🧰 Expressing a Swing Trade: Equity vs Bull Call Spreads

Introduction

There are many ways to express a swing trade in the market.

The most common, and often the first, is simply buying shares and managing risk with a stop-loss.

As traders evolve, questions around capital efficiency, risk definition, and portfolio construction naturally arise. This is often where options enter the conversation, sometimes with curiosity and sometimes with hesitation.

In this post, I’ll walk through one specific swing trade on $TGT and compare two ways of expressing the same trade idea:

- A traditional equity swing trade

- A long-dated Bull Call Spread

The goal is not to promote one approach over the other, but to understand what actually changes when you switch instruments while keeping the thesis intact.

The Trade Idea

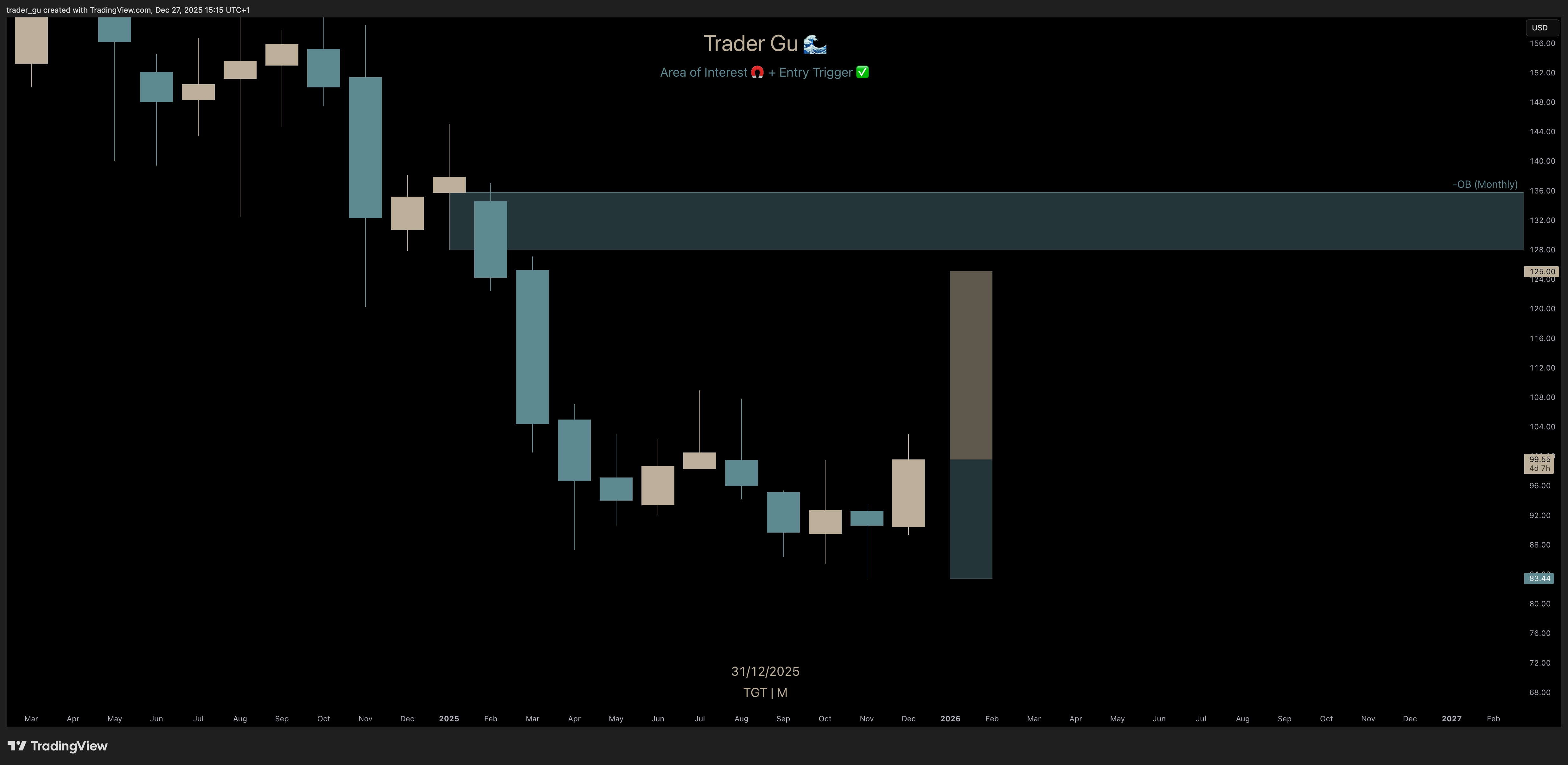

$TGT, monthly order block, entry, stop-loss and target

$TGT, monthly order block, entry, stop-loss and target

This is a higher-timeframe bullish reversal pattern idea

- Weekly bullish market structure reversal

- Monthly bullish market structure reversal building

- Liquidity sweep below prior months lows

- Liquidity sweep of the Covid low

- Clear upside target into an untested bearish Order Block

Key levels

- Entry: ~$99.55

- Stop: ~$83.44

- Target: ~$125

This is not a day or intraday trade.

It is a high-conviction swing designed to give price room to work, with risk defined by the stop-loss rather than by time.

Option 1 - The Equity Swing Trade

The most straightforward way to express this idea is by buying shares.

For comparison purposes, the position size is adjusted so that the dollar risk is approximately $1,000, keeping the same entry and stop-loss levels.

Trade structure

- Buy ~62 shares

- Capital deployed: ~$6,200

Risk

- Defined by the stop-loss

- Approximate risk: ~$1,000 (position sized for comparison)

Reward

- If price reaches ~$125

- Approximate profit: ~$1,580

- Risk-to-reward: ~1.6R

Why equity works well

- No time constraint

- No time decay

- Very forgiving if price moves slowly

- Simple to manage and easy to understand

- Easy to scale risk to an appropriate level

Trade-off

- Large capital commitment relative to defined risk

- Open-ended gap risk

Equity trades are robust and intuitive, but capital-heavy.

Option 2 - The Long-Dated Bull Call Spread

Instead of buying shares, we can express the same idea using options:

- Buy a call near current price

- Sell a call at the predefined target

- Use a long-dated expiry (LEAP-style)

Unlike equity, options introduce time as an explicit variable.

Using a long-dated structure is a deliberate choice to reduce time pressure while maintaining defined risk.

This approach fits naturally with the trade plan, as the exit level is already defined in advance.

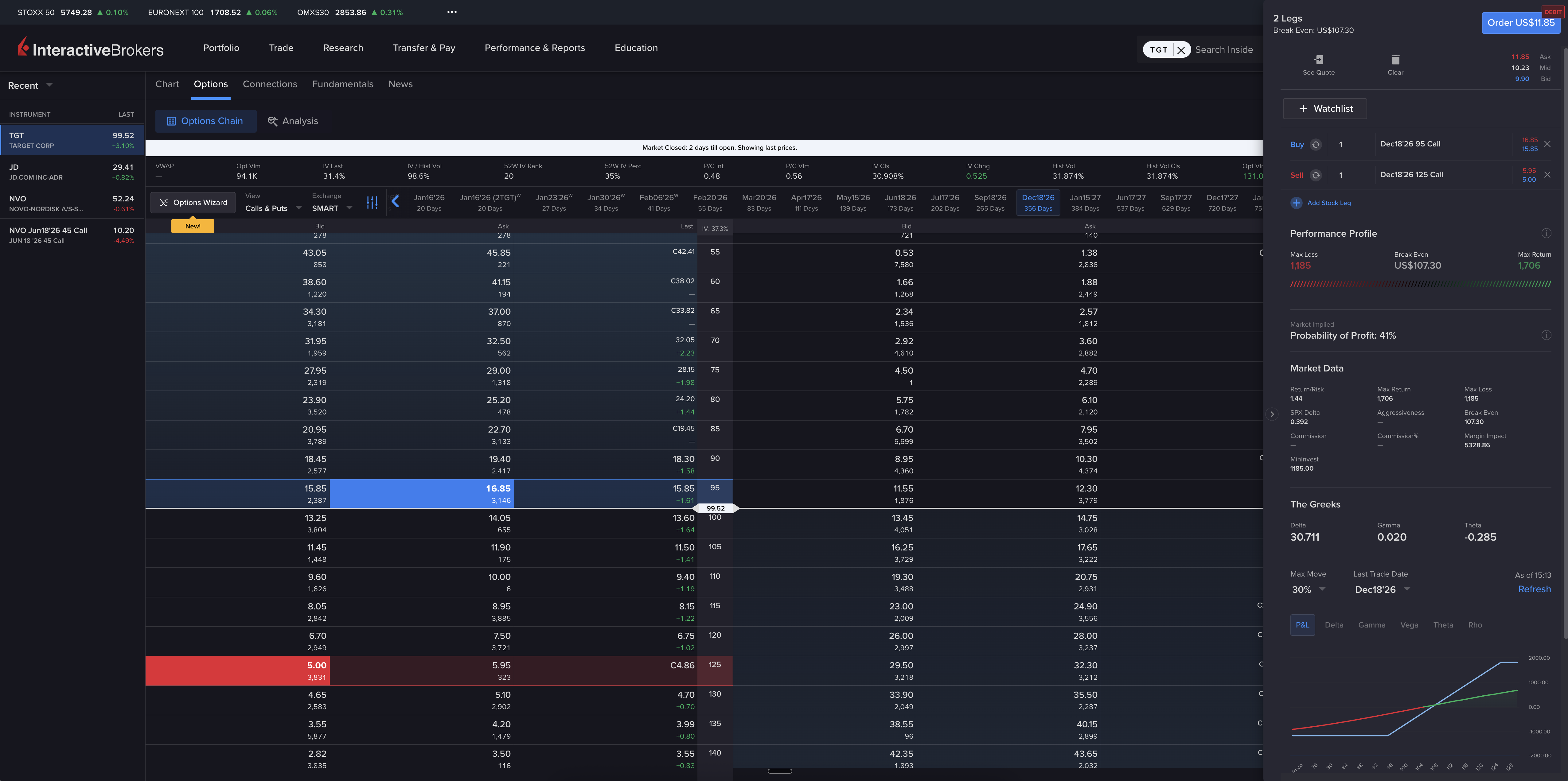

12-Month Bull Call Spread

$TGT, 12-month Bull Call Spread

$TGT, 12-month Bull Call Spread

Structure

- Buy 95 Call

- Sell 125 Call

- Expiry: ~12 months

Risk

- Capital at risk: ~$1,185 (fully defined)

Reward

- Max profit: ~$1,700

- Risk-to-reward: ~1.4R

What this structure does

- Replaces ~$6,200 of equity exposure with ~$1,200 of defined risk

- Preserves the same directional thesis

- Significantly reduces time pressure compared to shorter-dated options

What it does not do

- It does not materially improve R:R

- It does not add explosive upside

The primary benefit here is capital efficiency and risk definition, not higher expectancy.

A Note on Duration (Side Note)

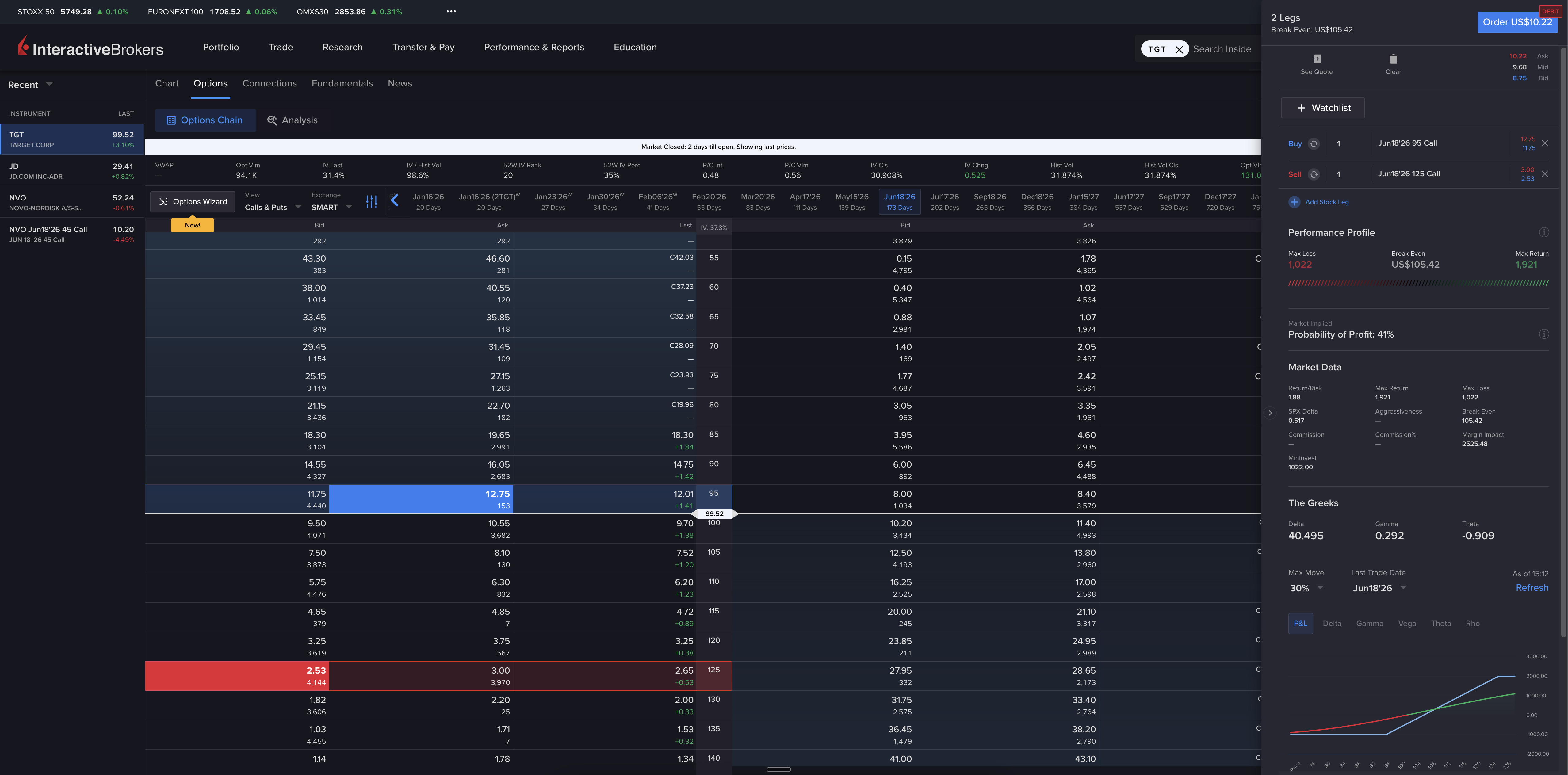

$TGT, 6-month Bull Call Spread

$TGT, 6-month Bull Call Spread

This is not part of the primary comparison, but highlights the trade-offs introduced by shorter duration.

Using the same strikes with a shorter expiry:

- Higher potential R:R

- Meaningfully higher time risk

Although the risk remains defined, approximately ~$1,500 considering two contracts, the uncertainty shifts toward timing and pace, making time a material stress factor.

Equity vs Long-Dated Bull Call Spread

| Feature | Equity | 12M Bull Call Spread |

|---|---|---|

| Capital used | Moderate | Low |

| Risk | Stop-based | Fully defined |

| Time constraint | None | Explicit |

| Time decay | None | Minimal |

| R:R | Higher | Slightly lower |

| Time forgiveness | Very high | High |

| Capital efficiency | Low | Very high |

Long-dated Bull Call Spread’s are not about maximizing returns. They are about optimizing capital usage while managing time risk.

The Right Mental Model

Equity and LEAP-style spreads are not competing ideas.

They are tools designed for different constraints.

- Equity excels when time is not a binding variable and risk is scaled through position sizing

- Long-dated Bull Call Spread’s excel when capital efficiency and defined risk matter, and when time risk must be managed rather than ignored

Equity trades also carry the risk of significantly larger losses in the event of an opening gap well below the defined stop-loss level.

For this $TGT setup:

- The thesis does not change

- The levels do not change

- Only the risk container and time exposure change

Summary

In this post, I compared two ways of expressing the same swing trade idea:

- A traditional equity position, sized to ~$1,000 of stop-based risk

- A long-dated bBull Call Spread with fully defined risk

Equity trades are governed by price and the stop-loss.

Options trades introduce time as an additional dimension of risk.

Using long-dated Bull Call Spread’s is not about leverage or aggression. It is a way to mitigate time risk, while gaining capital efficiency, defined risk, and portfolio flexibility.

Hope you found this breakdown useful.

If you trade both equity and options, or are considering the transition, I’d love to hear how you approach these decisions. 👇