🧰 Order Blocks for High-conviction Trading

Introduction

There are hundreds of trading methodologies, strategies, and approaches to the market. Some of the most common include the 200-day moving average, Fibonacci expansions, Elliott Wave Theory, bar counting, RSI and stochastic indicators, chart patterns, trendlines, and more.

Order-Block Theory

The strategy that truly resonated with my trading persona is Order Blocks (OB). And believe me, I’ve tried all the strategies mentioned above. 😅

Order blocks are interpreted as areas where institutions likely placed significant orders, leading to sharp price movements. These zones act as areas of liquidity where price often reacts, giving traders opportunities to enter high-probability setups. The main idea behind order blocks is to trade at points of institutional interest rather than following retail trading patterns.

You don’t need to understand why certain market behaviors exist or what causes them. What matters is that the market behaves in a way you can take advantage of.

How to Spot an Order Block

Order blocks can be defined in several ways depending on trading style and timeframe. The definition I follow is:

- Bullish Order Block: The zone from the candle open to the top of the wick on the last bearish candle before a significant move to the upside, confirming a bullish market structure.

- Bearish Order Block: The zone from the candle open to the bottom of the wick on the last bullish candle before a significant move to the downside, confirming a bearish market structure.

Some traders consider only the candle body (open to close) rather than the full wick, while others use wick-to-wick zones. This variation depends on timeframe, risk appetite, and overall strategy.

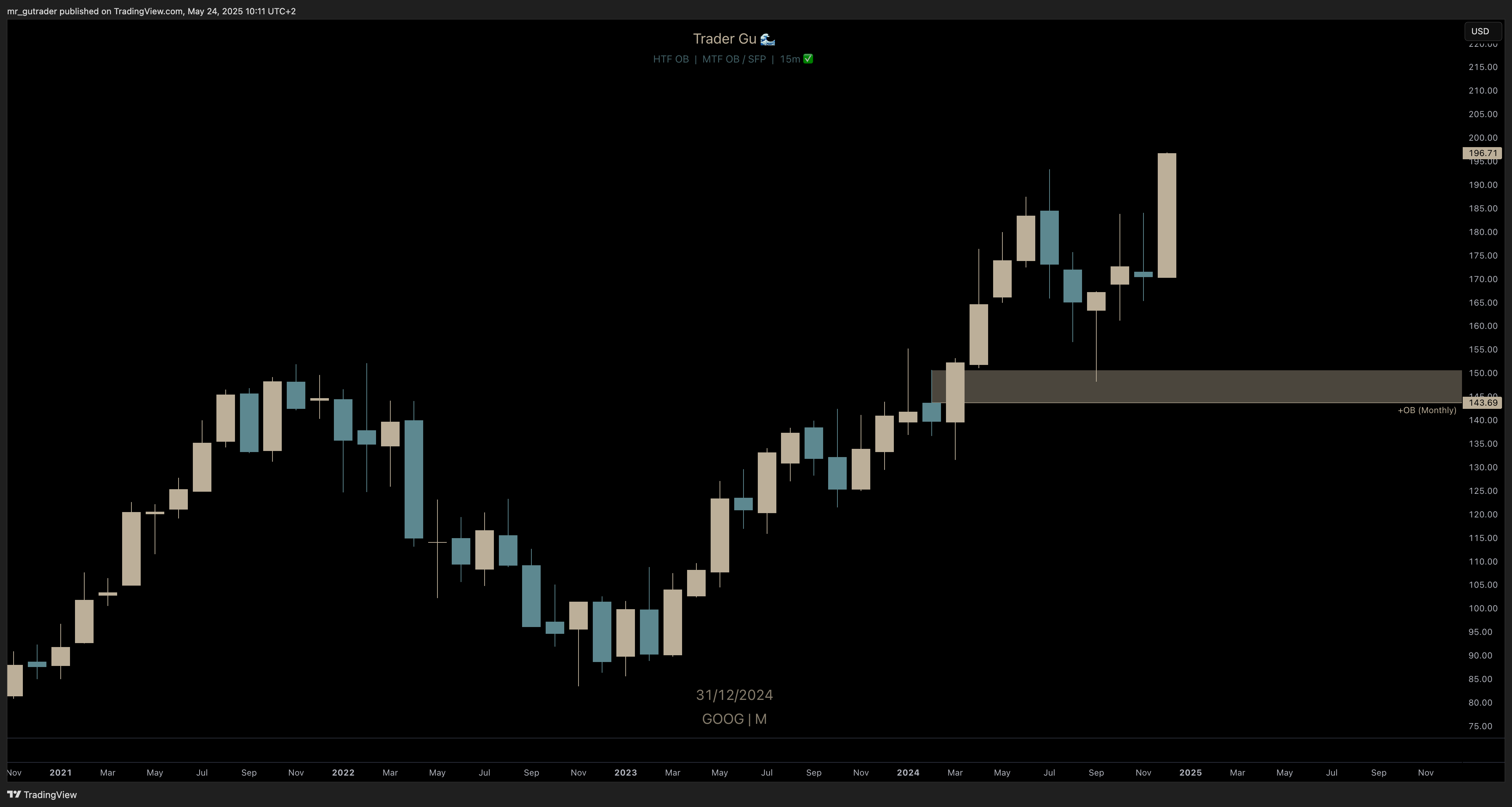

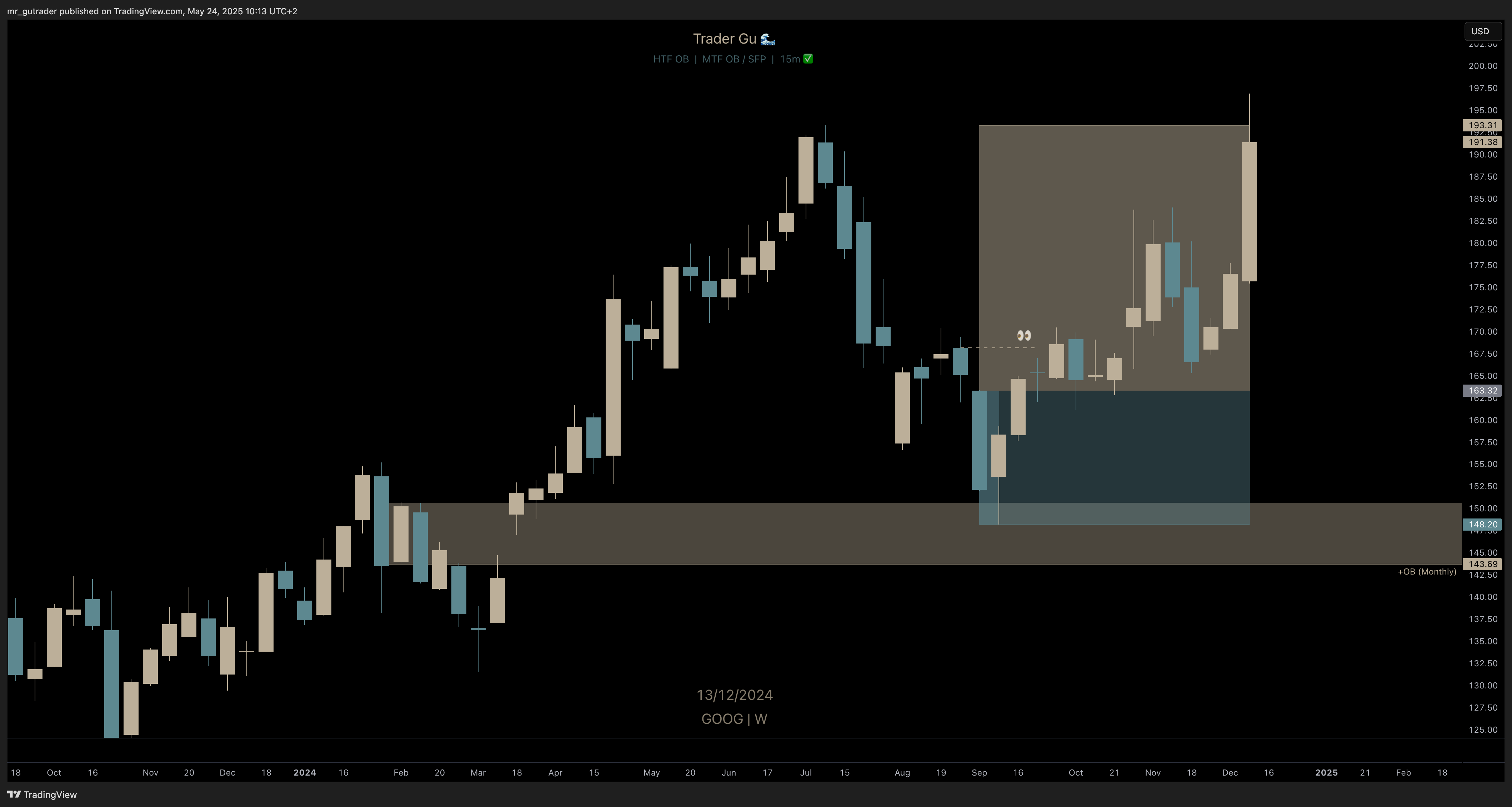

*$GOOG - Bullish order block, monthly

*$GOOG - Bullish order block, monthly

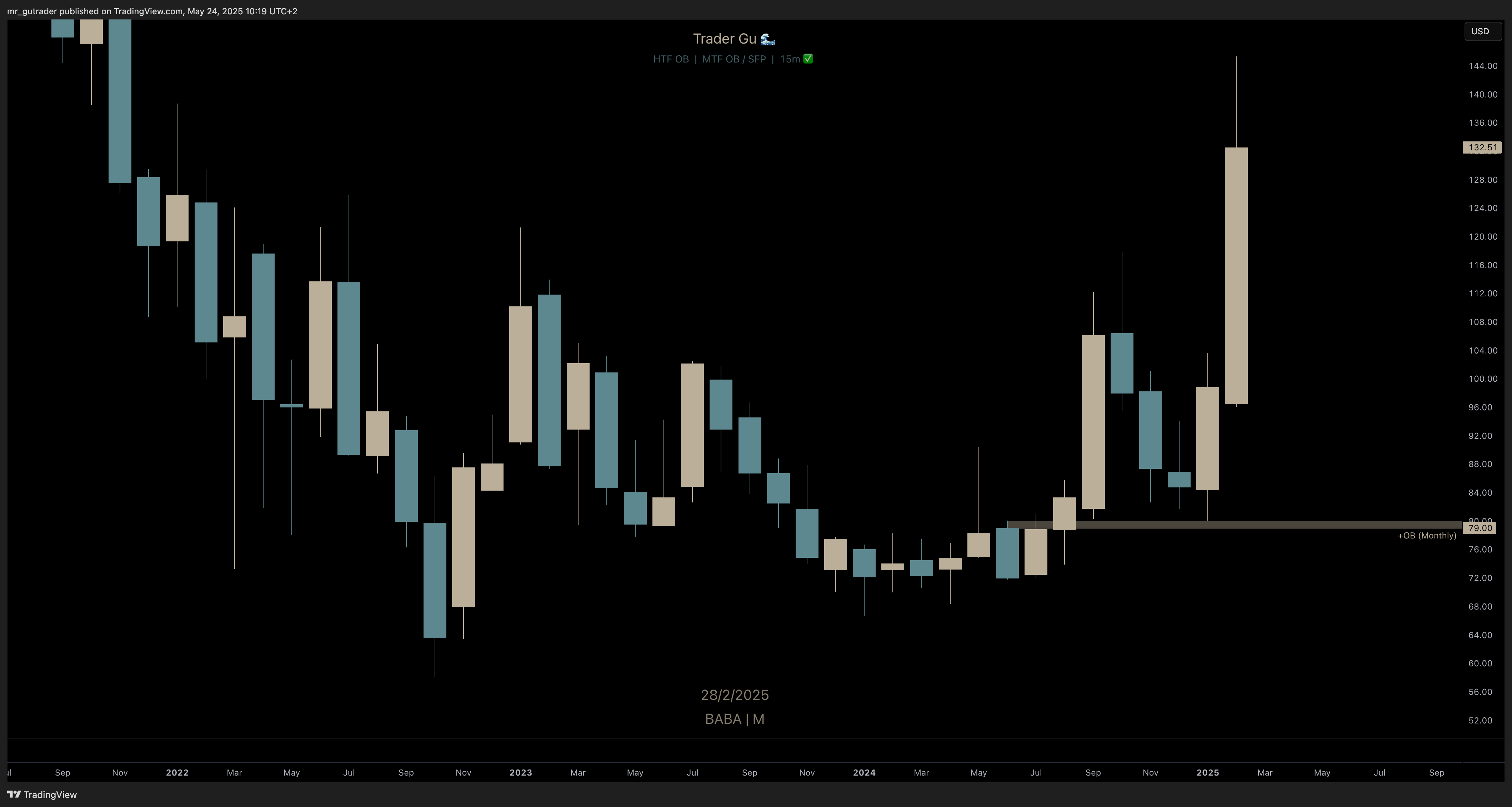

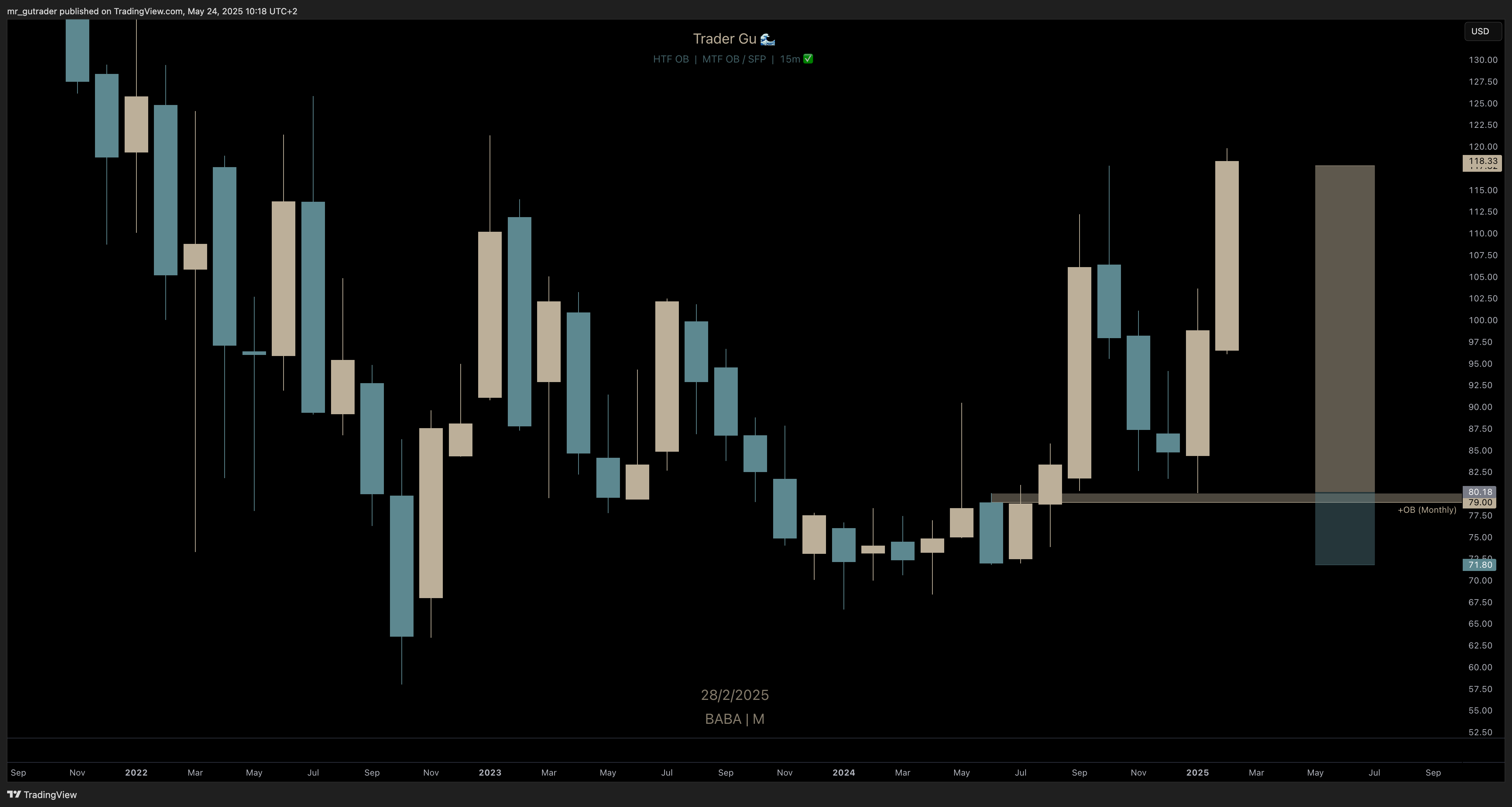

*$BABA - Bullish order block, monthly

*$BABA - Bullish order block, monthly

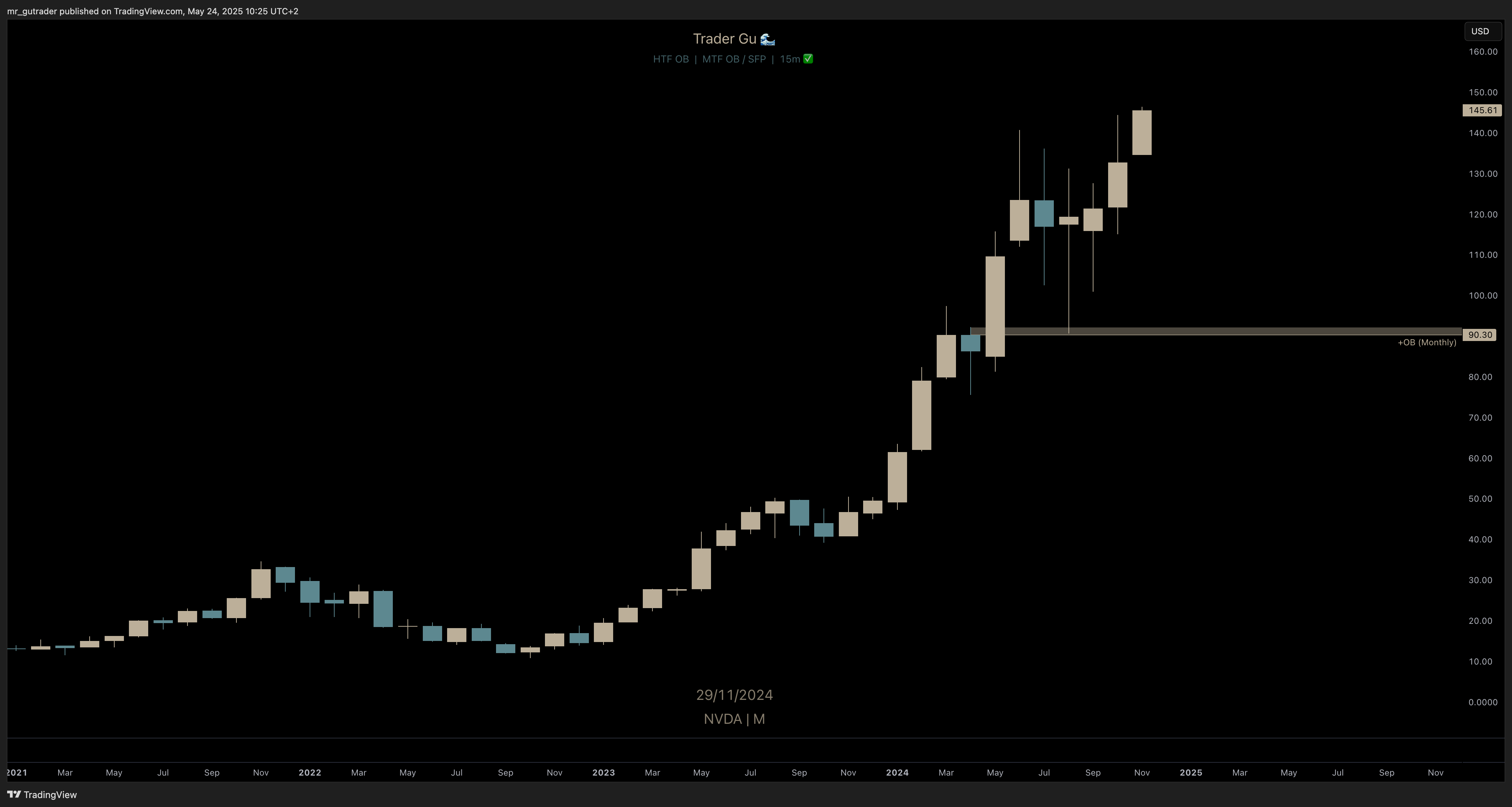

*$NVDA - Bullish order block, monthly

*$NVDA - Bullish order block, monthly

Why I Enjoy Trading Order Blocks

- ✅ Strong R:R – Order blocks typically yield a good risk-to-reward ratio

- ✅ No indicators needed – Easy to spot using just price action

- ✅ Clear invalidation – Defined stop-loss levels

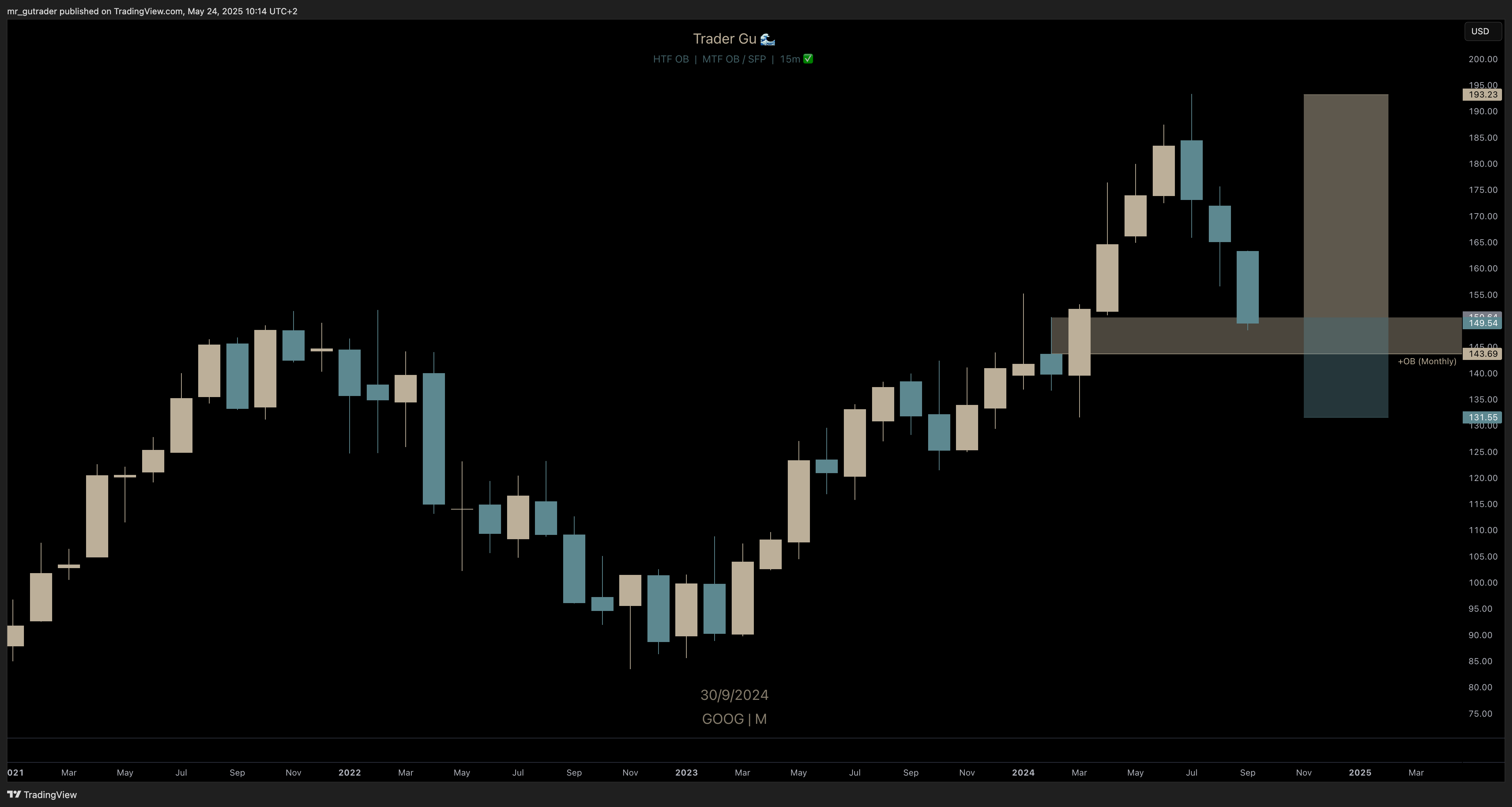

$GOOG - Position Entry, SL and Target

$GOOG - Position Entry, SL and Target

$BABA - Position Entry, SL and Target

$BABA - Position Entry, SL and Target

Order Blocks as Areas of Interest

High-timeframe order blocks serve as areas of interest rather than direct entry triggers - at least from a higher timeframe perspective. Simply identifying an order block may not be enough; you need an entry trigger methodology.

A trade setup for me consists of an Area of Interest + Entry Trigger ✅. However, I sometimes take aggressive entry positions at high-conviction levels, anticipating that a confirmed entry trigger will develop in the coming weeks - as I did in my recent $AAPL trade review.

$GOOG - Bullish market structure reversal from a higher timeframe order block

$GOOG - Bullish market structure reversal from a higher timeframe order block

Summary

In this post, I’ve outlined the high-level strategy I use for trading, focusing on order-block theory and how to spot them on a price chart. If you’ve explored my other Toolbox content, you’ll know that I primarily trade order blocks - though I occasionally cover other trade types that complement my approach.

In a future post, I’ll break down exactly what I look for in an entry trigger to form a high-conviction trade. Stay tuned.

Hope you enjoyed this post! Let me know if you trade using order blocks or have experimented with them - I’d love to hear about your experience. 👇