👀 $ADBE: Covid Low Swept - Is a Reversal Building?

$ADBE has been one of those names quietly bleeding out while the broader market held up. From a software giant trading near $700 at its peak to now sitting around $264 -a 60%+ decline from all-time highs. Last week, something significant happened: price swept the Covid low liquidity level at $255.

For high-conviction swing traders, that’s a level worth paying attention to. But is this the beginning of a reversal, or is there more downside to come? Let’s break down the price action across timeframes.

In this post, you’ll get:

- Monthly and weekly timeframe analysis with market structure context

- Key levels for entry, invalidation, and targets

- My conviction verdict on $ADBE right now

Not Financial Advice

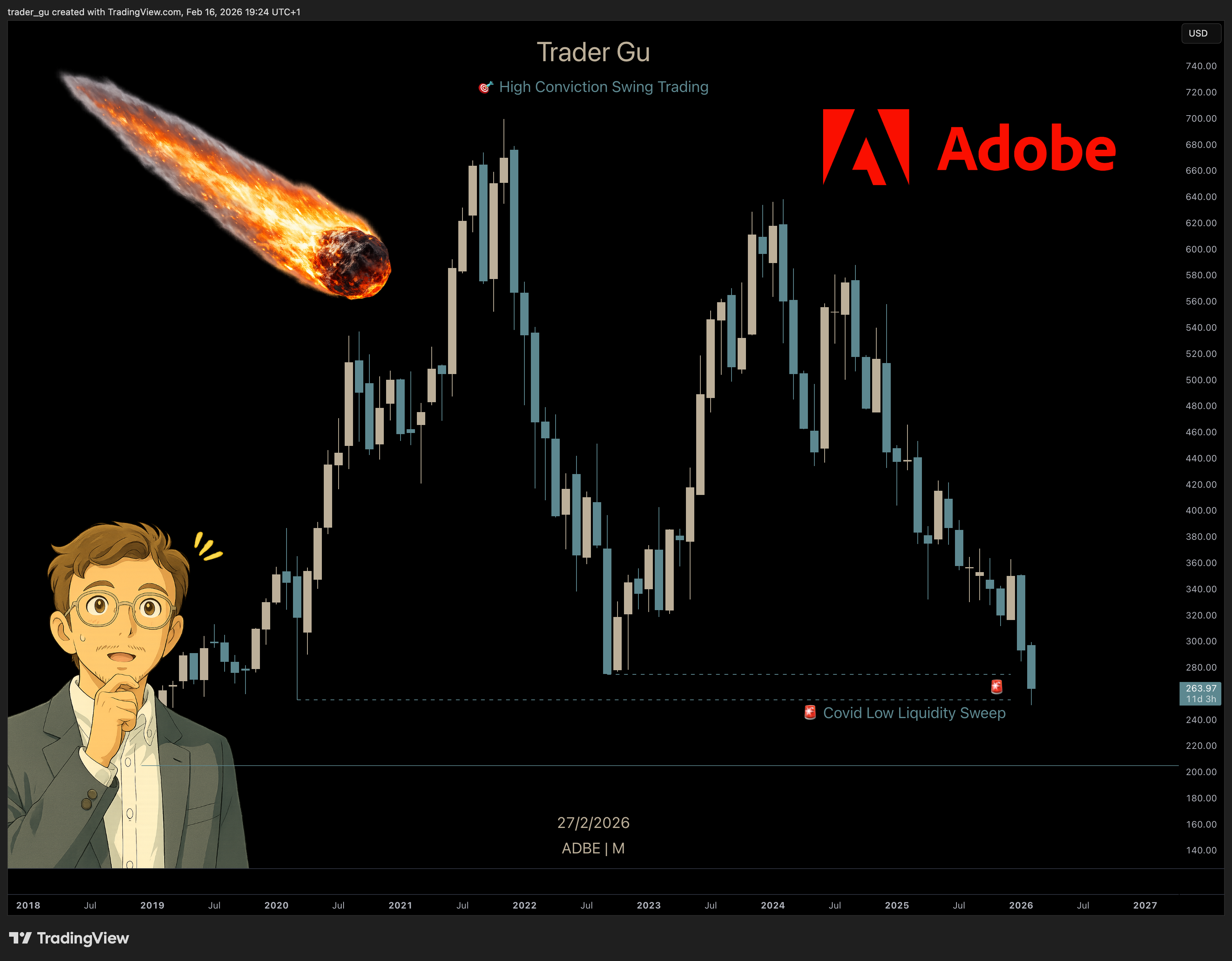

Monthly Timeframe

Since mid-2024, $ADBE has been in a clear bearish market structure on the monthly timeframe. Price has moved steadily lower with no confirmed bullish reversal pattern to date.

However, the latest leg to the downside swept the Covid low liquidity -a significant level where price previously reversed with conviction back in 2020. Price has also taken the previous month’s liquidity, which is a prerequisite I like to see when waiting for a potential bullish reversal.

That said, there is still no confirmed bullish reversal on the monthly timeframe. The liquidity sweep is a necessary ingredient, but not sufficient on its own. We need to see structure shift before conviction increases.

Monthly conviction: No confirmed reversal. Covid low liquidity has been swept, and previous month’s liquidity has been taken -both signs I want to see before a reversal, but confirmation is still missing.

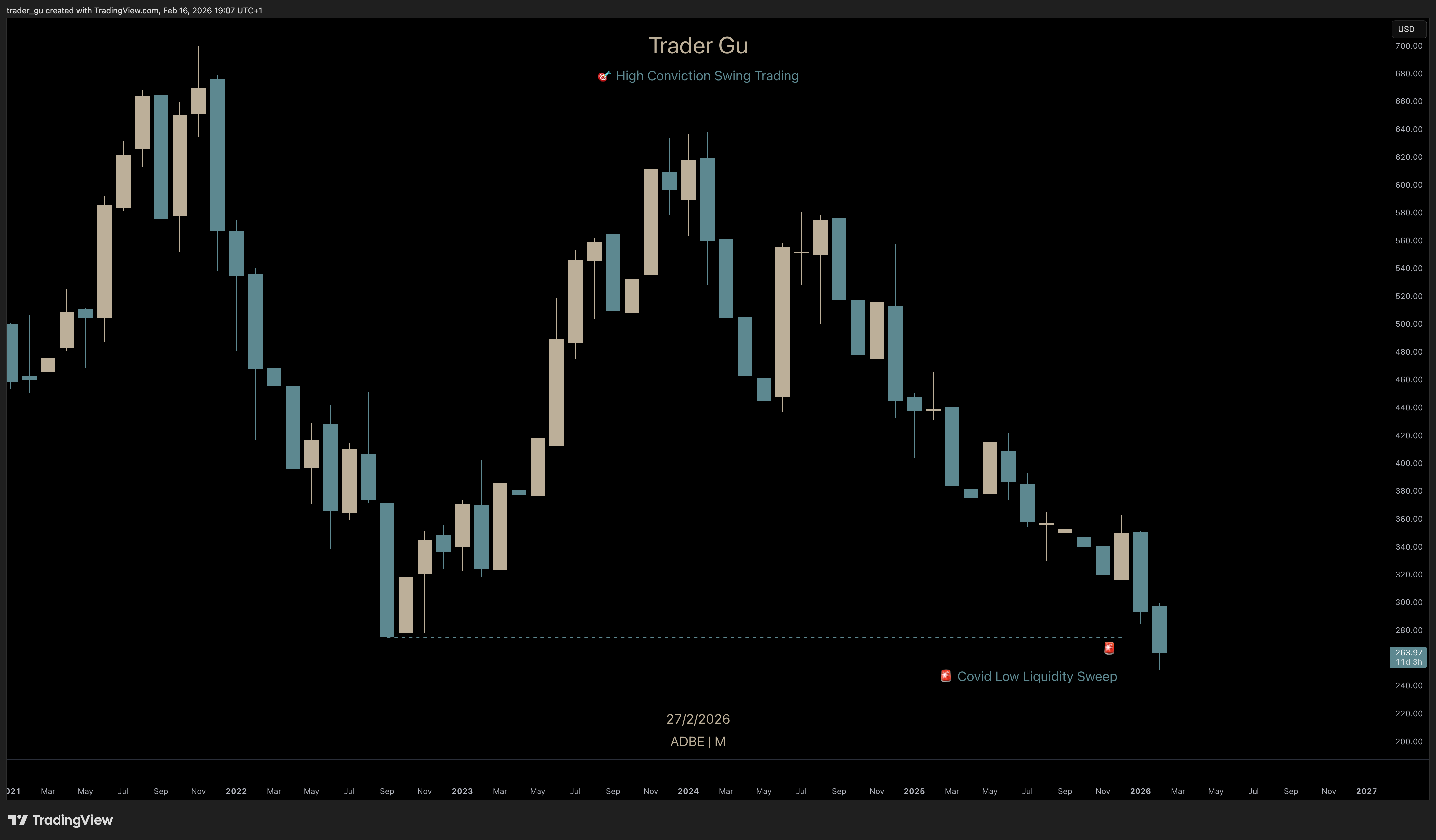

Weekly Timeframe

The weekly chart brings more clarity to what’s happening. As price has been moving down from all-time highs toward the Covid lows, there have been a few attempts at developing a bullish market structure reversal pattern on the weekly timeframe. All of them have failed.

Most recently, price did build a reversal pattern, but it was ultimately invalidated. Bulls were trapped -and for full transparency, I also had a failed trade based on that trigger, which I shared live on X.

What I would like to see now is price building a new bullish reversal pattern on the weekly timeframe. Preferably by tapping into the weekly bullish support level just below the previous week’s low around $251. However, we don’t necessarily need to tap into that level. I’m good to go with a reversal confirmed by a market structure shift on the weekly timeframe, defined by a weekly open or candle close above $301.4.

Weekly conviction: Developing. Structure is still bearish. I need a weekly close above $301.4 to confirm a bullish reversal trigger.

Targets and Invalidation

Target levels still need more clarity -we first need a confirmed weekly bullish reversal pattern before defining precise Fibonacci-based targets.

However, framing from the monthly timeframe, if we have now made our lows and are building a market structure shift from this level, a greedy target would be the $474 level. This aligns with an untested monthly bearish resistance level and the -1 Fibonacci expansion.

$ADBE - Targets and invalidation, monthly

$ADBE - Targets and invalidation, monthly

I would like to revisit the targets once we have more data from the developing price action.

Invalidation for an aggressive trade at these levels: a stop loss below $205, which aligns with the low of the 2018 bullish structure. However, if we are currently building a reversal pattern here, that thesis would be invalidated at $251.

Conviction Verdict

$ADBE Conviction: Developing

Monthly structure is bearish with no confirmed reversal, but the Covid low liquidity sweep and previous month’s liquidity taken are prerequisites for a potential shift. Weekly structure needs a close above $301.4 to confirm a bullish trigger. Targets to be revisited once structure develops further.

My Position

I’m currently not positioned in $ADBE at the time of publishing, but I’m keeping this ticker on my developing-to-trade watchlist. Any trade I take will be automatically shared on my X account.

Are you watching $ADBE at these levels? Do you think the Covid low sweep marks a turning point? Let me know on X or Substack.

More chart analyses and trade reviews can be found on my Substack and by following my journey on X for live updates.