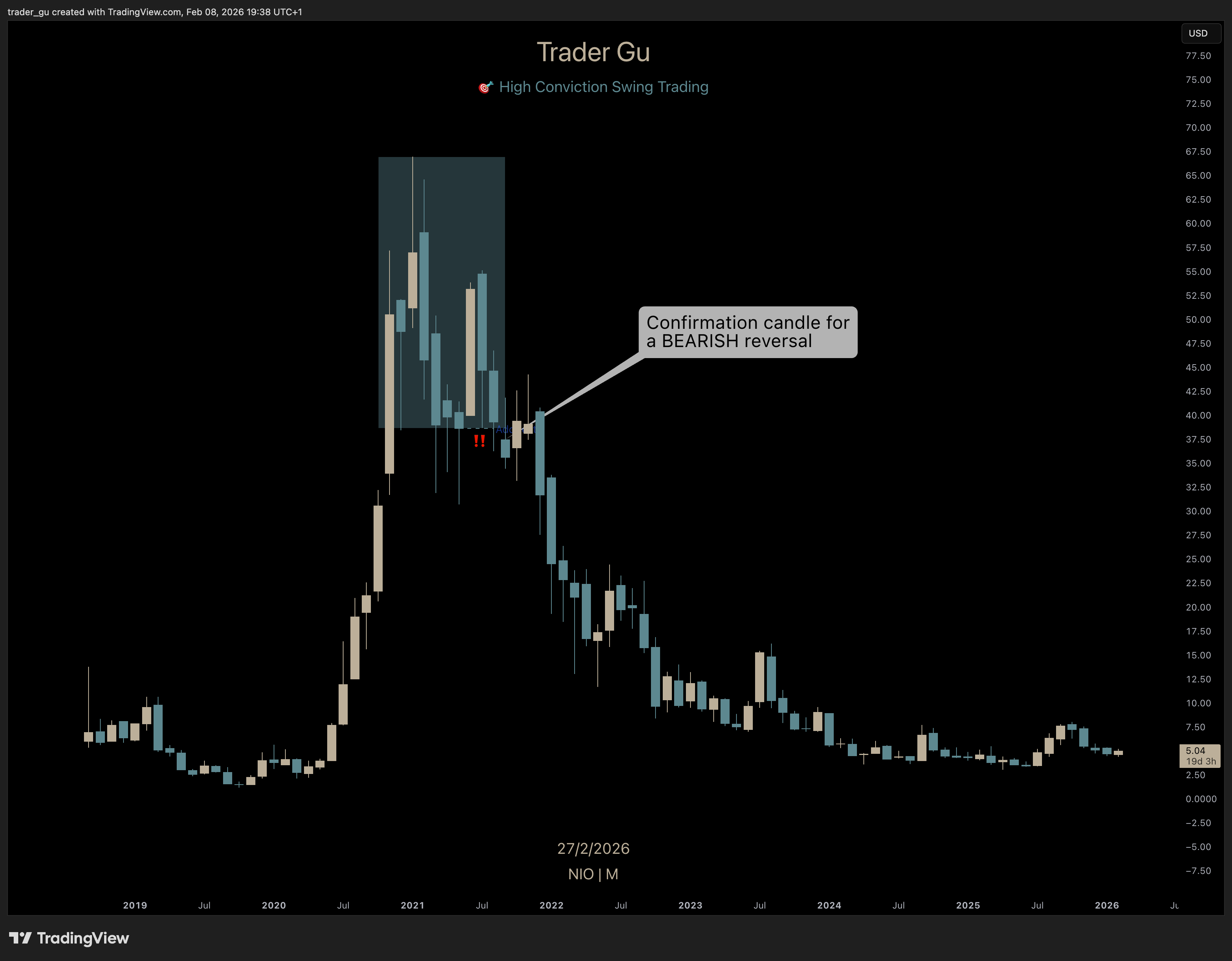

After a 3,000% move to the upside, price started to build a bearish reversal on the monthly timeframe, which was ultimately confirmed after closing the monthly candle below $38.6 in September 2021.

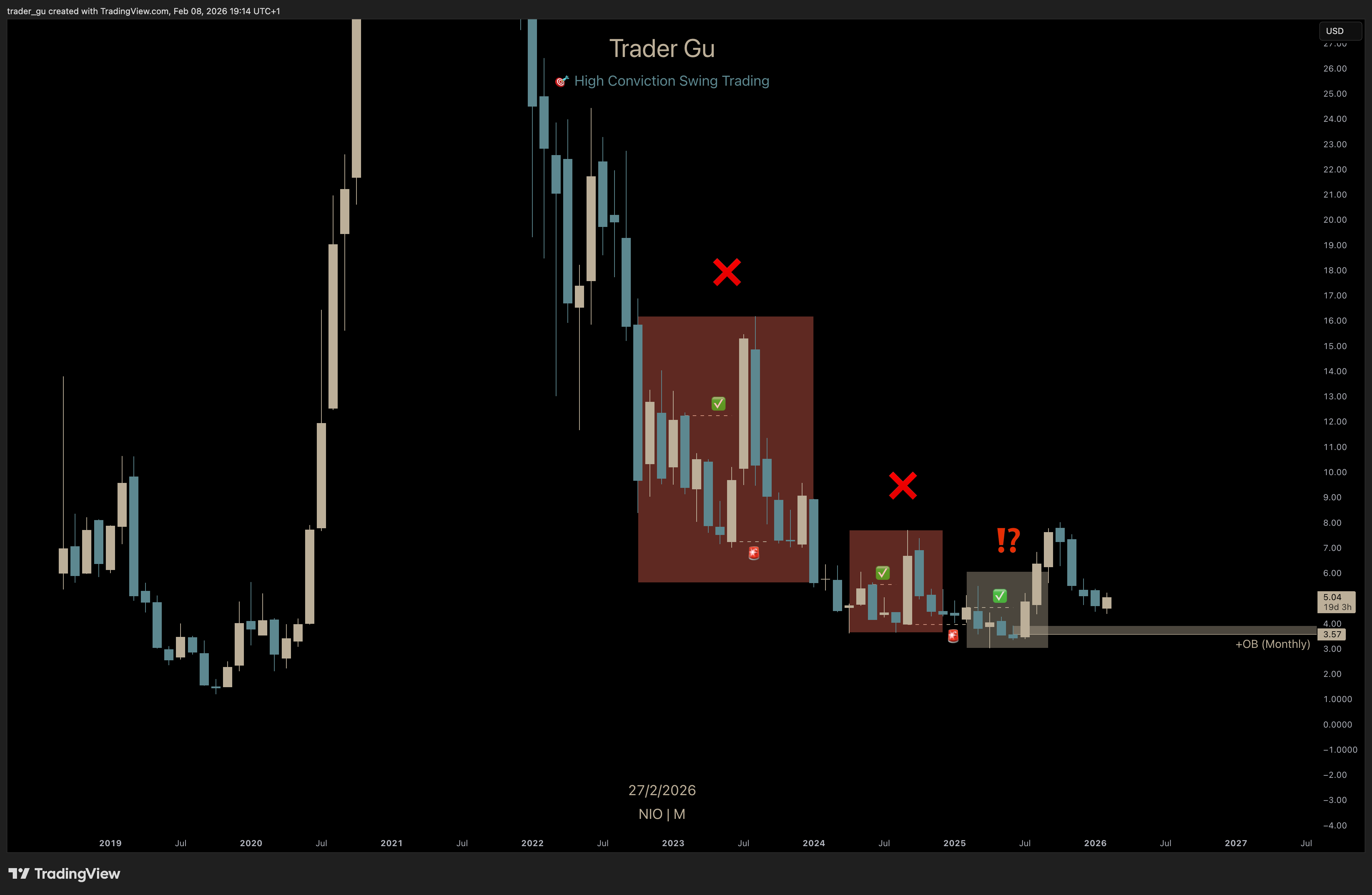

Price headed further south for years, and buyers made two attempts at breaking out of the bearish market structure. First in 2023, followed by a second attempt in 2024. Both of these triggers confirmed a bullish reversal on the monthly timeframe but were ultimately invalidated, and price moved further south.

2025 brought another attempt.

After taking the previous year’s liquidity, price closed the monthly candle above $4.63, signaling yet another bullish reversal on the monthly timeframe. This time, it was followed by a strong expansion to the upside, even taking the liquidity and closing the monthly candles above the previous attempt.

Once new highs are made, probabilities are in favor of a deeper retracement. This is where high-conviction swing traders prefer to enter. Favorable risk-reward with a clear invalidation level.

Price is currently retesting the $4.63 breakout and resting just above a monthly support level.

Monthly conviction: The monthly structure remains bullish and the third reversal attempt shows promise, though we’d prefer weekly timeframe confirmation before taking a higher-conviction position.

Weekly Timeframe

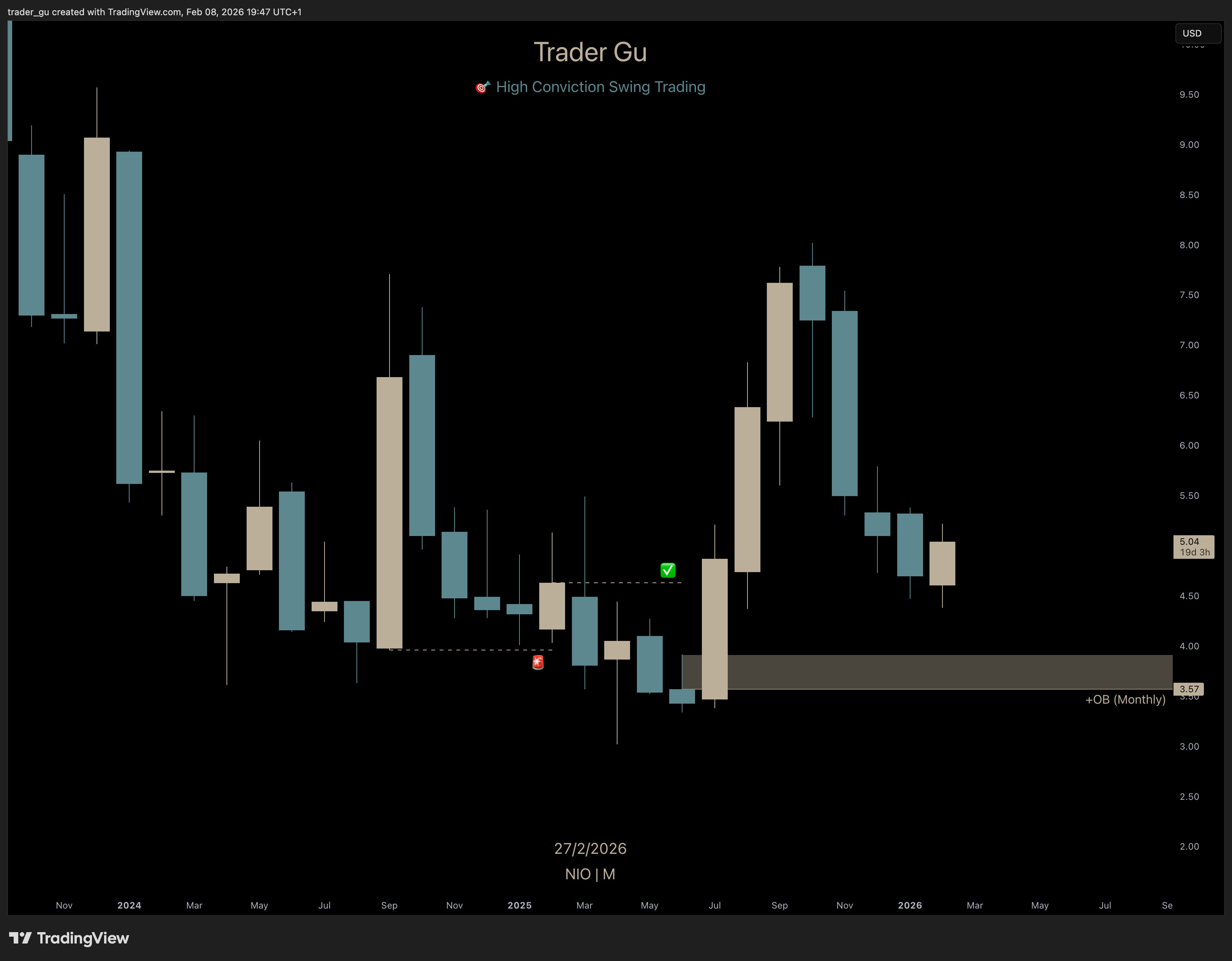

On the weekly timeframe, price has moved in clear waves. From making a bullish reversal with expansion to the recent high at $8, followed by a bearish reversal triggering the retracement to the downside. Price is now currently building for a bullish reversal pattern on the weekly timeframe.

I had my alerts set at a liquidity sweep of $4.37. However, price just missed it and started reversing to the upside but ultimately failed to close the weekly candle above $5.14. This would indicate a bullish reversal on the weekly timeframe.

If price opens the week above that level, that’s a bullish reversal trigger, laying the probability for a move towards the upside. If we open the week below that level, we need to wait until end of week for more clarity on where price is most likely heading over the next couple of months.

My preferred scenario would have been a clear liquidity sweep of $4.37, tapping into the monthly support level resting just below. It’s not out of the question, but the probability of that happening has decreased.

Weekly conviction: Developing. I need a weekly close above $5.14 to confirm bullish structure.

Targets and Invalidation

The target for an expansion to the upside would be the $10.9 level, which is the 0.618 Fibonacci expansion. A greedy second target could be $12.7, or even $16, but for my trading strategy, I would target $10.9.

Invalidation would be the $3.12 level. A monthly close below that would invalidate the trade.

Conviction Verdict

$NIO Conviction: Developing

Monthly structure is bullish with a confirmed reversal. Weekly structure needs a close above $5.14 to confirm a trade trigger.

My Position

I’m currently not positioned in $NIO at the time of publishing, but I’m keeping this ticker on my developing-to-trade watchlist. Any trade I take will be automatically shared on my X account.

So, are you currently positioned in $NIO? Have you been holding on for years or looking to enter? Let me know in the comments below 👇

For live trade entries and exits, follow me on X. For weekly deep dives like this one, make sure you’re subscribed to High Conviction Swing Trading here on Substack.

This is not financial advice. I am not a financial advisor. This content is for educational and entertainment purposes only.