📬 Trader Gu's Wave Report – June 2025

Monthly Newsletter - June 2025

Structured Analysis - High-Conviction Trading - Built for Part-Time Traders

⚡️ TL;DR – Quick Snapshot

👀 Developing Trades: $ASML, $TGT

🧲 Approaching Key Levels: $PDD, $MHK

🔭 HTF Watchlist: $META

🌕 Bonus Idea: $PEP

👋 Hey traders,

Welcome to another edition of Trader Gu’s Wave Report — a monthly breakdown of how I’m evaluating the market, step by step.

Inside, you’ll find the tickers on my watchlist, the Areas of Interest (AOI) I’m looking to trade, and my thought process behind each setup.

Trading, much like surfing, isn’t about chasing every move. You sit. You scan the horizon. You wait. Then, when the right wave rolls in — you execute with conviction.

Let’s dive into what’s shaping up for June 👇

👀 Developing Trades - Inside my Area of Interest (AOI)

These are potential setups building in my area of interest and the ones that I am tracking on the daily and weekly time frames for potential entries.

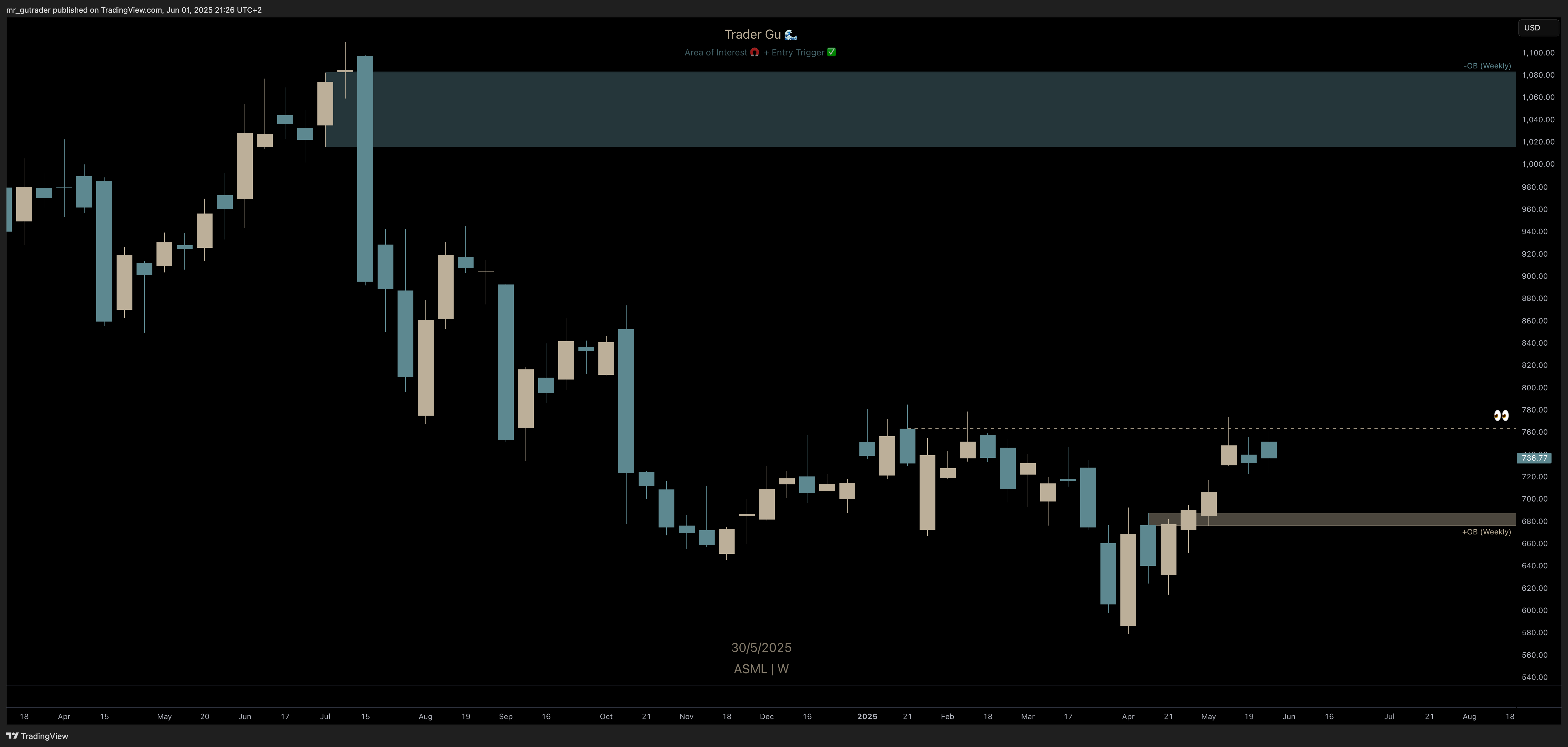

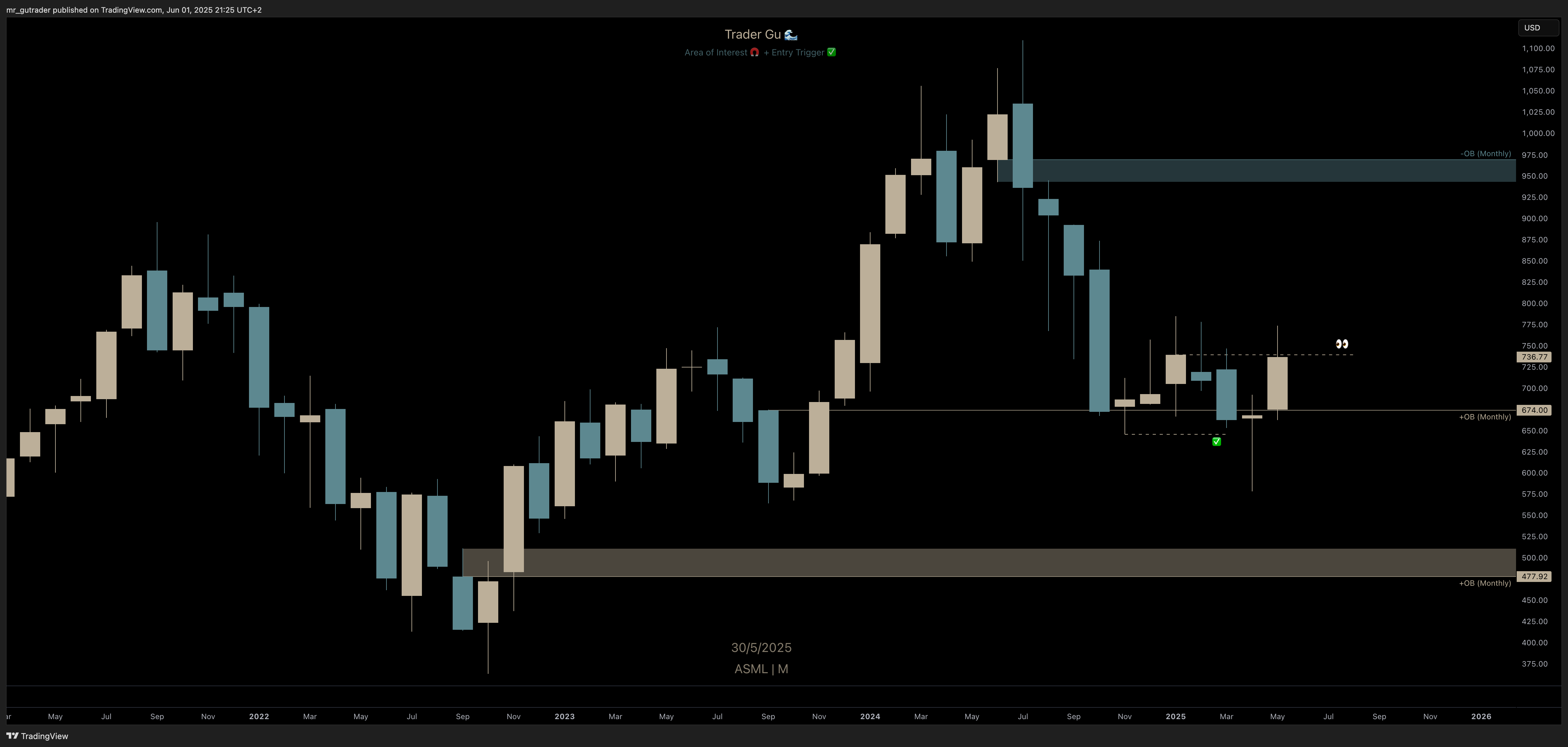

$ASML – Trend reversal on higher time frame?

ASML has been on my watchlist for some time now, and we’re currently seeing a bullish trend reversal forming after a significant reaction from the $674 order block. However, we failed to close May above $736. Let’s see where we open the month on June 2nd. If it’s above this level, that would be a significant confirmation of a bullish shift on the monthly timeframe.

The weekly level is also showing signs, but we haven’t yet seen confirmation of a bullish market structure shift. I’d be interested in a long from the $676 to $687 weekly order block, and depending on how the monthly develops, the price target for this move could be just above $1000, targeting the monthly bearish order block which hasn’t been tapped yet.

$TGT – Target ready for trend reversal?

Target has been on a massive downward slope since the highs in 2021, and we recently swept the COVID low liquidity around $90. Now, we’re likely seeing the early stages of a bullish trend reversal on the weekly timeframe, with a strong reaction from the $87–$90 monthly order block.

What I’d like to see next is a move back down to take out the local lows again around $88, before pushing higher and closing a weekly candle above $102. That would give a stronger trade trigger in my view.

That said, price could also just continue moving higher from here without retesting the lows - a weekly close above $102 would still be a valid setup. I’d be interested in taking a position in either scenario, but a sweep of $88 first would offer a higher conviction setup.

Either way, Target is starting to look very interesting in this area, and if the reversal plays out, a reasonable price target could be a move up toward $126.

🧲 Approaching my Area of Interest (AOI)

Tickers approaching my areas of interest often exhibit sharp, volatile reactions. Sometimes, price breaks down entirely. Other times, it begins to form a structure that can evolve into a trade over days, weeks even months.

When price reaches a high-conviction zone, I often consider aggressive entries—not because the setup is fully confirmed, but to ensure I’m positioned early at key levels while the trade thesis has time to develop.

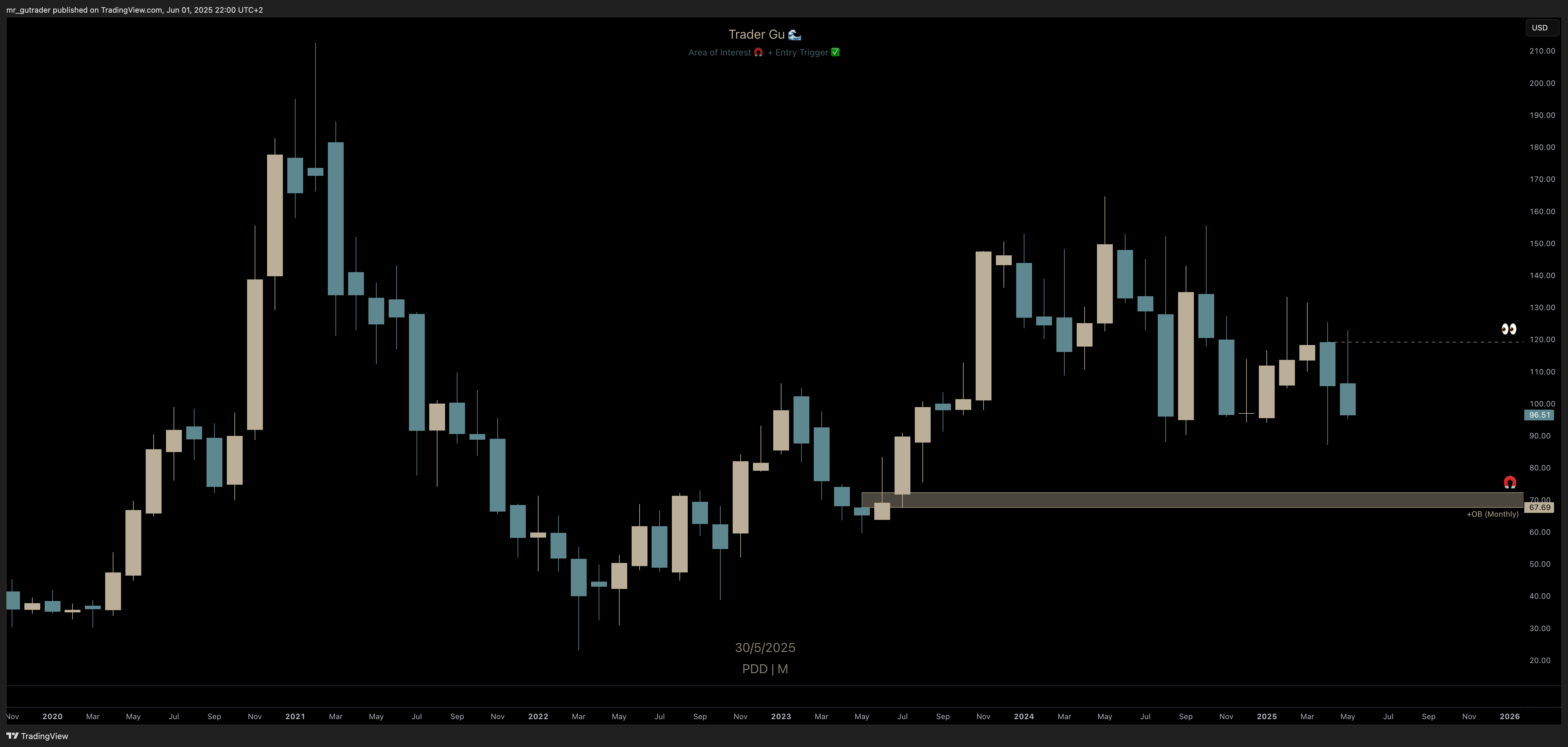

$PDD – Watching $72 vs. $120

If Pin Duo Duo’s Chinese ticker moves toward $72, it would bring us into a high-conviction area - retesting the bullish monthly order block I’ve been patiently waiting for. That’s the level I’m watching closely for a potential trade.

Alternatively, if price reverses from here and we get a monthly close above $120, that would signal we may have already bottomed and are on the way to retesting the $164 highs.

This is a ticker I typically keep on my broader watchlist, though I haven’t traded it yet. That said, Chinese tech stocks often offer particularly clean price action and high volatility - favorable for my trading strategy.

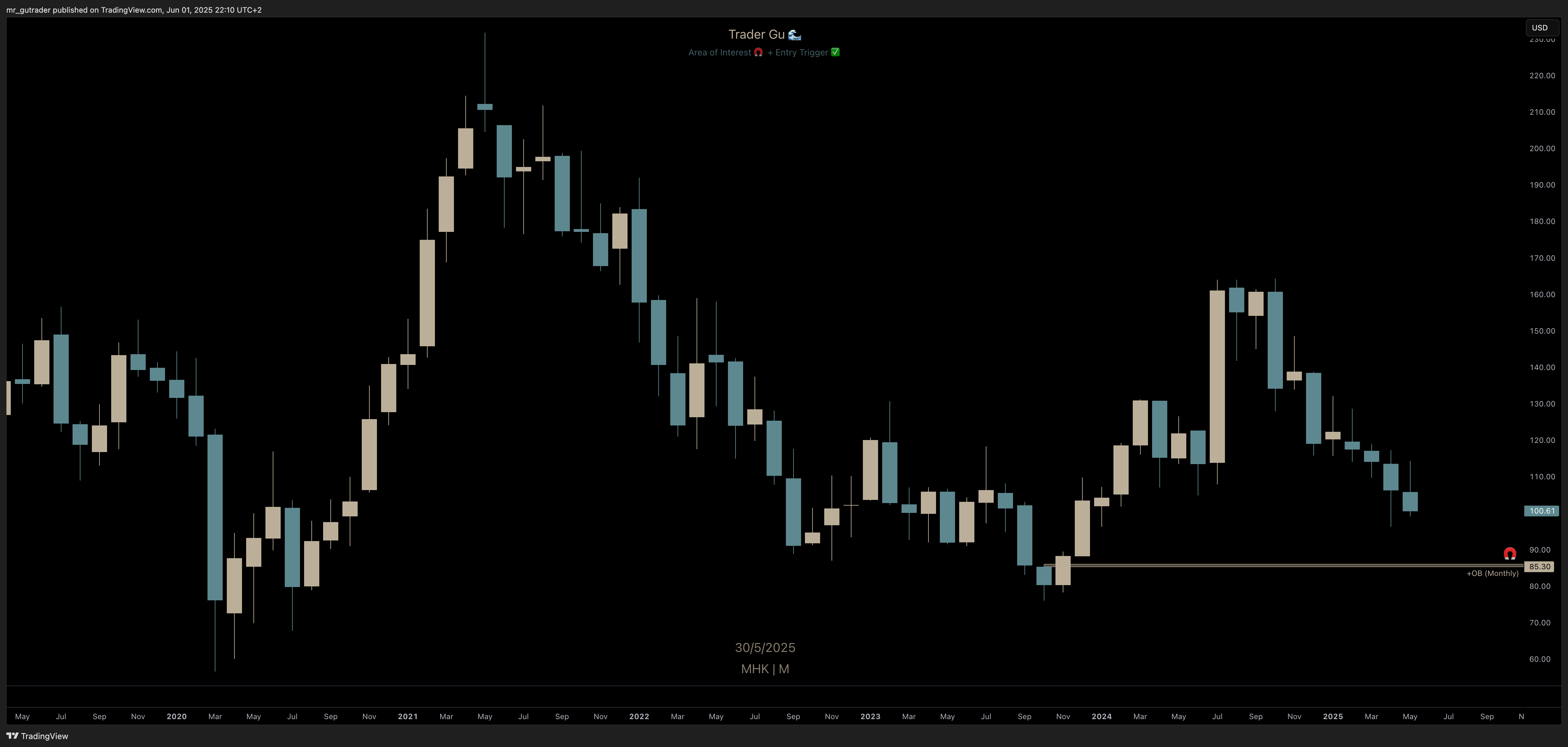

$MHK – Waiting for a greedy entry-level.

Mohawk Industries ($MHK) is a recent addition to my watchlist. Price action suggests a high probability of moving lower toward the $85 monthly order block — a level I’m eyeing for a potential trade.

If we see a strong reaction from that zone, or even a break below it followed by signs of reversal, that would be a key area of interest for me. I’m not in a rush here — I could easily see price moving another 10–15% lower before we start forming a potential bullish reversal on lower timeframes like the weekly.

🔭 Long-Term Watchlist

These are tickers I’m monitoring on the monthly or higher timeframes. While they may currently be far from my area of interest, I track them to stay aware of how price evolves as it approaches key levels. Monitoring on the higher timeframes allows me to prepare well in advance and be ready to position myself when trade opportunities emerge.

Long-term positions require long-term planning. That includes not just the technical setup, but also making sure I have capital available to allocate when the time is right.

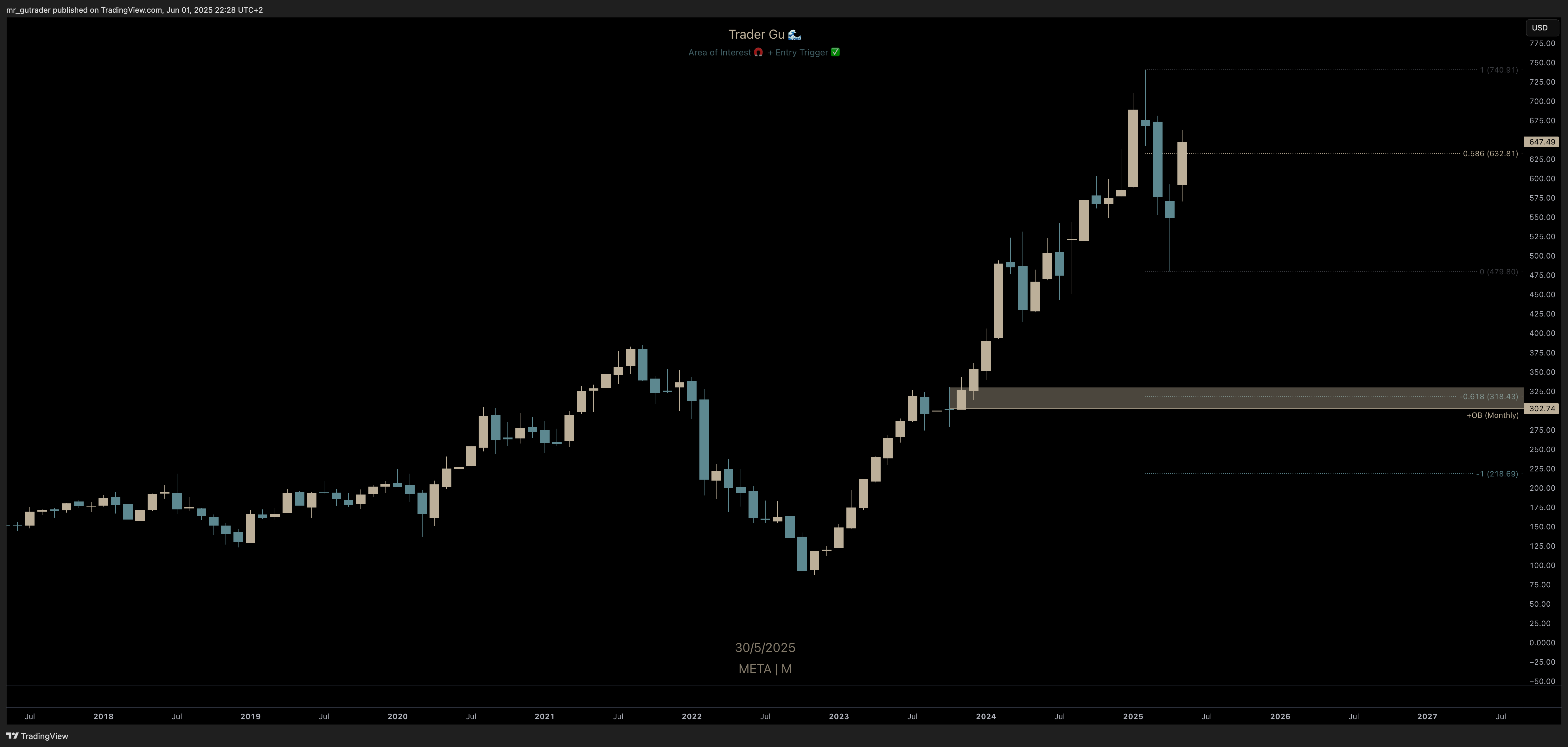

$META – Significant Downside or Missed Opportunity?

Meta is a tough one. Right now, it just keeps grinding higher - making consistent higher highs and higher lows. But the chart still suggests a high probability of a significant retest of the previous breakout above the 2021 high.

When that might happen is uncertain. The area I’m watching is the $300–$325 monthly order block — that’s where I’d either look to enter aggressively or wait for a high-confidence trade trigger.

If we never reach it, that’s fine. There are always other opportunities. But if we do get the chance to enter Meta, this is the zone where I’d prefer to open a position.

🌕 Bonus Chart

$PEP – Ready to Reverse?

This month’s bonus chart is Pepsi ($PEP), which recently invalidated a monthly order block that had previously led to a significant price reaction. After taking liquidity around $128, we could now be seeing the early stages of a bullish trend reversal pattern forming.

PEP is not a stock I typically trade due to its limited price movement, which would require a larger capital allocation to meet my risk parameters. That said, it could be an interesting opportunity for a leveraged position, or for dividend investors looking to open a new position or DCA into an existing one.

My preferred scenario would be a sweep of the recent lows, followed by a move higher and confirmation of a weekly bullish market structure. However, if we move higher from current levels and open the month above $132, I could see this setting up for a quick trade toward the first target at $138.

🌊 Wave Report Follow-up

There were plenty of opportunities last month, and $TSLA - featured in my May Wave Report - was one of them. I took a trade that resulted in a 38% realized profit for my 25-Year Trading Experiment portfolio, while also taking partial profits in my private trading account.

$JD was also highlighted in the May report. With the recent monthly close, it now looks increasingly likely that we’re heading toward the key level I’ve been watching. Depending on which portfolio I’m managing, this area could offer a solid opportunity to either add to my current position or open a new trade.

💡 Final Thought: Finding the Time to Update My Readers

Over the past two months, I’ve been traveling quite a bit — across Europe, China, and the Nordics - and it’s been challenging to find the time to reflect on my trades or share consistent updates.

As we head into summer, I’m shifting my focus. I plan to spend more time sharing my thoughts, engaging with fellow traders on X, and putting renewed energy into my trading process overall.

While my full-time engineering role usually doesn’t interfere with my trading itself, I do feel it’s impacted my ability to update consistently. Sharing insights, helping others, and documenting my journey has become a meaningful hobby — and when I fall behind on that, it can create some pressure. That’s something I’m actively working on improving.

Until next month,

– Trader Gu

🔧 Want to go deeper?

If you’re looking to refine your own trading process, I’ve built a free toolbox with the exact tools, workflows, and strategy templates I use as a part-time trader.

→ Explore the The Part-Time Trader’s Toolbox:

Tools, Strategies & Insights for High-Conviction Trading 🧲

👇 Let’s Trade Notes

What setups are on your radar this month?

Send me a message on X or Substack — I’d love to hear what you’re watching.

📬 This report goes out to subscribers one week before it’s published on my website.

Want early access? Subscribe here or follow on X for real-time updates.