📊 Trade Review: $AMD – Be Confident, Not Greedy

In this post, I’m walking through one of my best trades of 2025 (so far). This high-conviction Advanced Micro Devices ($AMD) trade started as an aggressive entry and evolved into a structured, high-conviction position, ending in a successful exit with a 🟢 +39% gain on the position.

Let me lay it out for you:

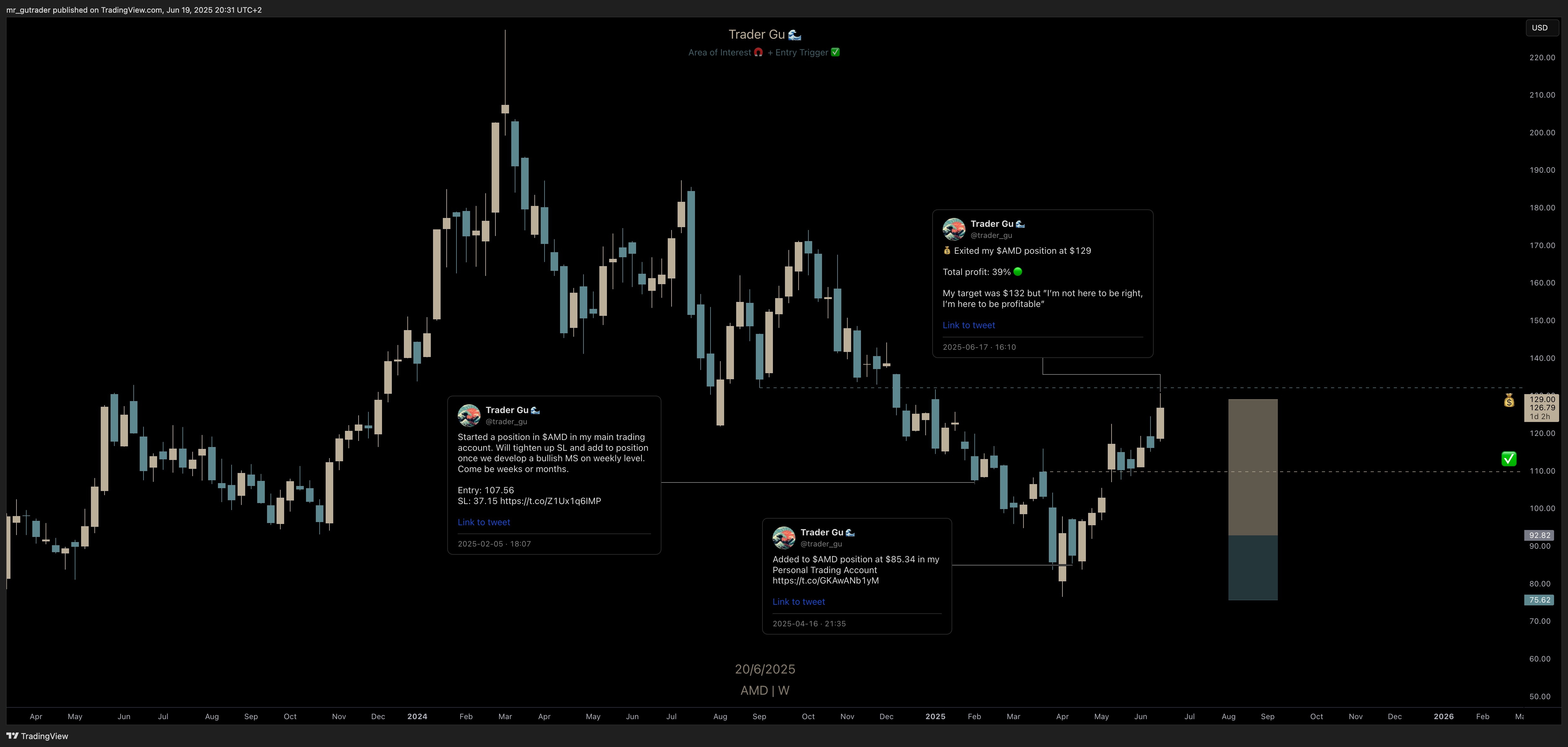

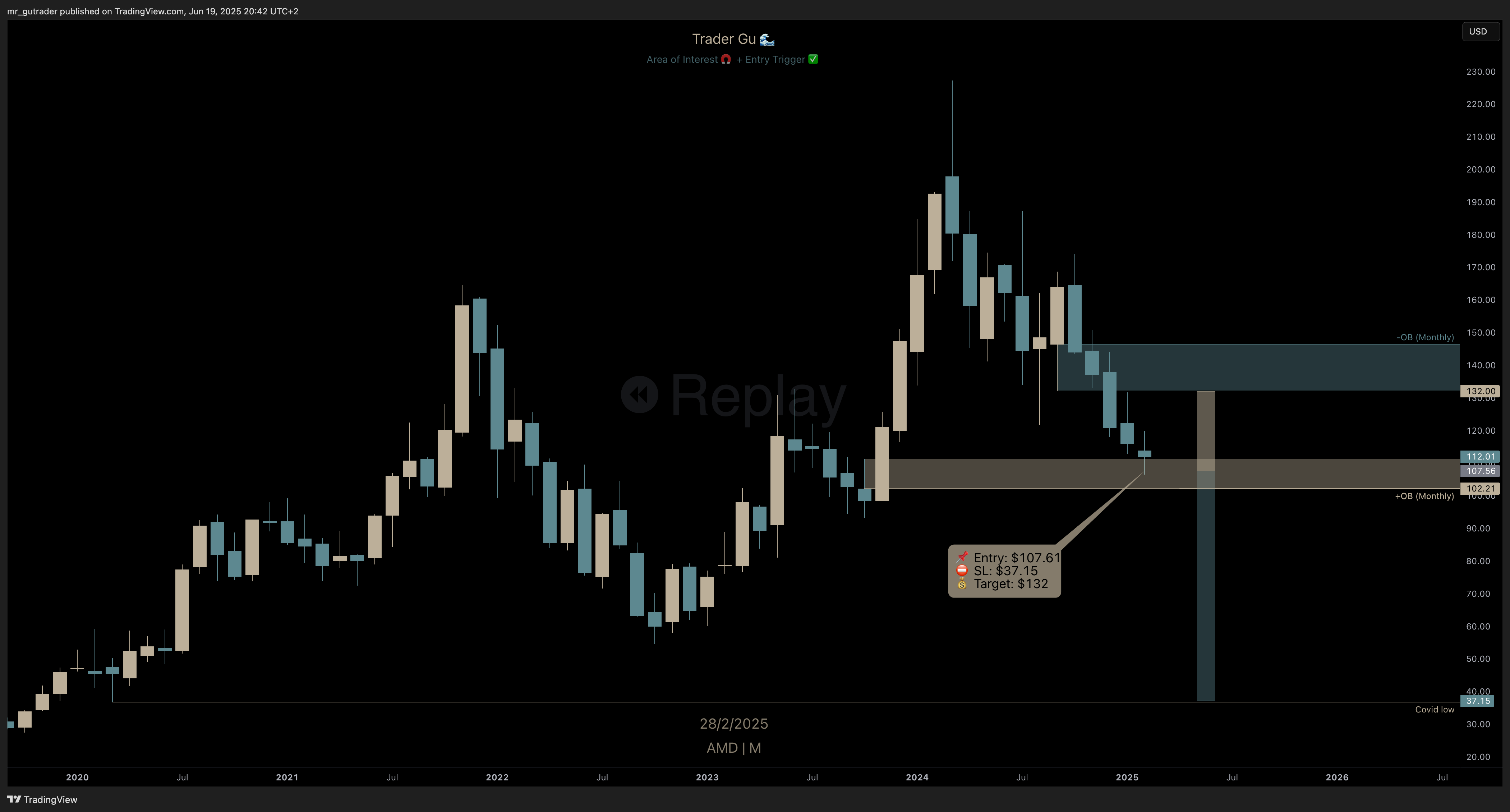

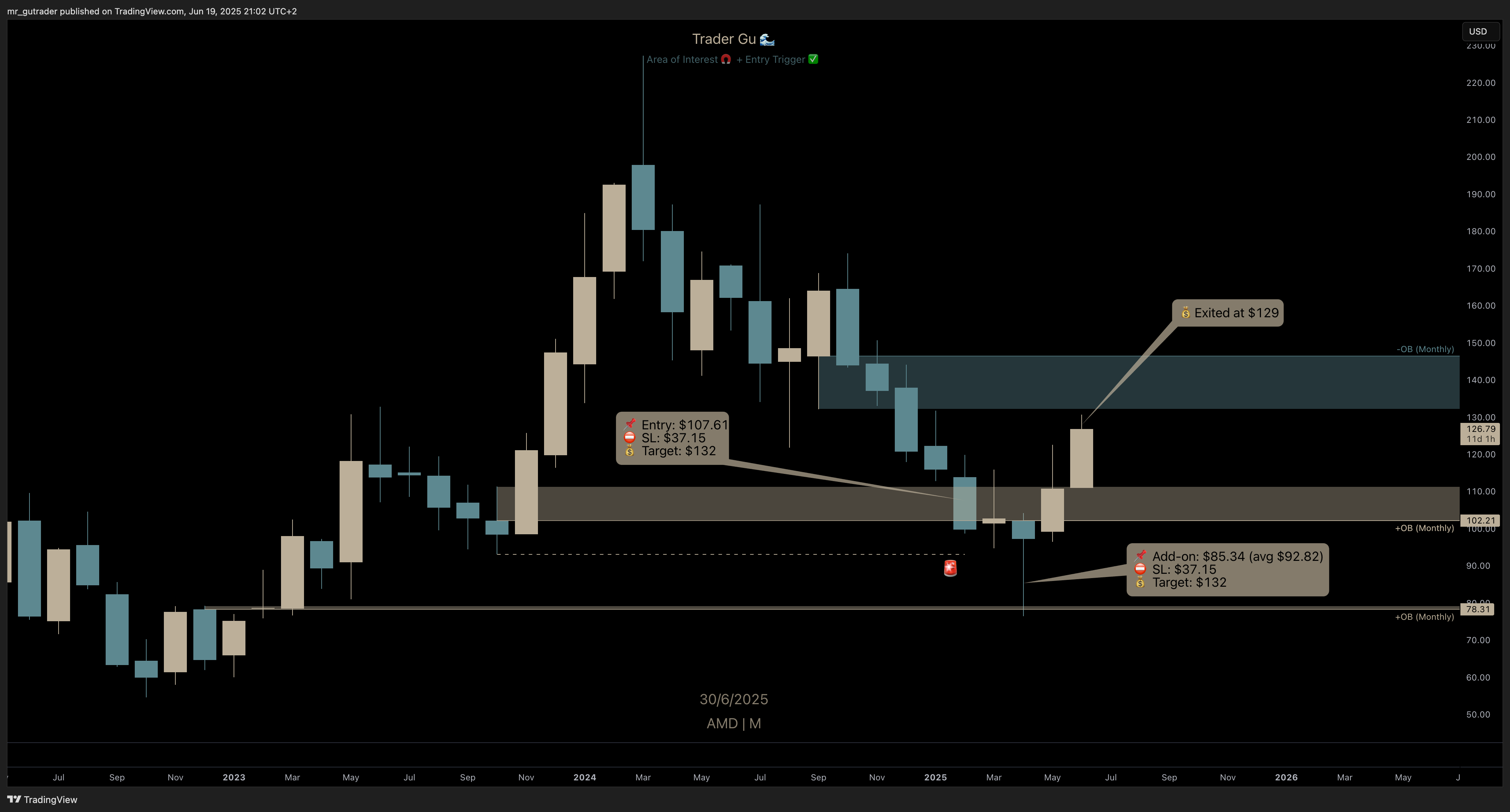

🧲 Area of Interest

$AMD had been on my watchlist for several months, and I patiently waited for price to move into the $102–$110 monthly order block. We had just closed the monthly candle above my area of interest, and I anticipated we would, in the following month, take out the previous month’s liquidity and tap into the order block - where I planned to look for an entry trigger.

$AMD - Area of Interest, monthly chart

✅ Trade Entry

This area was a high-conviction level where I expected a significant reaction. I opened an aggressive entry at $107 with a wide stop-loss at the COVID lows ($37), intending to await a higher-conviction trigger in the coming weeks.

My target was a newly formed weekly bearish order block, with exit target at $132.

📌 Entry: $107.61

⛔️ SL: $37.15

💰 Target: $132

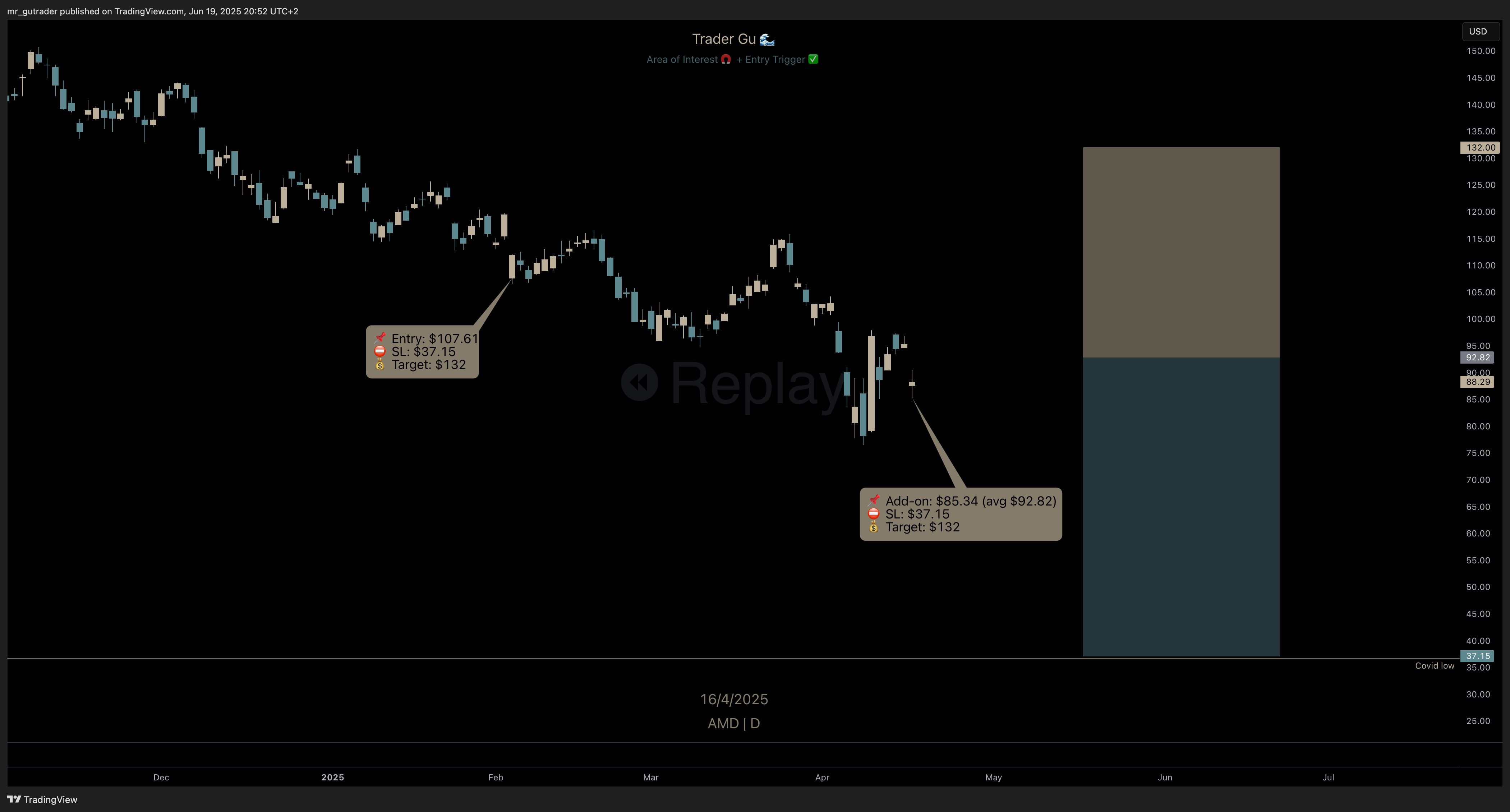

🚨 Invalidated Level and Add-on Position

The original monthly order block was decisively invalidated - price broke through it and took out a significant area of liquidity. It reacted strongly at a lower monthly order block, aligning with the previous major lows from 2023.

Because I had anticipated volatility with a wide stop and saw a strong reaction at this new area of interest, I added to the position with a second aggressive entry at $85.34, keeping the same original stop loss.

My confidence came from the bullish engulfing candle forming the strong reaction. I entered on the retracement into a newly formed daily order block.

📌 Add-on: $85.34 (avg: $92.82)

⛔️ SL: $37.15

💰 Target: $132

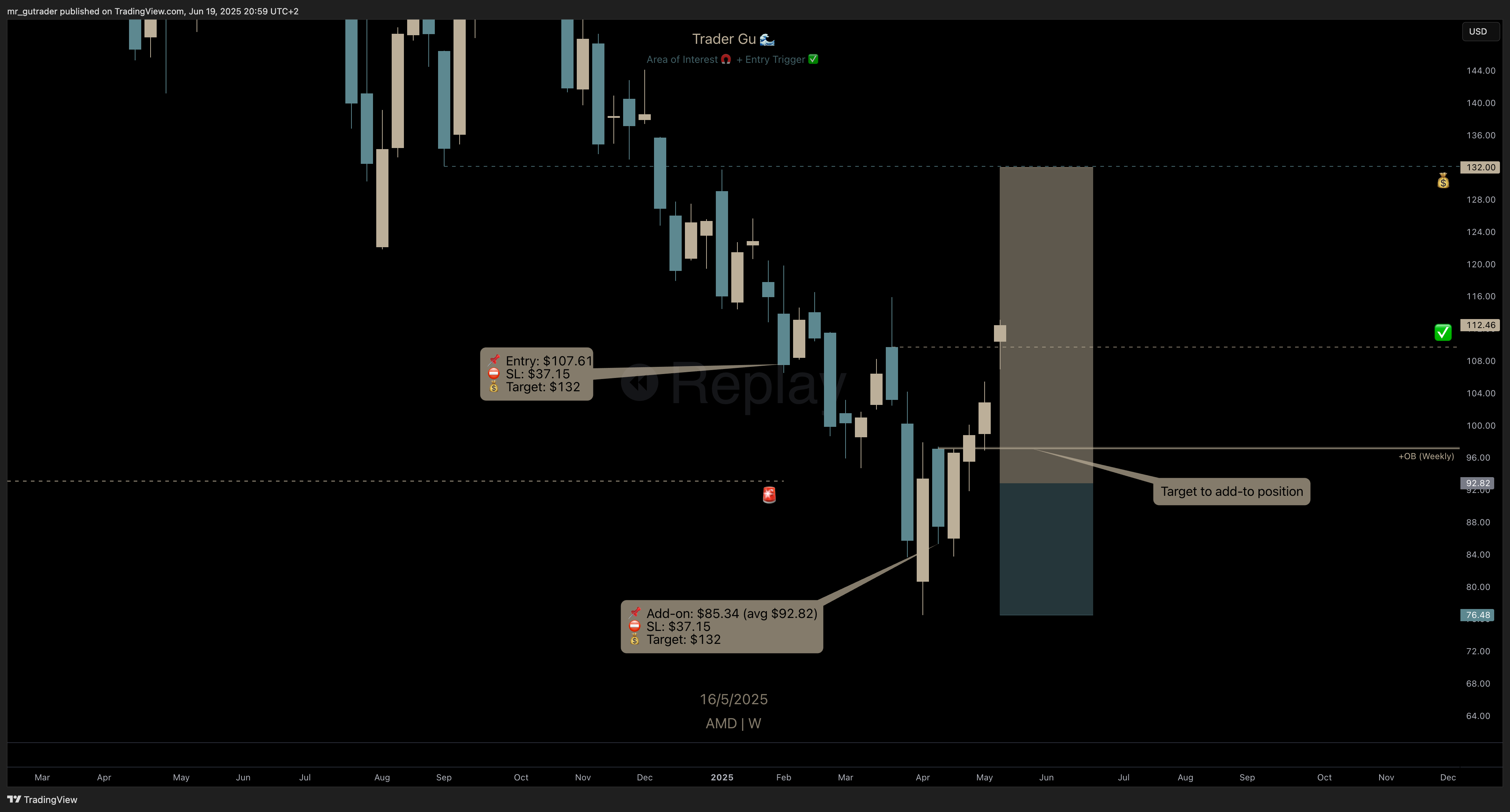

$AMD - Add-on position, weekly

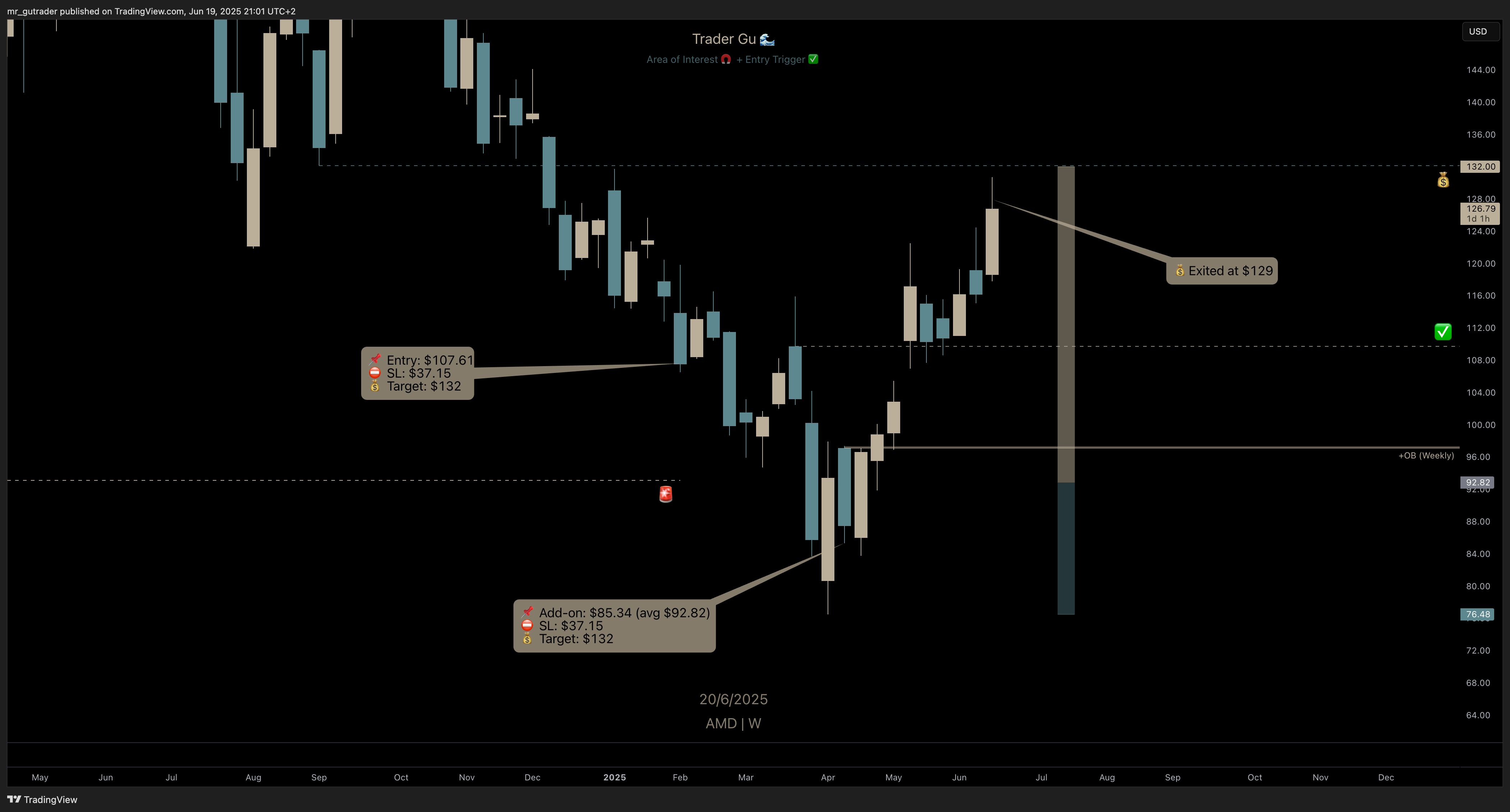

✅ Confirmation for a High-Conviction Trade

After entering two positions with a wide stop loss - maximizing my defined risk per trade—I waited for a weekly close or open above $109 to confirm a bullish reversal pattern and validate the setup as a high-conviction trade.

Once we opened with strong bullish momentum above that level, I tightened the stop loss to the recent swing low at $76.48. My plan was to add significantly to the position on a retracement targeting $98, aligning with a newly formed weekly bullish order block.

📌 Entry (avg): $92.82

⛔️ SL (tightened): $76.48

💰 Target: $132

$AMD - Awaiting confirmation, weekly

💰 Exit Position

Fortunately, I was already sized into the position because price never retraced to my add-on level. It moved quickly toward the target in the following weeks.

I exited at $129, just below of my $132 target, locking in a 🟢 +39% gain on the full position.

🪞 Reflection

This trade was months in the making. I executed an aggressive entry at my area of interest, followed my risk management plan, and exited just below target - with no greed or hesitation.

One of the best trades of 2025 so far.

While I wish I had been able to add more to the position, I’m genuinely satisfied that I stayed in the trade, followed the plan, and closed it with a meaningful profit.

✅ Followed my strategy

✅ Took full profit at target

If you want to learn how I build conviction for trades like this, check out:

💬 Drop a comment or DM on X — I’d love to connect with like-minded traders.