💼 Portfolio Update: 25 Year Trading Experiment | October 2025

October results are in, and the Passively Invested Portfolio is making moves. Let’s break down the performance after the past nine months.

All trades are always shared live on X.com/tradergu, and the public trading dashboard is always updated with the latest trade details and up-to-date portfolio allocations.

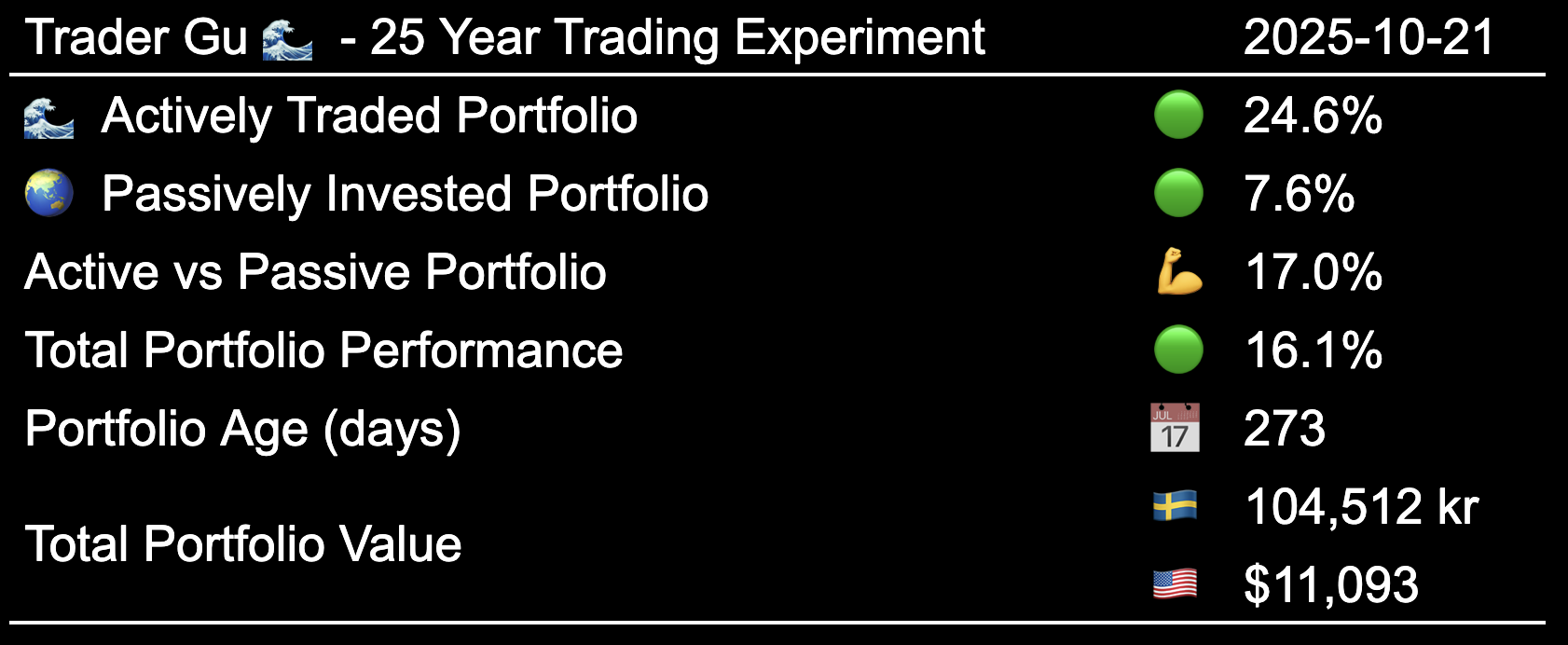

Performance: Year to Date

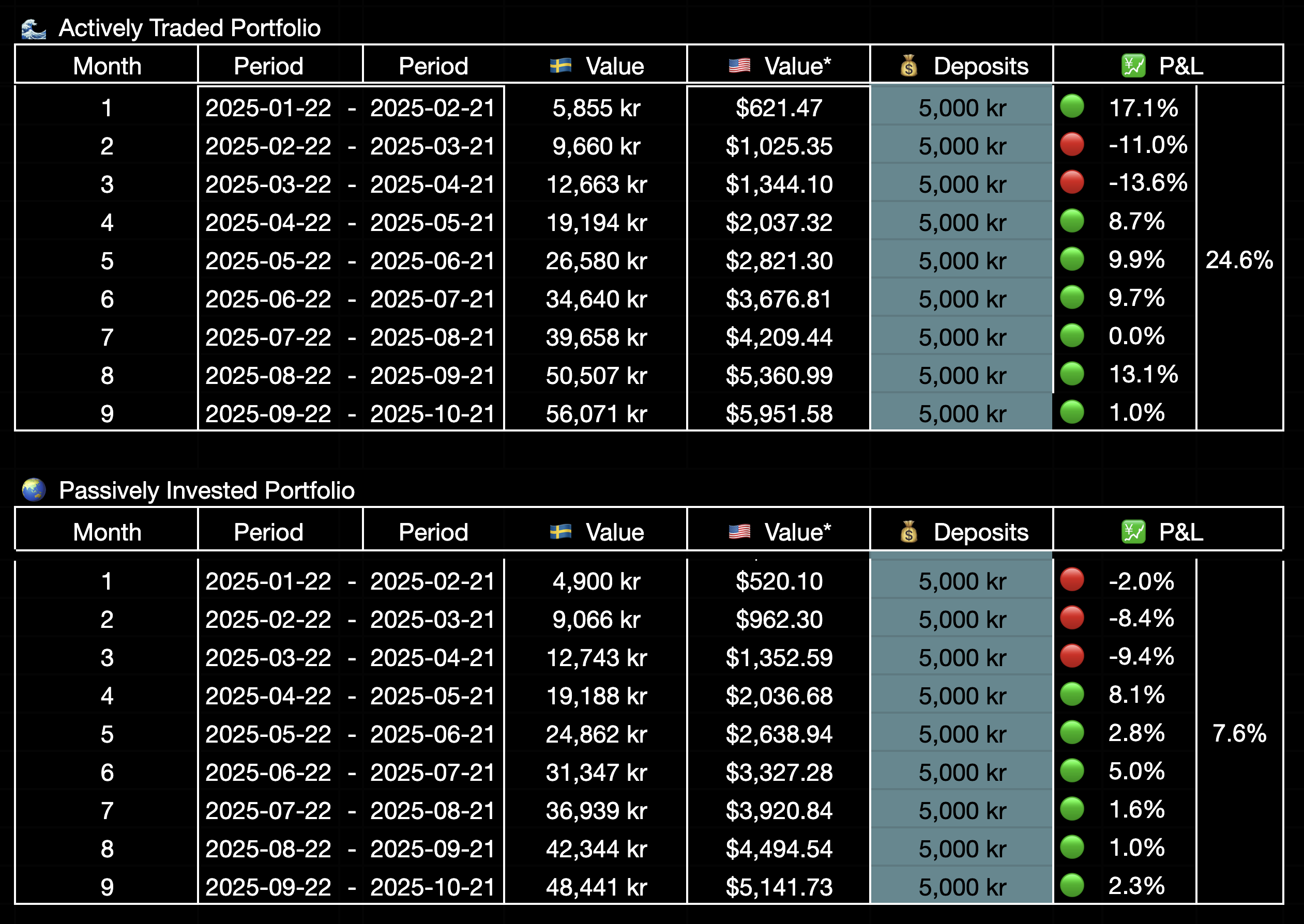

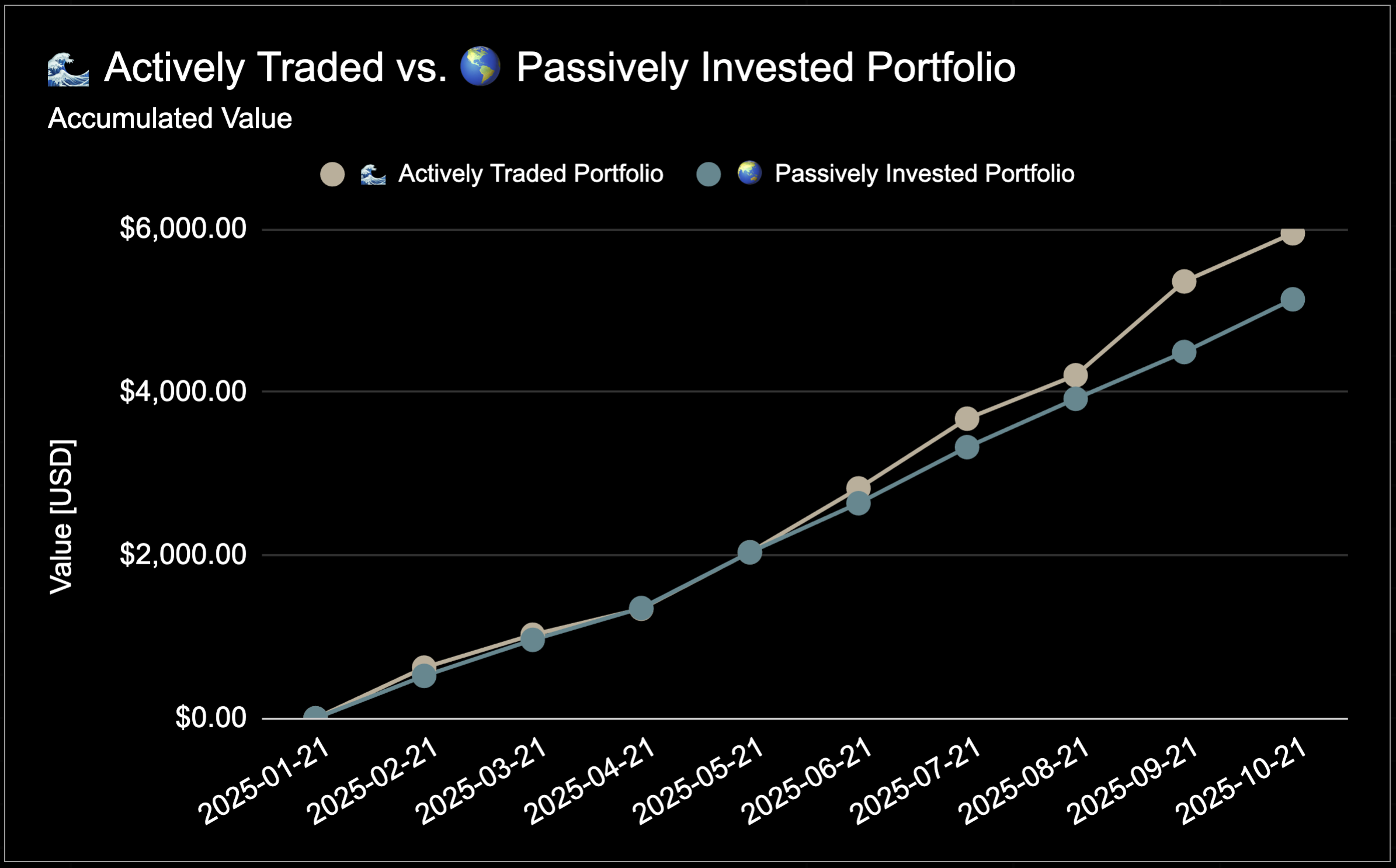

The total portfolio value is now above $10,000. Both portfolios are in profit, and the actively traded portfolio has outperformed the passively invested portfolio by 17 percentage points year-to-date 💪.

- Actively Traded Portfolio: 🟢 +24.6%

- Passively Invested Portfolio: 🟢 +7.6%

Performance: Month to Month Overview

On a month-to-month basis, the Actively Traded Portfolio has outperformed the Passively Invested Portfolio in five out of nine months (roughly 55%). However, during the months it outperformed, gains were significant enough that the Actively Traded Account’s P&L is roughly three times higher.

For October, the Actively Traded Account was flat, while the MSCI ACWI Index gained 2.3%.

Performance: Month by Month, Table

Performance: Month by Month, Table

Performance: Month by Month, Chart

Performance: Month by Month, Chart

Open Positions

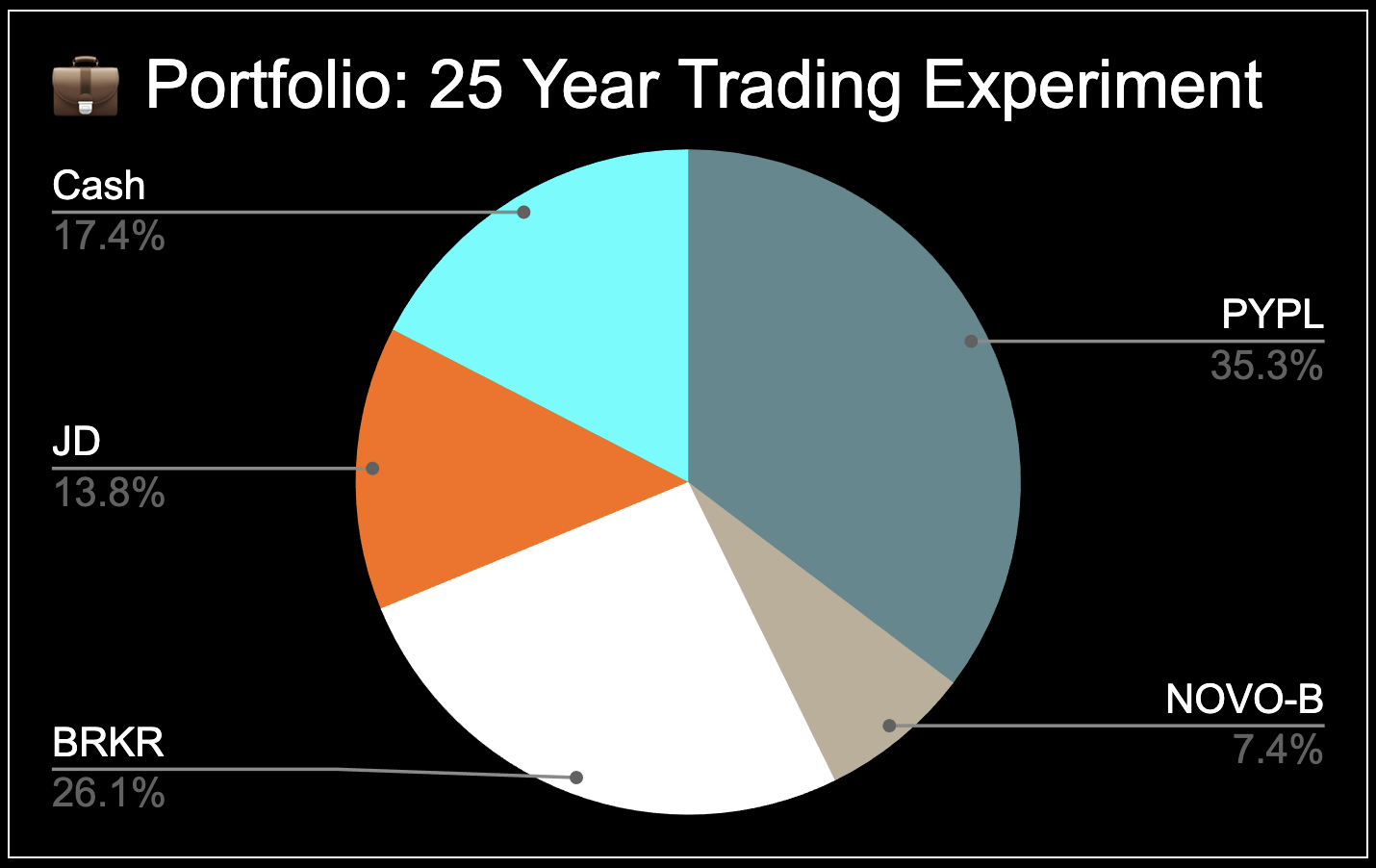

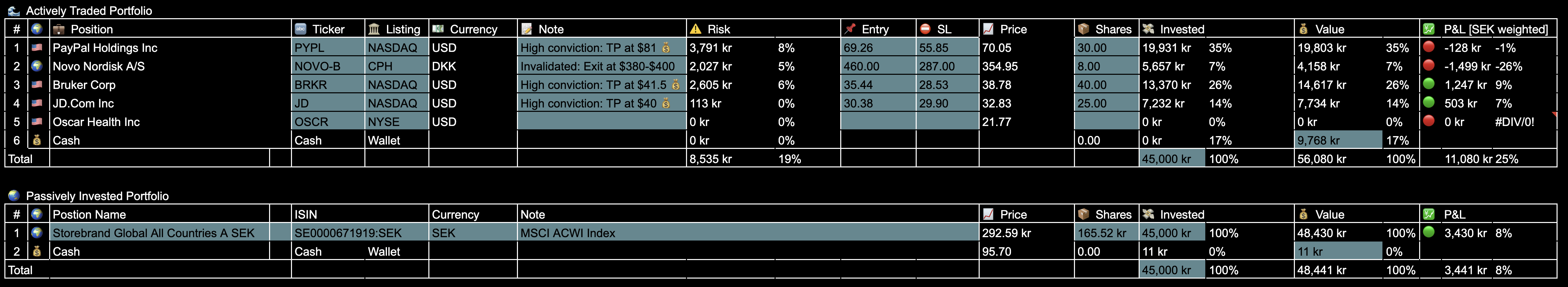

The portfolio currently consists of four open positions: $PYPL, $NOVO, $JD, and the latest addition, $BRKR.

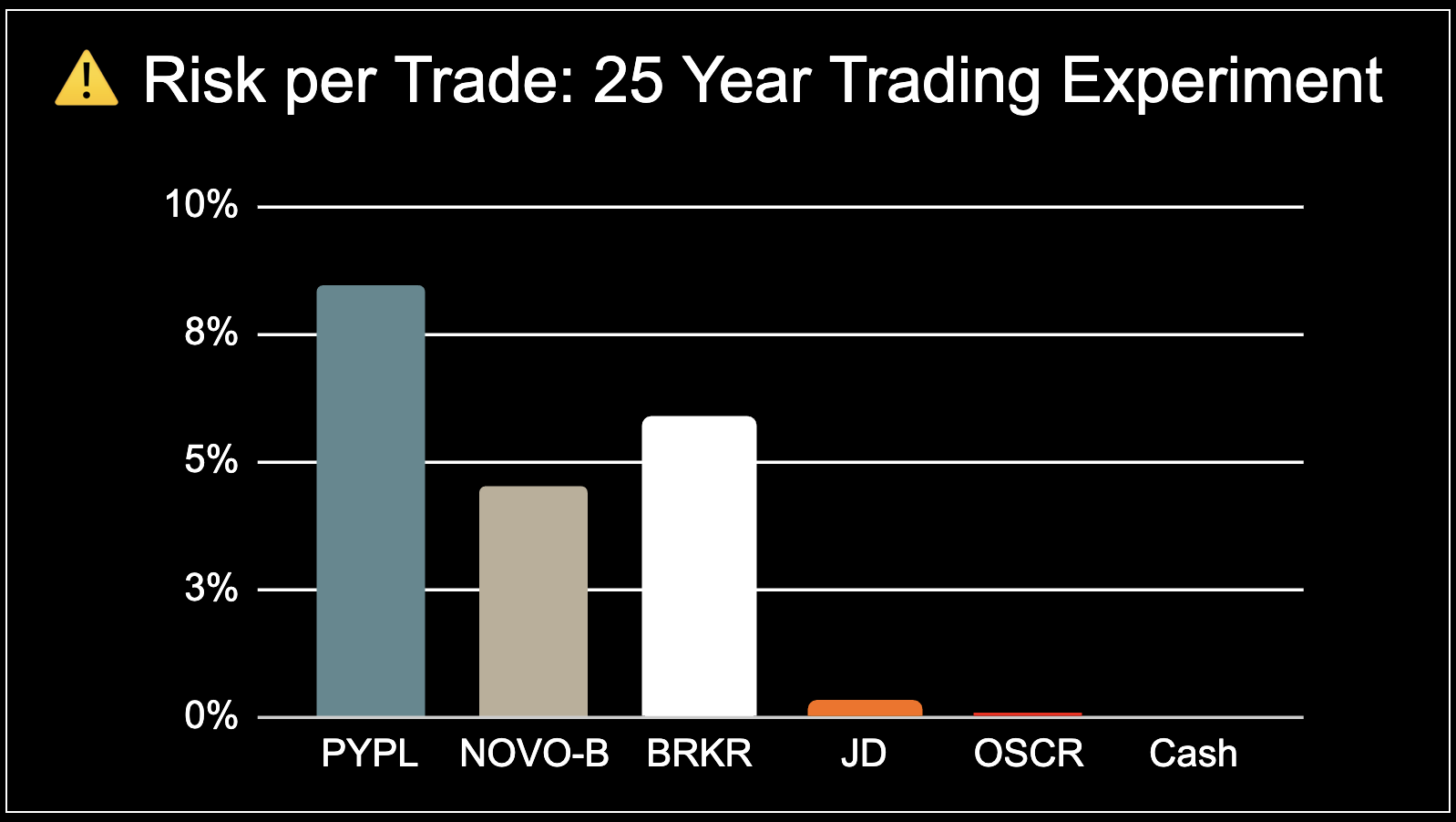

The total invested capital at risk is currently ⚠️ 17%, with the highest per-trade risk being 8% on $JD. Most recently, I’ve moved the stop loss for my $JD trade, resulting in 0% risk on the position.

Open Positions: Detailed Overview

The following table contains the entry, stop loss, position size, and current market prices.

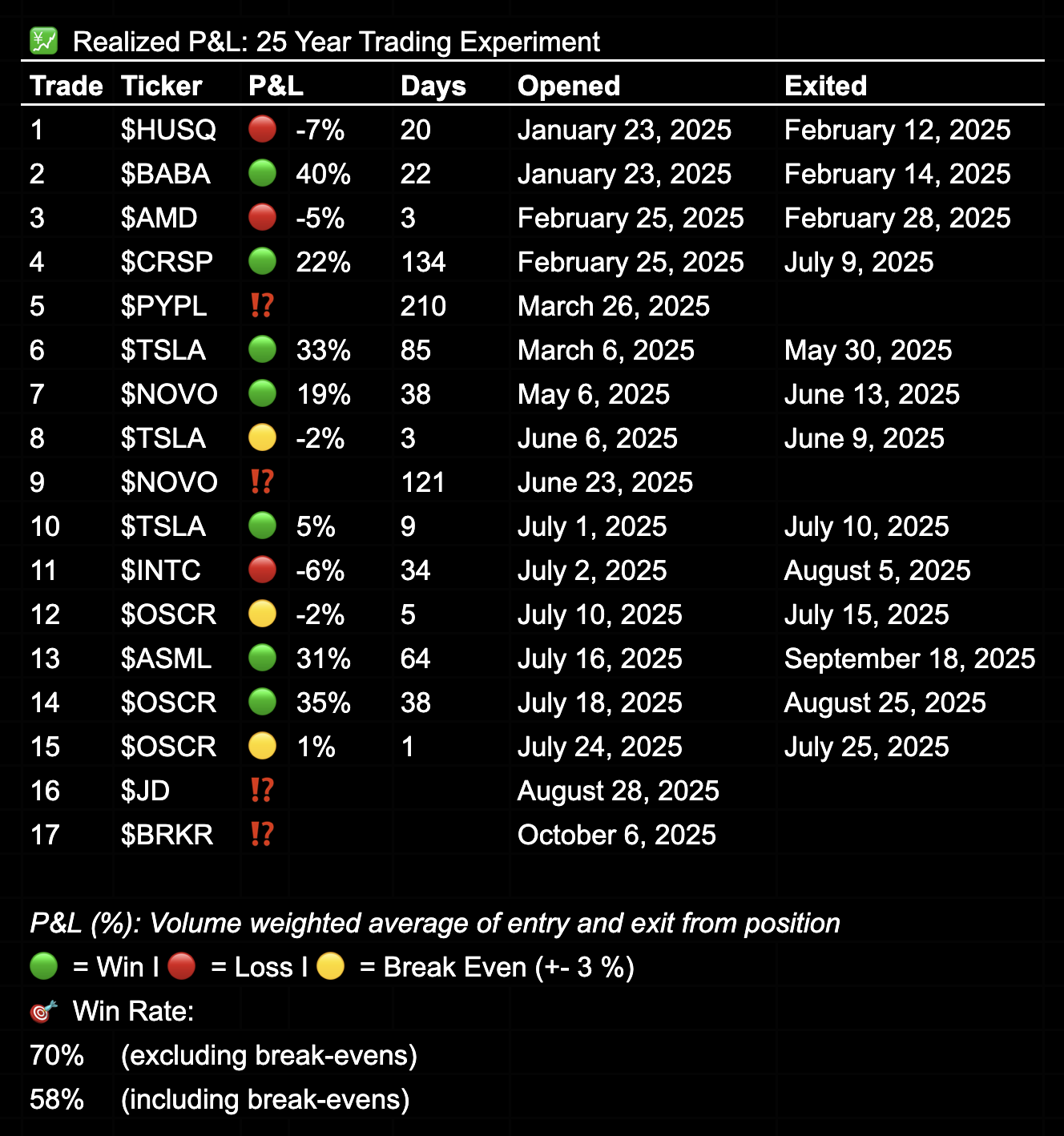

Realized P&L & Win Rate

Since inception, I have realized 13 trades:

- 🟢 7 Winners

- 🔴 3 Losses

- 🟡 3 Break-even (+/- 3%)

This translates to a 70% win rate when excluding break-even trades, or 58% including them. The top three trades, percentage-wise, have been $BABA, $TSLA, and $OSCR, each delivering between 31% and 40% from entry to exit.

Losses have been modest, with a maximum realized loss of just 7.2%. These results will change once I start realizing profit and loss for the open positions, especially when $NOVO is invalidated but h I haven’t closed yet. The win rate would most likely be slightly lower.

25 Year Trading Experiment

For a full overview of the experiment’s purpose and structure, check out my First Post from January 2025, or watch the previously released YouTube introduction.

In short:

- 💰 10,000 SEK (~$1,000) invested monthly – split 50/50

- 🌊 Actively Traded vs 🌍 Passively Invested Global Index Fund

- 📅 Contributions on the 22nd of every month

- 🕰 Tracking my performance from 2025 to 2050

- 🌐 Transparency: Every trade shared publicly

Summary

October has been quite volatile, with big moves in $PYPL, $NOVO, and $JD. My latest addition, $BRKR, and the most notable changes to the portfolio have been increasing risk in the $PYPL position-betting on more upside—and opening a new position in Bruker Corp.

I also posted a $BRKR chart analysis and walkthrough on my YouTube channel.

That said, I’ve made some mistakes. I failed to exit my $NOVO position, although I was very close—only a couple of percentage points from my exit level. Since then, we’ve had a big move to the downside, which I could have avoided if I had accepted the loss at the time. Now I’m still trapped and will evaluate what to do with that position in the coming weeks and months. It’s been bothering my performance lately.

I’m still heavy in cash, ready to take advantage of a potential larger market move to the downside. I’m not betting on it; I just don’t see many opportunities in the market right now, which is why I’ve built up a larger cash position.

How are you tracking your trading performance?

💬 Drop a comment below, share your thoughts on my YouTube channel, or connect with me on X - I’m always interested in connecting with like-minded people.