💼 Portfolio Update: 25 Year Trading Experiment | December 2025

Finally, December has arrived, and it has been a very quiet month with not much volatility. Let’s review the performance and see where we stand before closing the year within the next week and half.

All trades are always shared live on X.com/tradergu, and the public trading dashboard is updated with the latest trade details and up-to-date portfolio allocations.

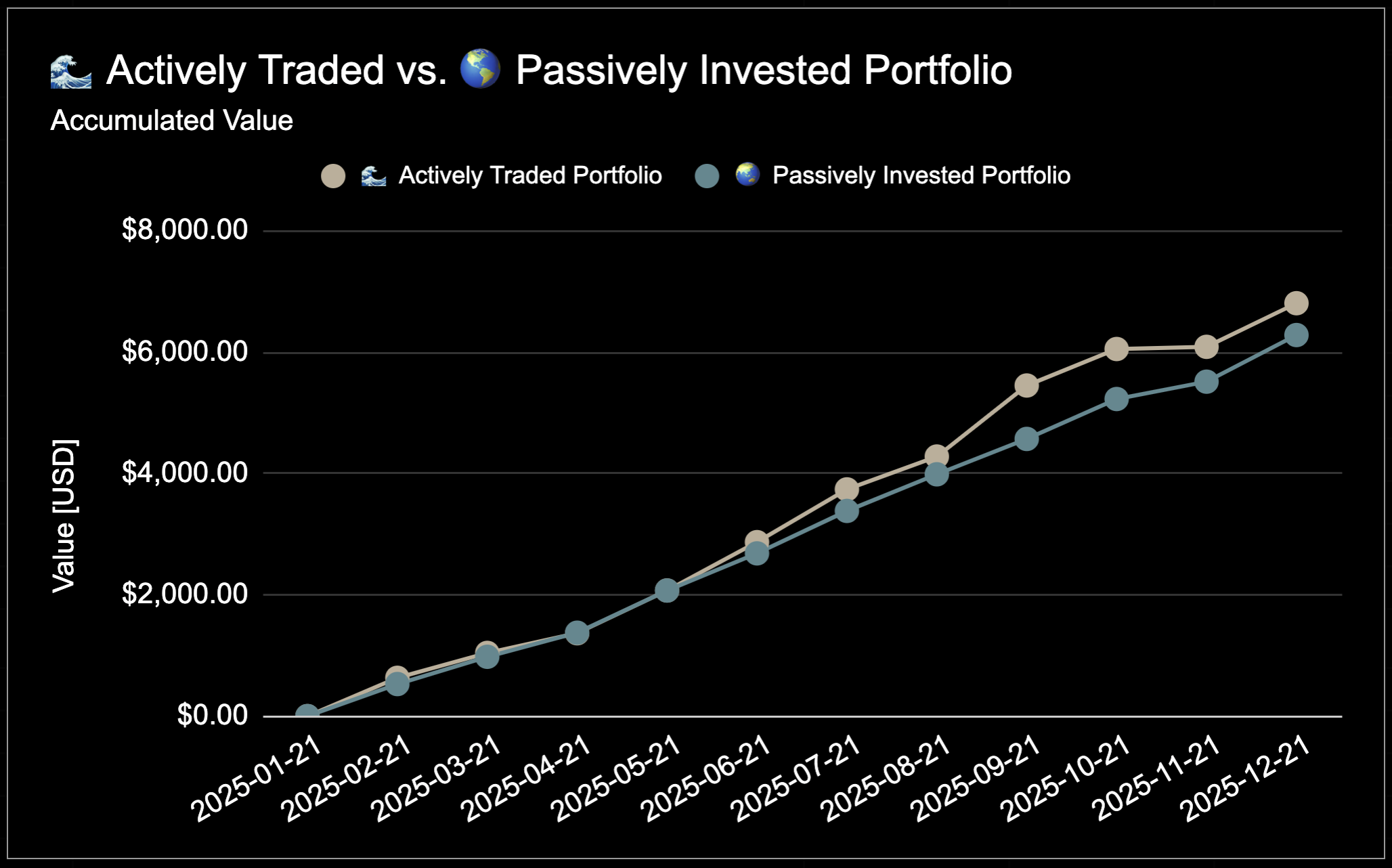

Performance: Year to Date

The total portfolio value is now worth $13,000. Both portfolios are in profit, and the Actively Traded Portfolio has outperformed the Passively Invested Portfolio by 8.8 percentage points year-to-date 💪.

- Actively Traded Portfolio: 🟢 +16.7%

- Passively Invested Portfolio: 🟢 +5.3%

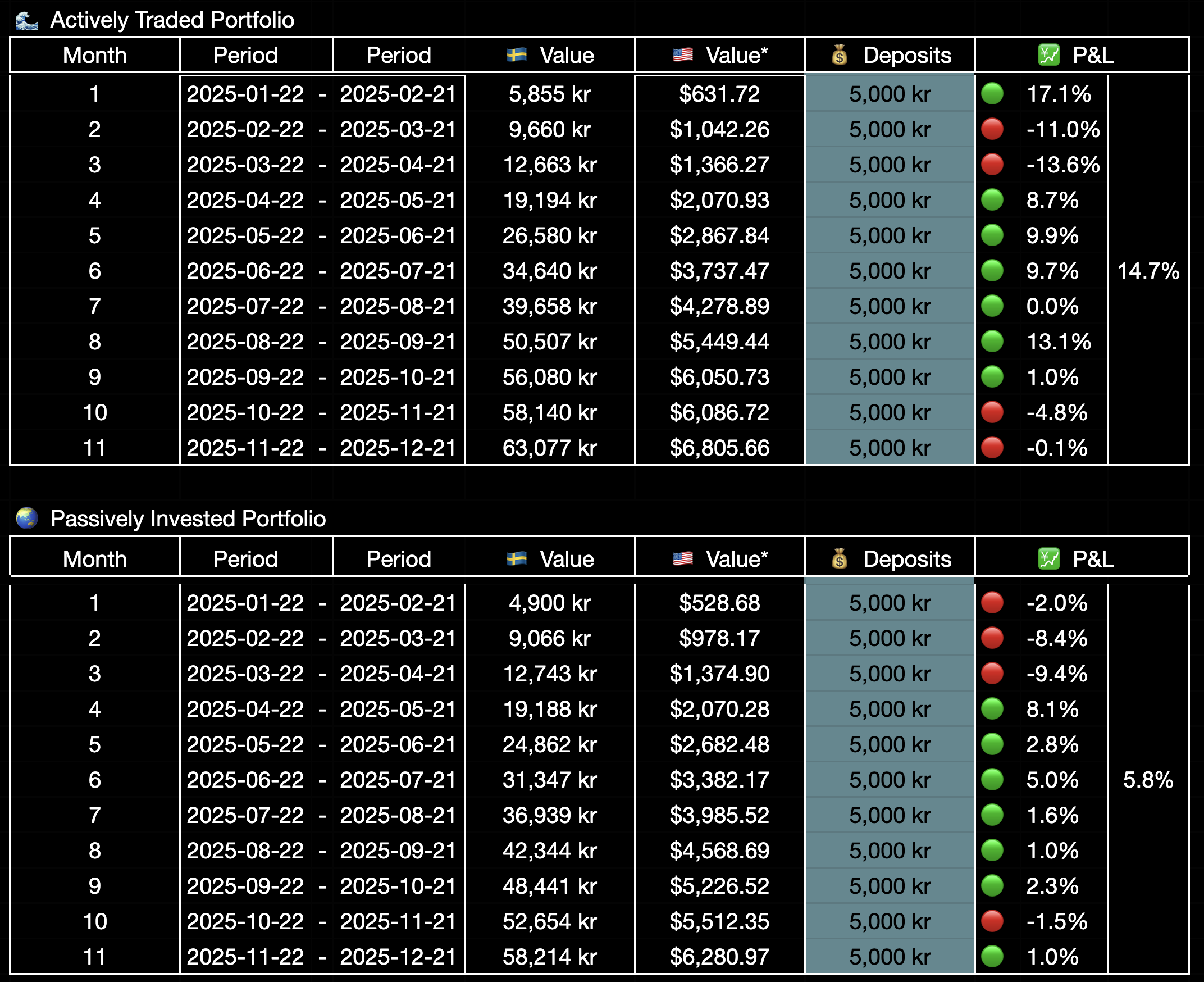

Performance: Month to Month Overview

On a month-to-month basis, the past month has been slow and ends up close to being flat on both accounts.

Performance: Month by Month, Table

Performance: Month by Month, Table

Performance: Month by Month, Chart

Performance: Month by Month, Chart

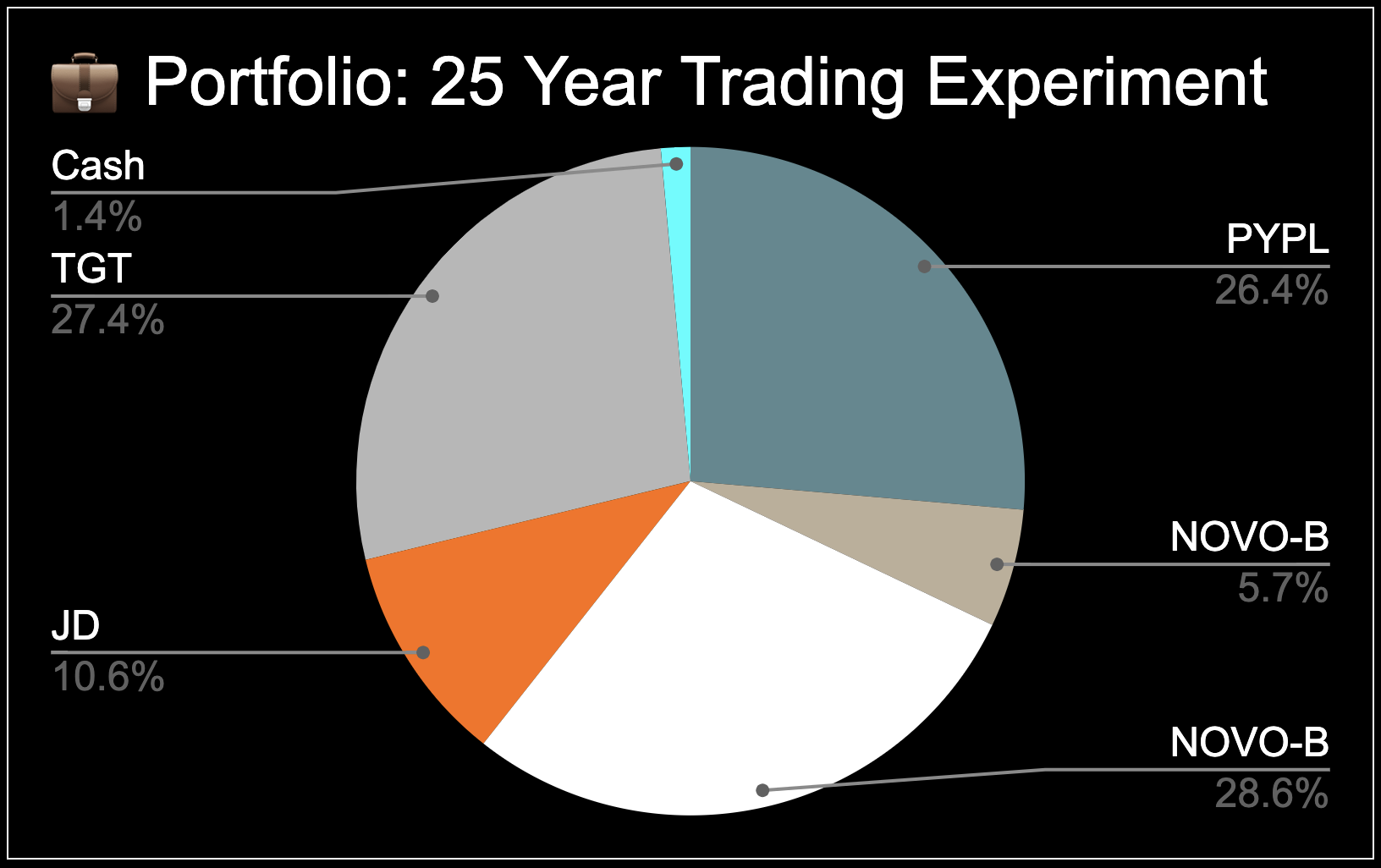

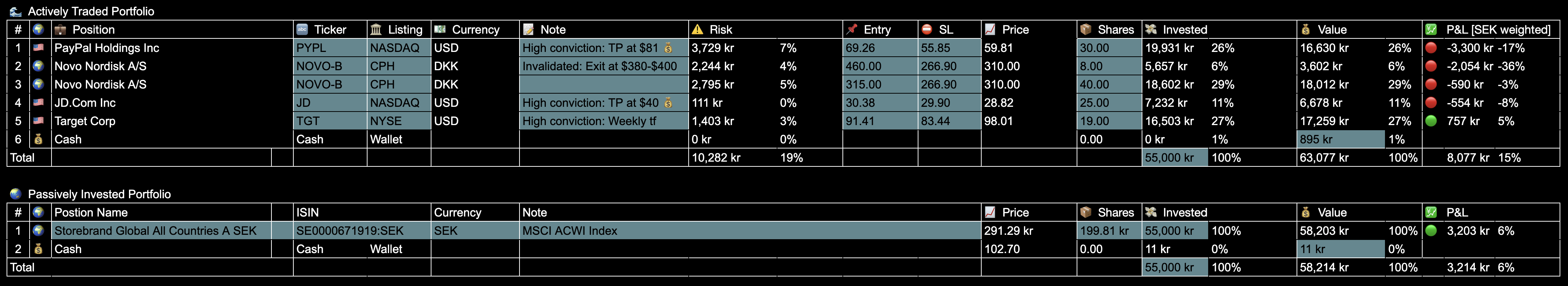

Open Positions

The portfolio currently consists of five open trades: $PYPL, $NOVO, $JD, $TGT and another recently opened $NOVO position.

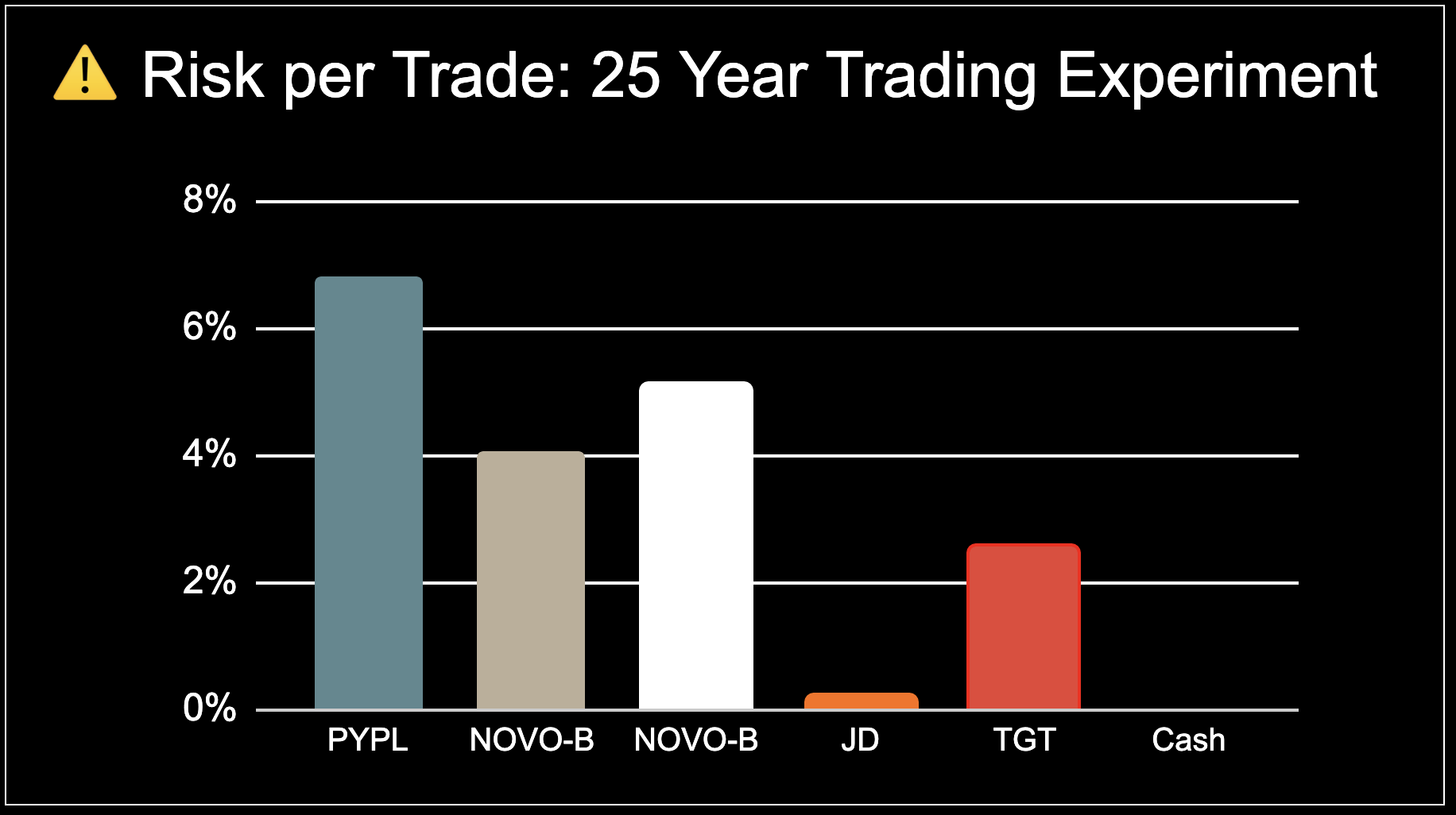

The total invested capital at risk is currently ⚠️ 15%, with the highest per-trade risk being 8% on $PYPL.

Open Positions: Detailed Overview

The following table contains the entry, stop loss, position size, and current market prices.

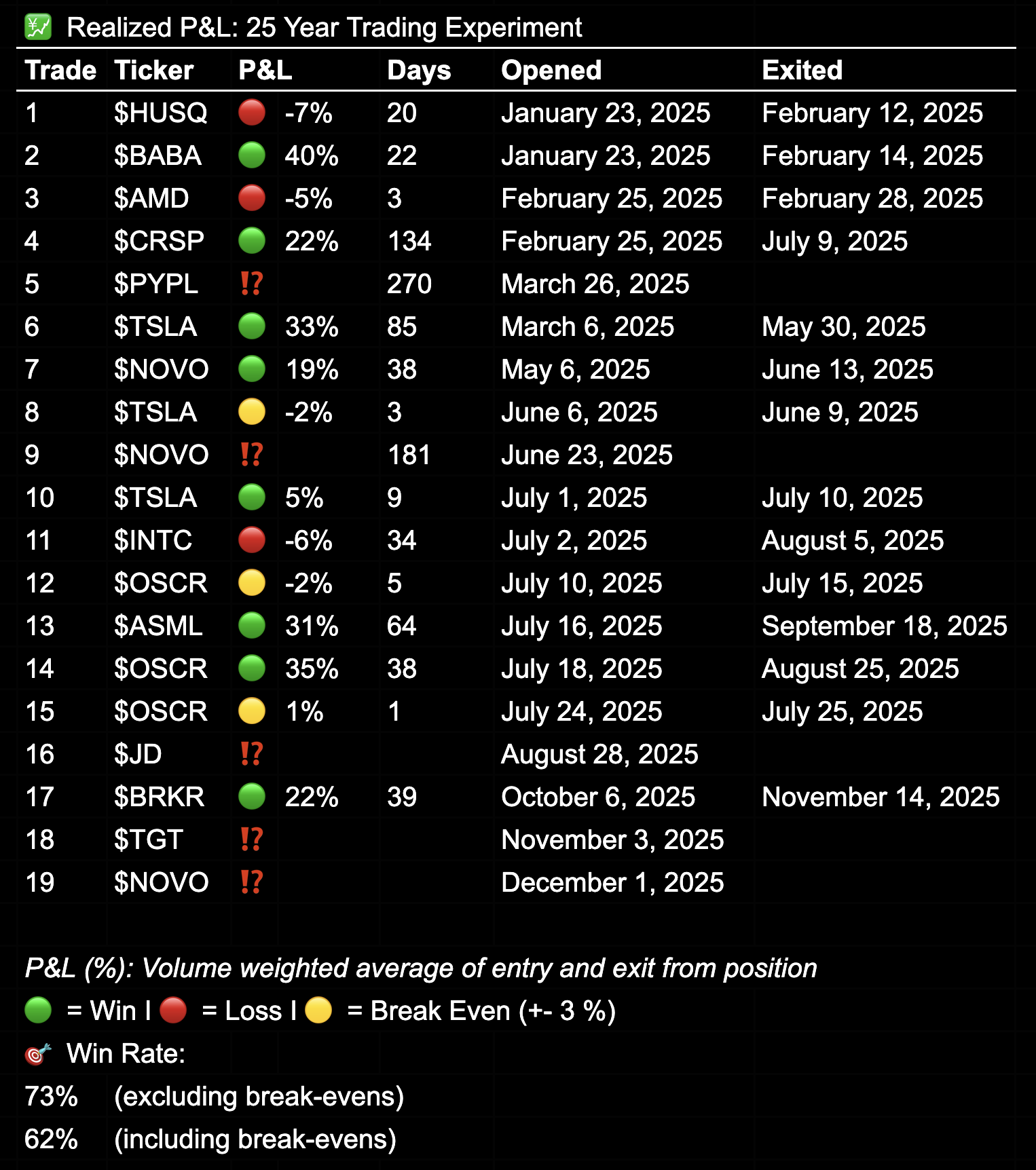

Realized P&L & Win Rate

Since inception, I have realized 14 trades:

- 🟢 8 Winners

- 🔴 3 Losses

- 🟡 3 Break-even (+/- 3%)

This translates to a 73% win rate when excluding break-even trades, or 62% including them. The top three trades, percentage-wise, have been $BABA, $TSLA, and $OSCR, each delivering between 31% and 40% from entry to exit.

Realized losses have so far been modest, with a maximum realized loss of just 7.2%. These results will change once I start realizing profit and loss for the open invalidated positions such as a massive drawback in a $NVO trade.

25 Year Trading Experiment

For a full overview of the experiment’s purpose and structure, check out my First Post from January 2025, or watch the previously released YouTube introduction.

In short:

- 💰 10,000 SEK (~$1,000) invested monthly – split 50/50

- 🌊 Actively Traded vs 🌍 Passively Invested Global Index Fund

- 📅 Contributions on the 22nd of every month

- 🕰 Tracking my performance from 2025 to 2050

- 🌐 Transparency: Every trade shared publicly

Summary

December price action so far has been quite slow with not much volatility, and I am not realized any trade in the past month except opened a new trade in $NVO. I’ve yet had the chance to realize the loss in the previous trade, but with the current price action, I believe I will be able to close it close to my entry point. Although that might take some time, so for now, that loss is holding up my cash position. But as I feel confident I will be able to realize a slightly lower loss, I’m happy to carry it for the next coming months. I might have seen it a little bit different if this was a trading account with no monthly deposits. But since I’m having additional cash deposited on a monthly basis, it makes it easier to take a bit of a more risk approach to realizing losses in the portfolio.

On a trading mentality basis, I feel strong moving into the end of the year, and I’m happy that I’ve almost continued this experiment for almost one year. It will be very interesting to see where we close the end of the year in the next week and a half.

Are you satisfied with your performance past month?

💬 Share your thoughts on X or Substack — I’m always interested in connecting with like-minded people.