🎯 2025 Trading Performance - Year in Review

As 2026 is just getting started, I want to take a step back and review the year across my trading portfolios, not just in terms of returns, but in terms of process, discipline, and decision quality.

This post is intended as a transparent year-end record.

No hindsight optimization.

No cherry-picked performance.

Just what happened, why it matters, and what I’m carrying forward.

All trades are always shared live on X.com/tradergu - Not Financial Advice

🧭 Before the Numbers

My approach hasn’t changed:

- High-timeframe focus (weekly & monthly)

- Infrequent, high-conviction trades

- Defined risk & clear invalidation

- Long periods of doing nothing

- Trading designed to fit alongside a full-time career

2025 was a year where I started increasing risk on my portfolio and also going public with my trading journey. A lot has happened.

📈 Portfolio Overview – 2025

I currently execute my High Conviction Swing Trading strategy in 4 accounts:

- Main Trading Account

- 25 Year Trading Experiment

- Crypto Gu

- Options Gu

All my accounts are traded in SEK and evaluated on actual P&L

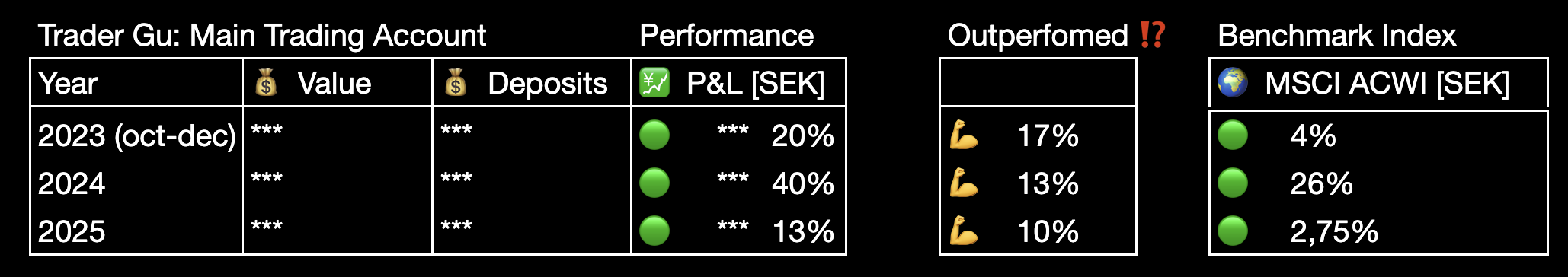

Main Trading Account (Equities – Swing Trading)

This portfolio remains my primary focus for long-term capital growth.

The year ended with +13%, and outperformed the global index by 10% 💪.

Compared to previous years, the performance is lower on a percentage basis but significantly higher in P&L as the portfolio is larger, mainly due to deposits throughout the year.

Portfolio performance - Main Trading Account

Portfolio performance - Main Trading Account

Key takeaway:

The more I keep trading, the more confident I get and am able to deposit more capital into my trading account. Percentage growth is great but what ultimately matters is how much P&L you do relative to keeping everything in a global index fund.

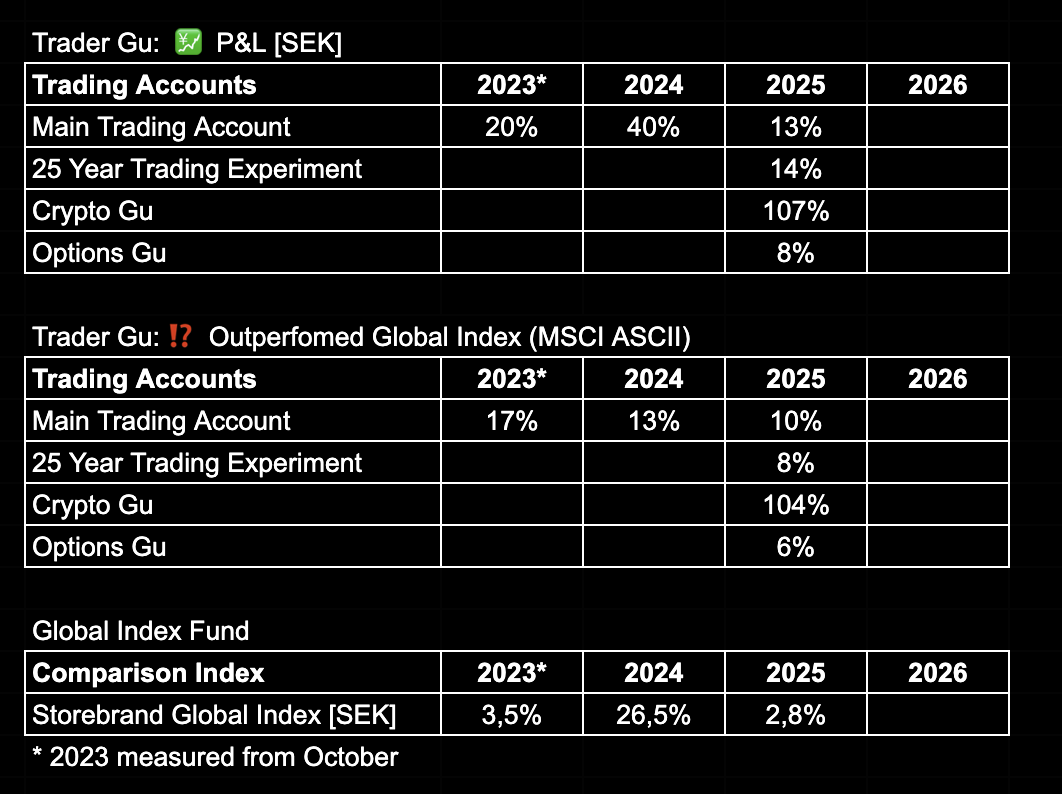

Trade Activity and P&L

I opened 18 trades in 2025, significantly more than previous years, and I ended up closing 14 of those trades as well as 2 trades from previous years.

Current statistics, inception to date:

- Winning trades: 13 (2 from previous years)

- Losing trades: 4

- Break-even trades: 4

- Open trades at year end: 6

Win rate:

- ~76% excluding break-evens

~62% including break-evens

- 🟢 13 Winners

- 🔴 4 Losses

- 🟡 4 Break-even (+/- 3%)

Trade P&L - Main Trading Account

Trade P&L - Main Trading Account

Average trade duration is 154 days.

✅ 2025 Winners & Losers

The biggest winners of 2025 are my $CRSP, $AMD, $ASML, $OSCR, and $BRKR trades. Check out my published trade reviews for details.

Open Trades (Carried Into 2026)

The following positions remain open. Their results belong to 2026.

- $BABA (🟢 in profit)

- $JD (🔴 in drawdown)

- $PYPL (🔴 in drawdown)

- $NOVO (🔴 in drawdown)

- $NOVO (🟢 in profit)

- $TGT (🟢 in profit)

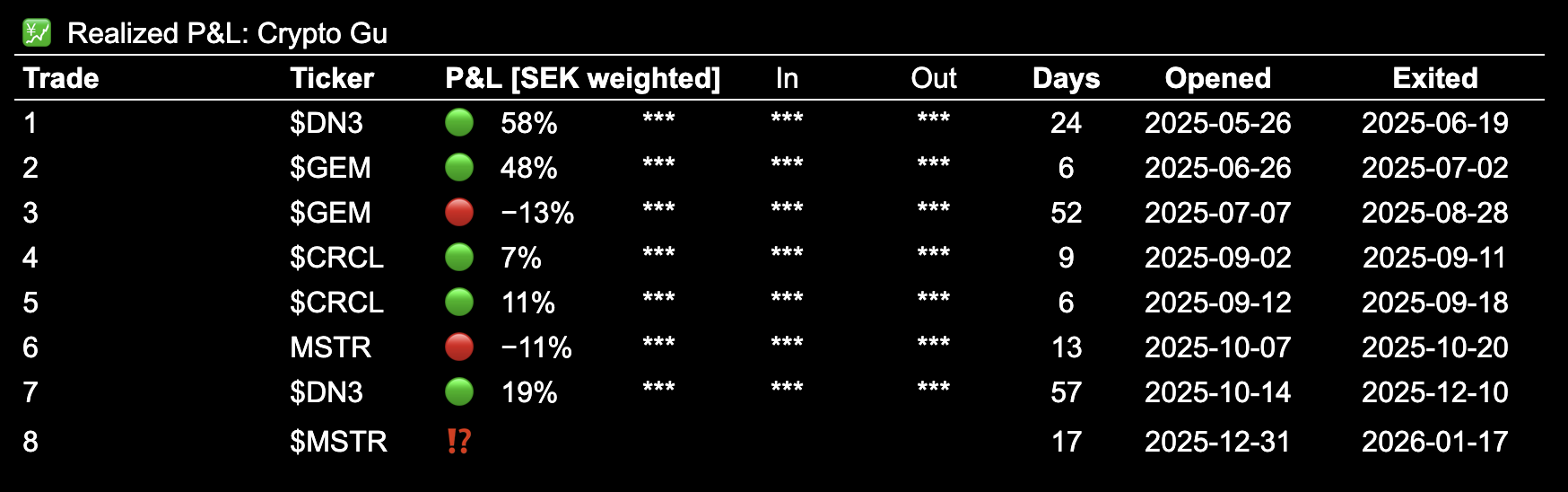

₿ Crypto Gu - Equity Trades with Crypto Exposure

Crypto Gu focuses on crypto-related equities, traded with the same high-timeframe, High Conviction Swing Trading strategy but with higher risk on invested capital.

- 2025 P&L: 🟢 +107%

This was the strongest-performing portfolio of the year, benefiting from volatility, but still executed selectively. No leverage.

High risk potential for high reward.

Options Gu - Most recent portfolio

Options Gu is my most recent trading account where I’m utilizing my Swing Trading strategy in the options market. Recently started in December, and the P&L is unrealized. Looking to add more capital to this portfolio going forward.

- 2025 P&L: 🟢 +8%

The 25 Year Trading Experiment

2025 marked the foundation year of the 25 Year Trading Experiment

I won’t go deep here.

📅 January 22 marks exactly one year since inception, and I’ll publish a full deep dive covering:

- Active trading vs passive investing

- Capital flows & psychology

- What worked / what didn’t

- Early structural lessons

- 100% transparency

Stay tuned.

Trade P&L - 25 Year Trading Experiment

Trade P&L - 25 Year Trading Experiment

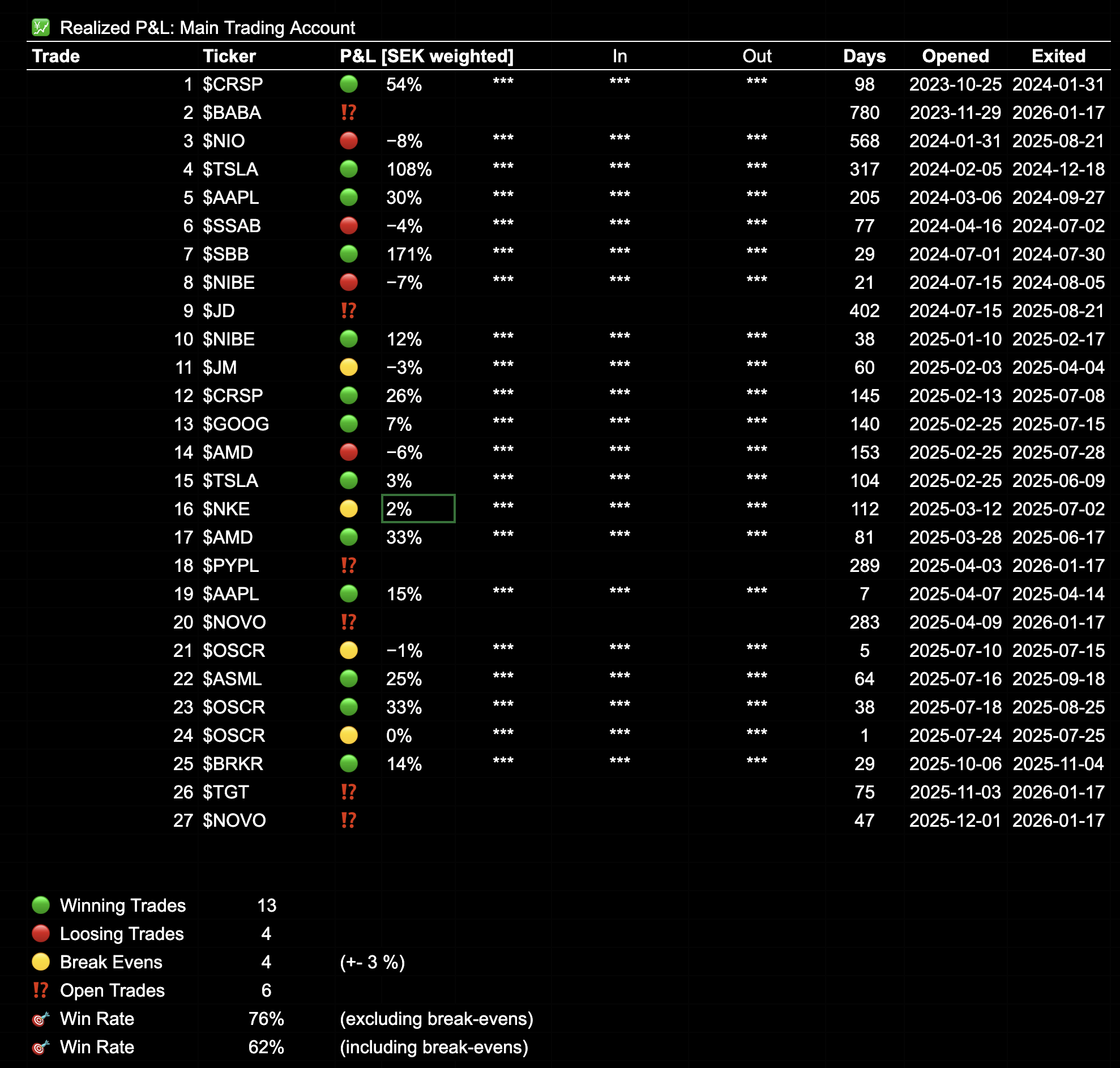

Did I outperform the index in 2025 - summary

- Main Trading Account: 10% 💪

- 25 Year Trading Experiment: 7% 💪

- Crypto Gu: 104% 💪💪💪

- Options Gu: 8% 💪

All my accounts are compared to the Storebrand Global All Countries A SEK which tracks the MSCI ACWI global index in SEK.

Trade P&L and Comparison to the Global Index - Overall

Trade P&L and Comparison to the Global Index - Overall

What 2025 Reinforced

A few things became even clearer this year:

- Overtrading is still the biggest enemy

- Public transparency improves discipline but adds pressure

- Adding capital mid-year distorts percentage metrics

- Except for the 25 Year Trading Experiment which tracks the difference transparently

- Patience remains my strongest edge

- The best trades are difficult to carry to target

Or simply:

I’m not here to be right. I’m here to be profitable.

Looking Ahead to 2026

The trading plan remains intentionally boring:

- Fewer trades

- Higher conviction

- Continued transparency

- Improved risk scalability

- Increase risk and keep depositing to my money making machines

I’ll continue documenting trades, insights, and mistakes publicly, not as financial advice, but as a public journal, and honestly it makes the lonely life of a trader more fulfilling.

Final Thoughts

2025 wasn’t perfect from a P&L perspective, but looking at the growth numbers from a percentage standpoint, it’s clear that I’m on a good track to keep being consistently profitable and outperform the overall global index.

One of my main accomplishments for 2025 is venturing out on my journey with the 25-year trading experiment, which is the best way of comparing your performance to the global market in a portfolio where you do monthly or bi-monthly deposits.

One of my best outcomes after 2025 is also the fact that I started my options trading account, which I’ve been thinking about for years but now finally went ahead and deposited the money into my Interactive Brokers account. It’s been a very exciting journey, short but volatile, and I’m really looking forward to seeing how I can take my swing trading to the next level, both by increasing risk, focusing on higher conviction setups, and scaling my P&L using options trading.

If you value patience and following a transparent trading journey, you’re exactly who this work is for.

Thanks for following along this year.

More to come in 2026.

How was your trading year? Let me know in the comment section! 👇