📊 Trade Review: $AAPL – Sometimes Aggressive Entries Are the Only Way In

Apple ($AAPL) Trade Review – High-conviction AOI + Aggressive Entry

This was a trade that reinforced why I sometimes enter aggressively, even without a fully developed trigger.

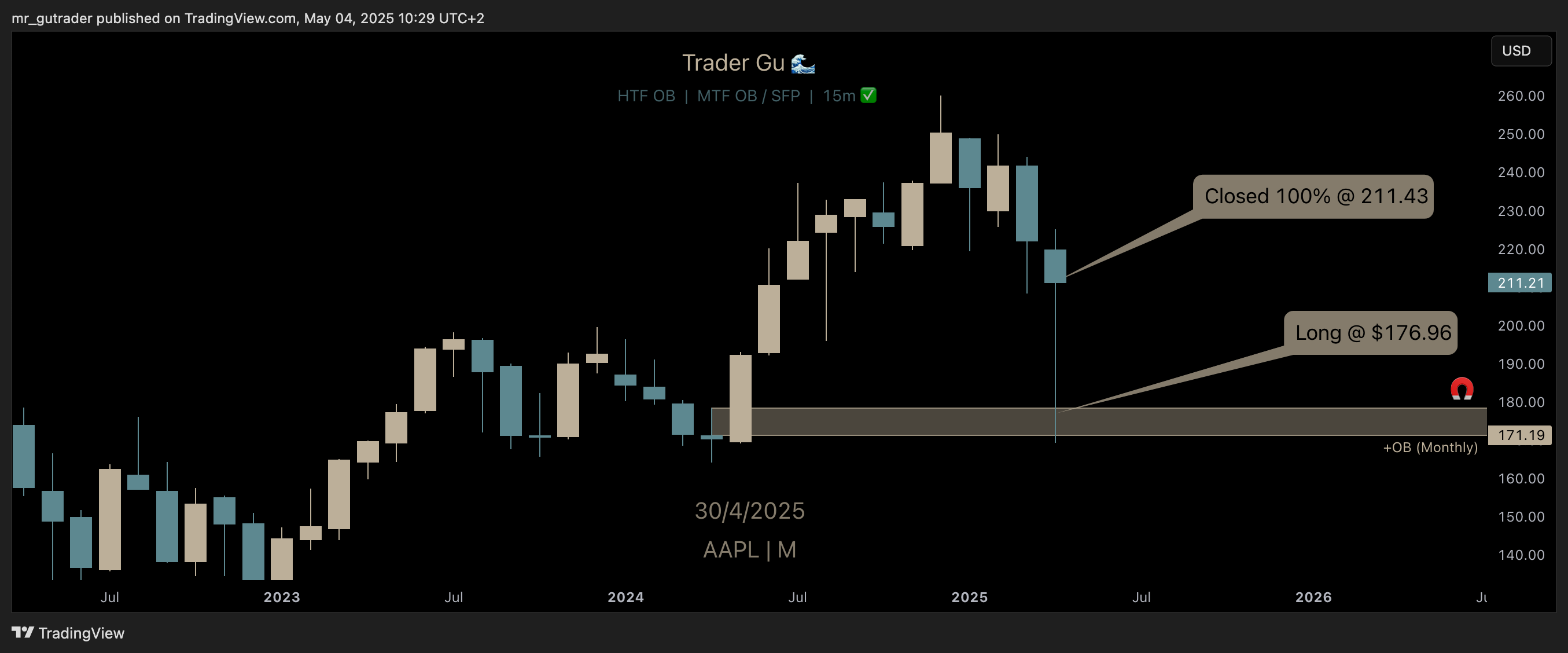

In the April Wave Report, I outlined the $170–$180 monthly order block as a high-conviction area of interest, calling it “the real focus” for a long setup. I’ve been watching this level form for months. It finally tapped in - and when it did, I was ready with the long order with defined risk to participate in a possible move higher - which ended up paying off big time.

That’s where my aggressive entry model came into play. Waiting for confirmation would’ve meant missing the move entirely.

📍 Area of Interest

The area of interest I was looking to trade is the $170–$180 monthly order block, which I’ve been watching for months. The weekly chart also revealed a weekly order block at that level which would be my main level for our entry position with a clear invalidation below the lows.

$AAPL - Area of Interest, monthly chart

$AAPL - Area of Interest, monthly chart

$AAPL - Area of Interest, weekly chart

$AAPL - Area of Interest, weekly chart

✅ Aggressive Entry

I took an aggressive entry at $176.96 with a stop below the invalidation level at $164 (monthly OB low). Sometimes price reacts explosively at your AOI, sometimes it doesn’t and it can take weeks or months before a clean trigger forms.

What I usually do at high-conviction levels is take an early position, betting we either get that fast reaction or a setup starts to build. If it develops, I’ve already got a solid entry I can build on. It doesn’t always work, but I enjoy the risk/reward at strong AOIs.

🧲 Target level

The main target is a move back into the new weekly bearish order block, where I’m planning to exit around $210. For me, this was a high-probability retest of that zone.

💰 Exit Position

I closed the full position at $211.43 - right at my target. I didn’t expect the move to happen this fast. I was in the trade for less than a week and thought it might take several to play out, but sometimes the market moves quicker than expected.

The trade ended up at 2.6R, locking in solid profits for my main trading account.

$AAPL - Exit position, weekly chart

$AAPL - Exit position, weekly chart

$AAPL - Exit position, monthly chart

$AAPL - Exit position, monthly chart

Final Thoughts

This wasn’t the cleanest setup, and it didn’t come with all the boxes checked. But that’s exactly why this model exists.

✅ Sometimes aggressive entries are the only way to be in the move

✅ I had high timeframe context, clear preparation, and a clear invalidation

✅ I’ve been watching this zone build for months—and I was happy to be part of it

Being aggressive doesn’t mean being reckless. It means being prepared to act when the time comes.

Want to learn more about the aggressive entry model and how I manage risk in these types of trades? Drop a comment or DM on X - I’m happy to share with likeminded traders.